正在加载图片...

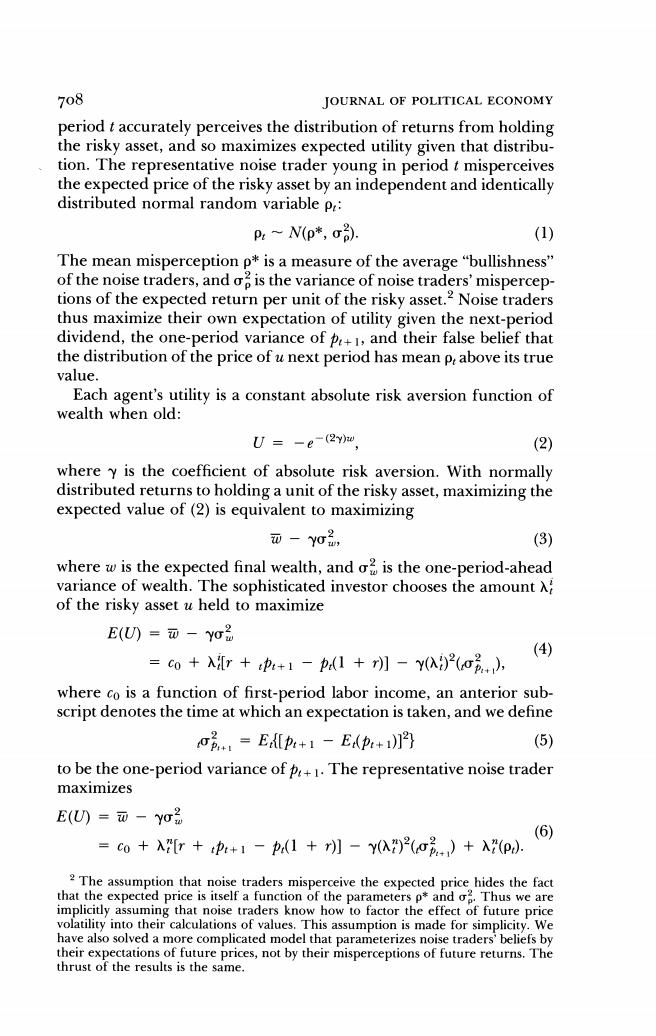

708 JOURNAL OF POLITICAL ECONOMY period t accurately perceives the distribution of returns from holding the risky asset,and so maximizes expected utility given that distribu- tion.The representative noise trader young in period t misperceives the expected price of the risky asset by an independent and identically distributed normal random variable p: p~N(p*,σ). (1) The mean misperception p*is a measure of the average"bullishness" of the noise traders,and o is the variance of noise traders'mispercep- tions of the expected return per unit of the risky asset.?Noise traders thus maximize their own expectation of utility given the next-period dividend,the one-period variance of,and their false belief that the distribution of the price of u next period has mean p above its true value. Each agent's utility is a constant absolute risk aversion function of wealth when old: U=-e-(2y)w. (2) where y is the coefficient of absolute risk aversion.With normally distributed returns to holding a unit of the risky asset,maximizing the expected value of(2)is equivalent to maximizing 而-yo2, (3) where w is the expected final wealth,and o is the one-period-ahead variance of wealth.The sophisticated investor chooses the amountA of the risky asset u held to maximize E(U)=w-yo (4) =c0+入r+p+1-p1+]-y2(oa., where co is a function of first-period labor income,an anterior sub- script denotes the time at which an expectation is taken,and we define o,=Ep+1-Ep+]門 (5) to be the one-period variance of p+1.The representative noise trader maximizes E(U)=而-yσ品 (6) =c0+入[r+p+1-(1+]-y入)(o)+入2(p) 2 The assumption that noise traders misperceive the expected price hides the fact that the expected price is itself a function of the parameters p*and o Thus we are implicitly assuming that noise traders know how to factor the effect of future price volatility into their calculations of values.This assumption is made for simplicity.We have also solved a more complicated model that parameterizes noise traders'beliefs by their expectations of future prices,not by their misperceptions of future returns.The thrust of the results is the same