正在加载图片...

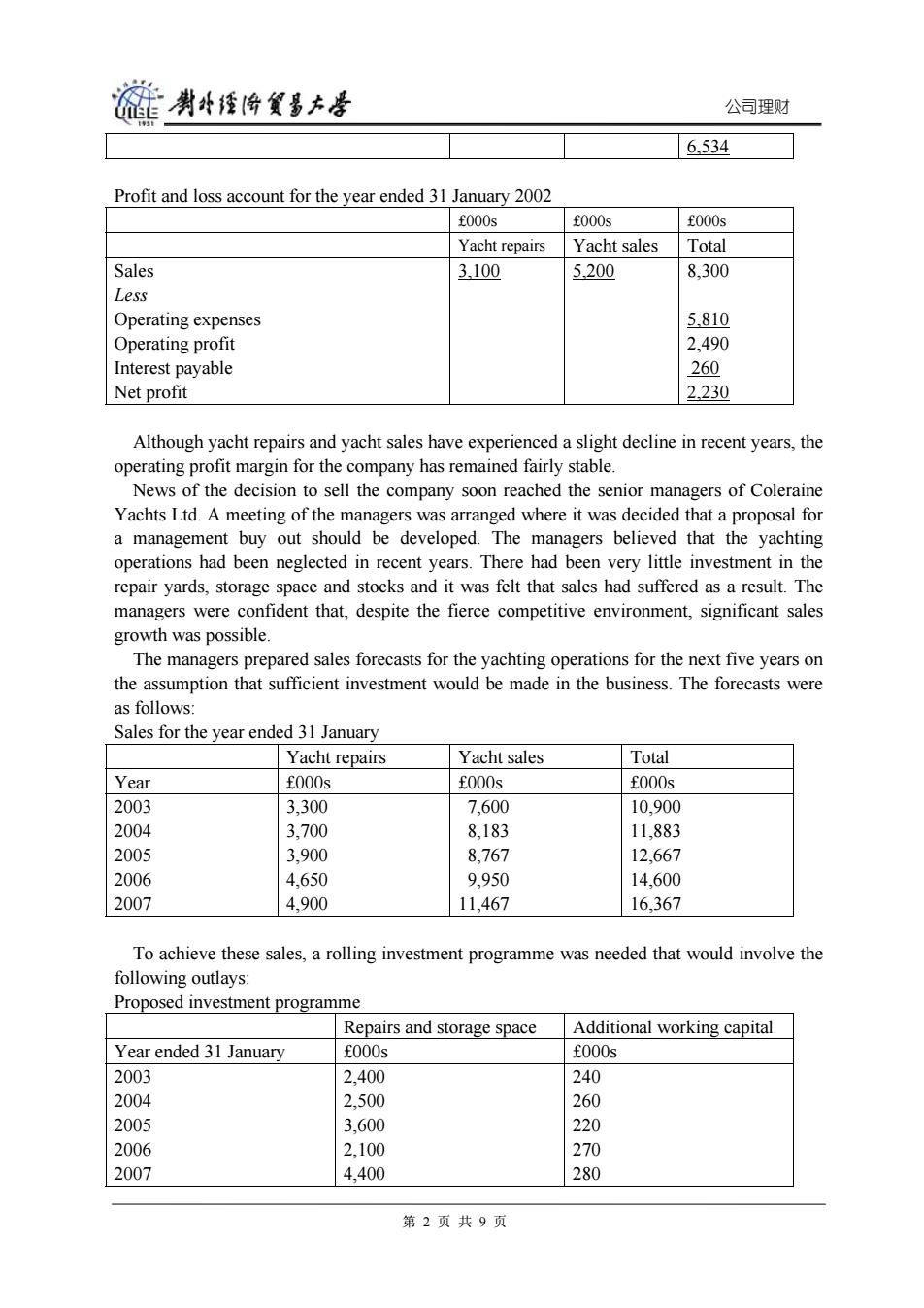

旋剥经降贸多去号 公司理财 6.534 Profit and loss account for the year ended 31 January 2002 f000s 000s f000s Yacht repairs Yacht sales Total Sales 3.100 5.200 8,300 Less Operating expenses 5.810 Operating profit 2,490 Interest payable 260 Net profit 2.230 Although yacht repairs and yacht sales have experienced a slight decline in recent years,the operating profit margin for the company has remained fairly stable. News of the decision to sell the company soon reached the senior managers of Coleraine Yachts Ltd.A meeting of the managers was arranged where it was decided that a proposal for a management buy out should be developed.The managers believed that the yachting operations had been neglected in recent years.There had been very little investment in the repair yards,storage space and stocks and it was felt that sales had suffered as a result.The managers were confident that,despite the fierce competitive environment,significant sales growth was possible. The managers prepared sales forecasts for the yachting operations for the next five years on the assumption that sufficient investment would be made in the business.The forecasts were as follows: Sales for the year ended 31 January Yacht repairs Yacht sales Total Year f000s f000s f000s 2003 3,300 7,600 10,900 2004 3,700 8,183 11,883 2005 3.900 8.767 12.667 2006 4,650 9,950 14,600 2007 4,900 11,467 16,367 To achieve these sales,a rolling investment programme was needed that would involve the following outlays: Proposed investment programme Repairs and storage space Additional working capital Year ended 31 January f000s f000s 2003 2,400 240 2004 2,500 260 2005 3,600 220 2006 2,100 270 2007 4,400 280 第2页共9页公司理财 6,534 Profit and loss account for the year ended 31 January 2002 £000s £000s £000s Yacht repairs Yacht sales Total Sales Less Operating expenses Operating profit Interest payable Net profit 3,100 5,200 8,300 5,810 2,490 260 2,230 Although yacht repairs and yacht sales have experienced a slight decline in recent years, the operating profit margin for the company has remained fairly stable. News of the decision to sell the company soon reached the senior managers of Coleraine Yachts Ltd. A meeting of the managers was arranged where it was decided that a proposal for a management buy out should be developed. The managers believed that the yachting operations had been neglected in recent years. There had been very little investment in the repair yards, storage space and stocks and it was felt that sales had suffered as a result. The managers were confident that, despite the fierce competitive environment, significant sales growth was possible. The managers prepared sales forecasts for the yachting operations for the next five years on the assumption that sufficient investment would be made in the business. The forecasts were as follows: Sales for the year ended 31 January Yacht repairs Yacht sales Total Year £000s £000s £000s 2003 2004 2005 2006 2007 3,300 3,700 3,900 4,650 4,900 7,600 8,183 8,767 9,950 11,467 10,900 11,883 12,667 14,600 16,367 To achieve these sales, a rolling investment programme was needed that would involve the following outlays: Proposed investment programme Repairs and storage space Additional working capital Year ended 31 January £000s £000s 2003 2004 2005 2006 2007 2,400 2,500 3,600 2,100 4,400 240 260 220 270 280 第 2 页 共 9 页