正在加载图片...

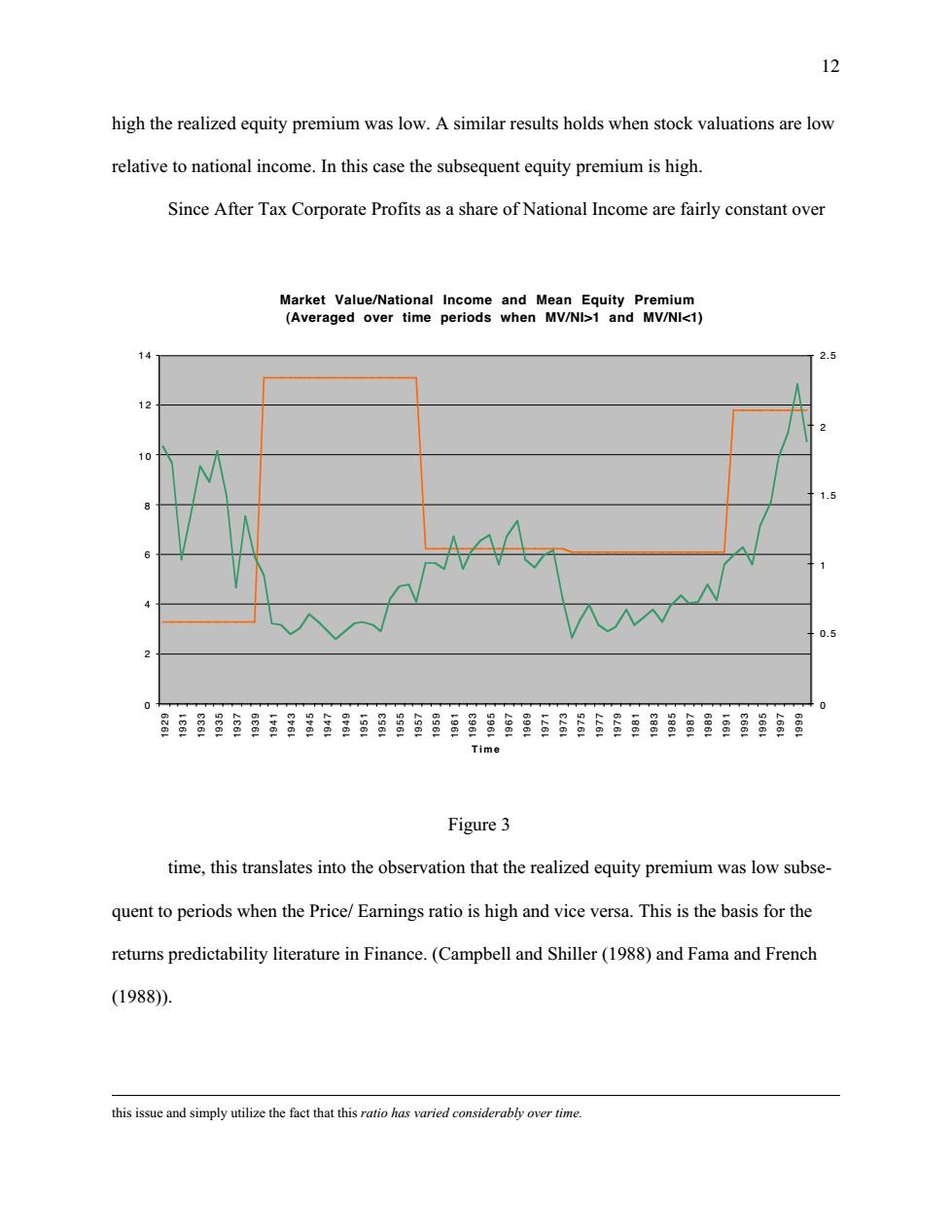

12 high the realized equity premium was low.A similar results holds when stock valuations are low relative to national income.In this case the subsequent equity premium is high. Since After Tax Corporate Profits as a share of National Income are fairly constant over Market Value/National Income and Mean Equity Premium (Averaged over time periods when MV/NI>1 and MV/NI<1) 14 2.5 12 2 10 1.5 0.5 0 0 Time Figure 3 time,this translates into the observation that the realized equity premium was low subse- quent to periods when the Price/Earnings ratio is high and vice versa.This is the basis for the returns predictability literature in Finance.(Campbell and Shiller(1988)and Fama and French (1988). this issue and simply utilize the fact that this ratio has varied considerably over time.12 high the realized equity premium was low. A similar results holds when stock valuations are low relative to national income. In this case the subsequent equity premium is high. Since After Tax Corporate Profits as a share of National Income are fairly constant over Figure 3 time, this translates into the observation that the realized equity premium was low subsequent to periods when the Price/ Earnings ratio is high and vice versa. This is the basis for the returns predictability literature in Finance. (Campbell and Shiller (1988) and Fama and French (1988)). this issue and simply utilize the fact that this ratio has varied considerably over time. Market Value/National Income and Mean Equity Premium (Averaged over time periods when MV/NI>1 and MV/NI<1) 0 2 4 6 8 1 0 1 2 1 4 1929 1931 1933 1935 1937 1939 1941 1943 1945 1947 1949 1951 1953 1955 1957 1959 1961 1963 1965 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 Time 0 0.5 1 1.5 2 2.5