正在加载图片...

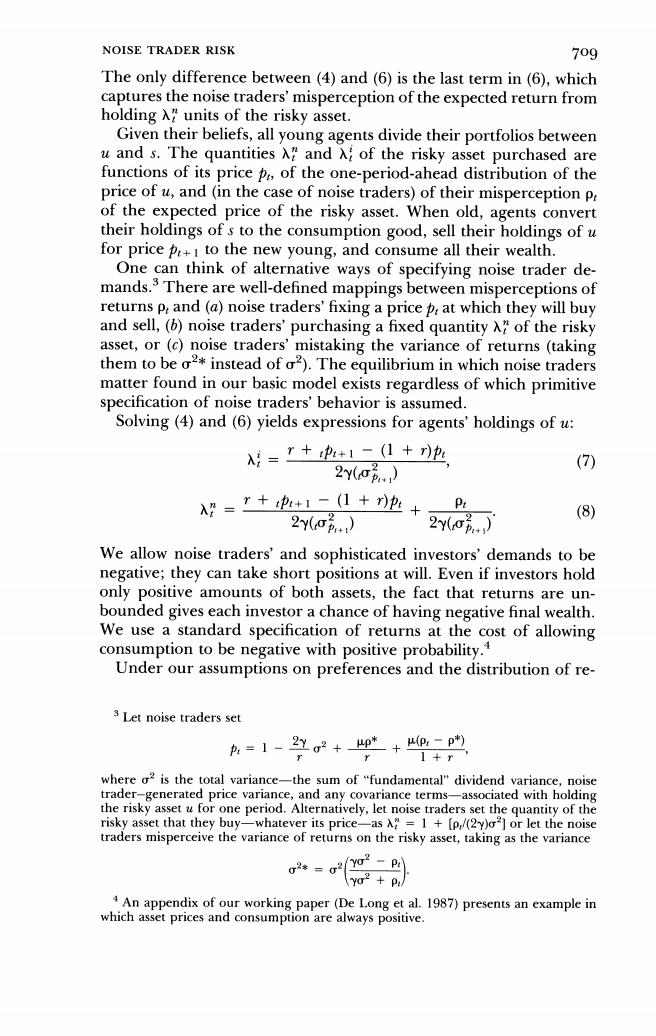

NOISE TRADER RISK 709 The only difference between(4)and(6)is the last term in(6),which captures the noise traders'misperception of the expected return from holding A"units of the risky asset. Given their beliefs,all young agents divide their portfolios between u and s.The quantities A and of the risky asset purchased are functions of its price pa,of the one-period-ahead distribution of the price of u,and(in the case of noise traders)of their misperception pe of the expected price of the risky asset.When old,agents convert their holdings of s to the consumption good,sell their holdings of u for pricep+I to the new young,and consume all their wealth. One can think of alternative ways of specifying noise trader de- mands.3 There are well-defined mappings between misperceptions of returns p and(a)noise traders'fixing a price p at which they will buy and sell,(b)noise traders'purchasing a fixed quantity A"of the risky asset,or (c)noise traders'mistaking the variance of returns (taking them to be o2*instead of o2).The equilibrium in which noise traders matter found in our basic model exists regardless of which primitive specification of noise traders'behavior is assumed. Solving(4)and(6)yields expressions for agents'holdings of u: x=T++1-((1+p (7) 2y(o.) N=+0+地+ P (8) 2yo.) 2() We allow noise traders'and sophisticated investors'demands to be negative;they can take short positions at will.Even if investors hold only positive amounts of both assets,the fact that returns are un- bounded gives each investor a chance of having negative final wealth. We use a standard specification of returns at the cost of allowing consumption to be negative with positive probability.4 Under our assumptions on preferences and the distribution of re- 3 Let noise traders set p:=1-2Yg2+p*+®-p 1+r where o2 is the total variance-the sum of "fundamental"dividend variance,noise trader-generated price variance,and any covariance terms-associated with holding the risky asset u for one period.Alternatively,let noise traders set the quantity of the risky asset that they buy-whatever its price-asA=1 [p/(2y)o2]or let the noise traders misperceive the variance of returns on the risky asset,taking as the variance 2*=g2Y02-p4 yo2 pr 4 An appendix of our working paper(De Long et al.1987)presents an example in which asset prices and consumption are always positive