正在加载图片...

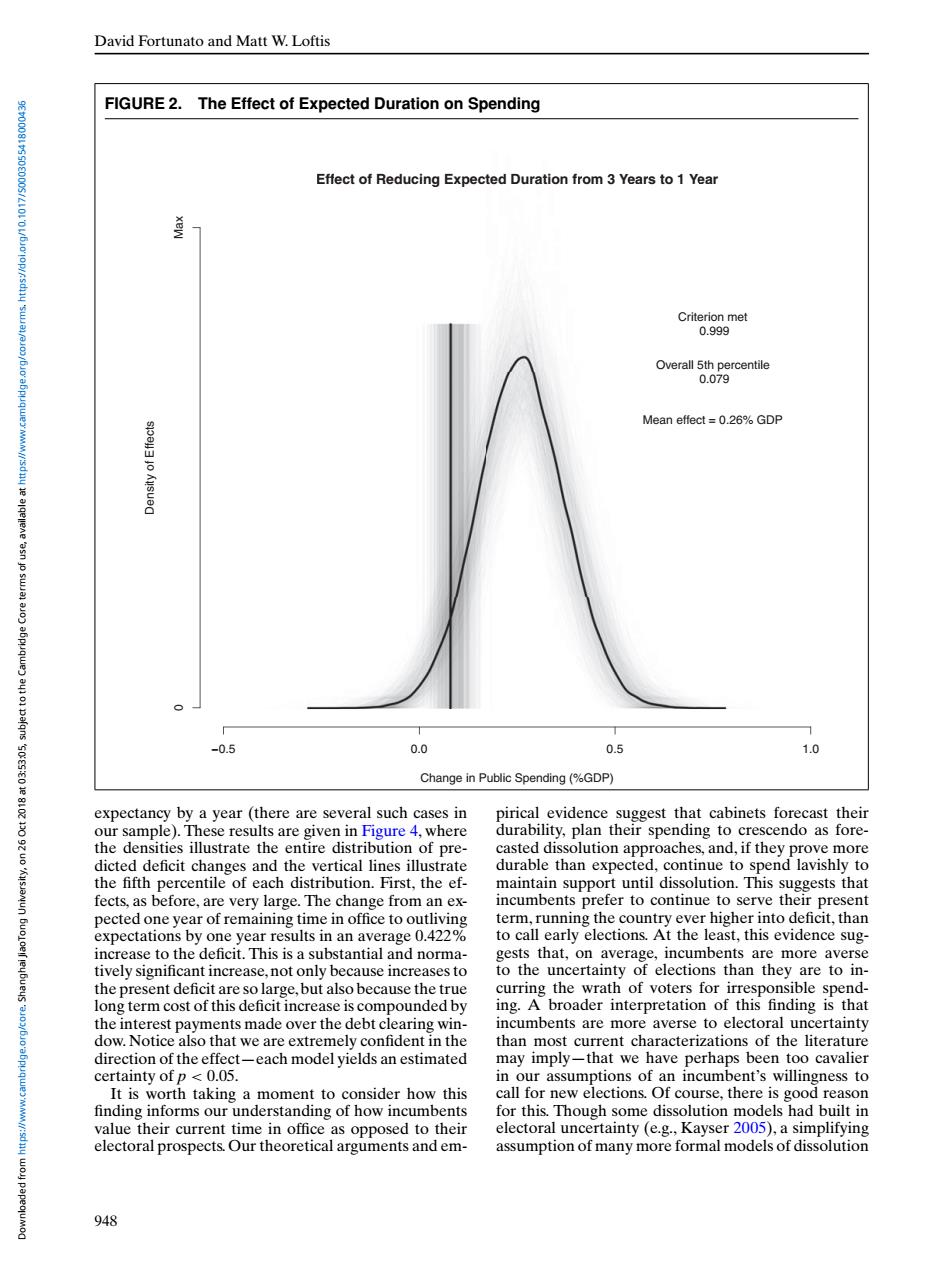

David Fortunato and Matt W.Loftis FIGURE 2.The Effect of Expected Duration on Spending Effect of Reducing Expected Duration from 3 Years to 1 Year Criterion met 0.999 Overall 5th percentile 0.079 Mean effect=0.26%GDP -0.5 0.0 0.5 1.0 Change in Public Spending(%GDP) expectancy by a year (there are several such cases in pirical evidence suggest that cabinets forecast their our sample).These results are given in Figure 4,where durability,plan their spending to crescendo as fore- the densities illustrate the entire distribution of pre- casted dissolution approaches,and,if they prove more dicted deficit changes and the vertical lines illustrate durable than expected,continue to spend lavishly to the fifth percentile of each distribution.First,the ef- maintain support until dissolution.This suggests that fects,as before,are very large.The change from an ex- incumbents prefer to continue to serve their present pected one year of remaining time in office to outliving term,running the country ever higher into deficit,than expectations by one year results in an average 0.422% to call early elections.At the least,this evidence sug- increase to the deficit.This is a substantial and norma- gests that,on average,incumbents are more averse tively significant increase,not only because increases to to the uncertainty of elections than they are to in- the present deficit are so large,but also because the true curring the wrath of voters for irresponsible spend- long term cost of this deficit increase is compounded by ing.A broader interpretation of this finding is that the interest payments made over the debt clearing win- incumbents are more averse to electoral uncertainty dow.Notice also that we are extremely confident in the than most current characterizations of the literature direction of the effect-each model yields an estimated may imply-that we have perhaps been too cavalier certainty of p<0.05. in our assumptions of an incumbent's willingness to It is worth taking a moment to consider how this call for new elections.Of course,there is good reason MM//:sdny finding informs our understanding of how incumbents for this.Though some dissolution models had built in value their current time in office as opposed to their electoral uncertainty (e.g.,Kayser 2005),a simplifying electoral prospects.Our theoretical arguments and em- assumption of many more formal models of dissolution 948David Fortunato and Matt W. Loftis FIGURE 2. The Effect of Expected Duration on Spending Effect of Reducing Expected Duration from 3 Years to 1 Year Change in Public Spending (%GDP) Density of Effects −0.5 0.0 0.5 1.0 0 Max Effect of Reducing Expected Duration from 3 Years to 1 Year Criterion met 0.999 Overall 5th percentile 0.079 Mean effect = 0.26% GDP expectancy by a year (there are several such cases in our sample). These results are given in Figure 4, where the densities illustrate the entire distribution of predicted deficit changes and the vertical lines illustrate the fifth percentile of each distribution. First, the effects, as before, are very large. The change from an expected one year of remaining time in office to outliving expectations by one year results in an average 0.422% increase to the deficit. This is a substantial and normatively significant increase, not only because increases to the present deficit are so large, but also because the true long term cost of this deficit increase is compounded by the interest payments made over the debt clearing window. Notice also that we are extremely confident in the direction of the effect—each model yields an estimated certainty of p < 0.05. It is worth taking a moment to consider how this finding informs our understanding of how incumbents value their current time in office as opposed to their electoral prospects.Our theoretical arguments and empirical evidence suggest that cabinets forecast their durability, plan their spending to crescendo as forecasted dissolution approaches, and, if they prove more durable than expected, continue to spend lavishly to maintain support until dissolution. This suggests that incumbents prefer to continue to serve their present term, running the country ever higher into deficit, than to call early elections. At the least, this evidence suggests that, on average, incumbents are more averse to the uncertainty of elections than they are to incurring the wrath of voters for irresponsible spending. A broader interpretation of this finding is that incumbents are more averse to electoral uncertainty than most current characterizations of the literature may imply—that we have perhaps been too cavalier in our assumptions of an incumbent’s willingness to call for new elections. Of course, there is good reason for this. Though some dissolution models had built in electoral uncertainty (e.g., Kayser 2005), a simplifying assumption of many more formal models of dissolution 948 Downloaded from https://www.cambridge.org/core. Shanghai JiaoTong University, on 26 Oct 2018 at 03:53:05, subject to the Cambridge Core terms of use, available at https://www.cambridge.org/core/terms. https://doi.org/10.1017/S0003055418000436