正在加载图片...

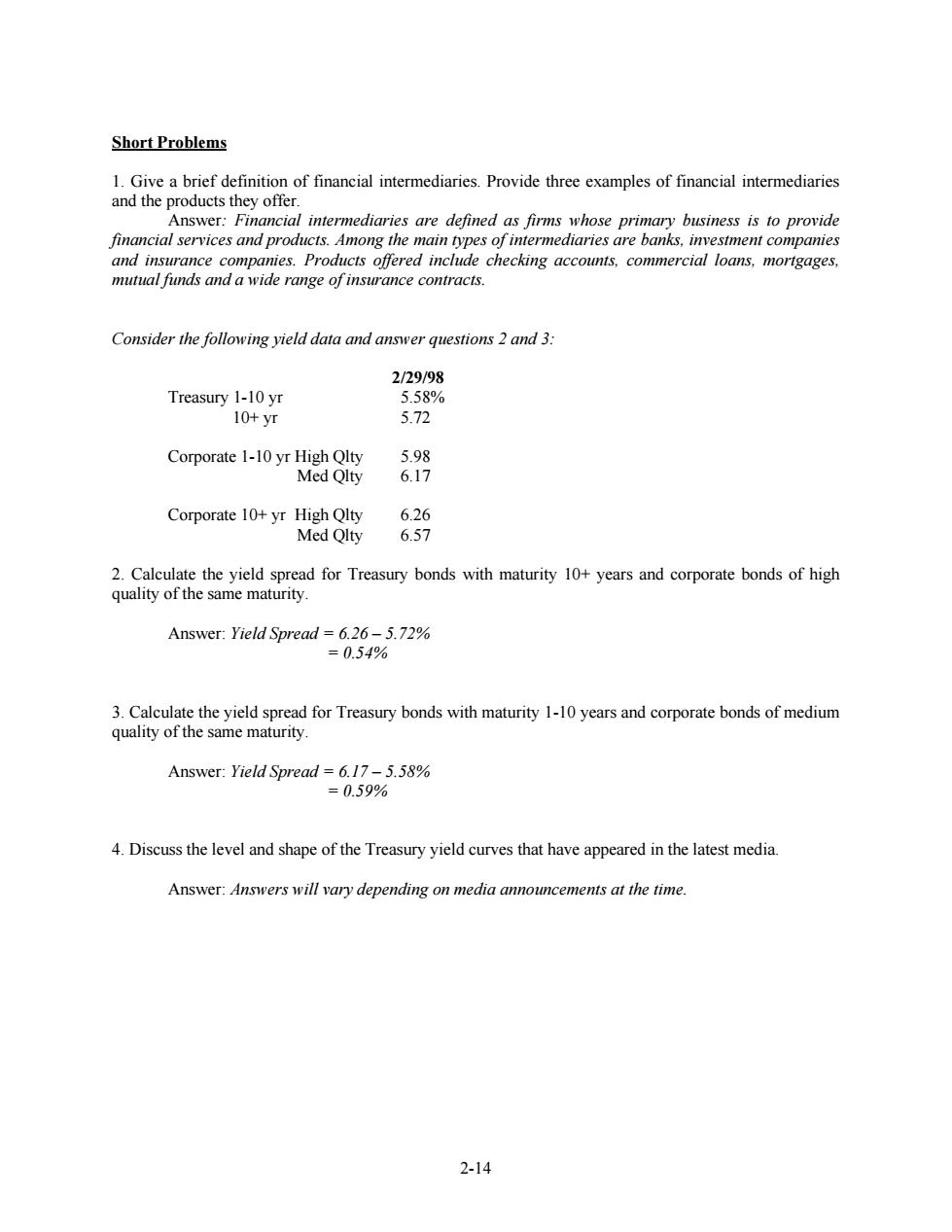

Short Problems 1.Give a brief definition of financial intermediaries.Provide three examples of financial intermediaries and the products they offer. Answer:Financial intermediaries are defined as firms whose primary business is to provide financial services and products.Among the main types of intermediaries are banks,investment companies and insurance companies.Products offered include checking accounts,commercial loans,mortgages, mutual funds and a wide range of insurance contracts. Consider the following yield data and answer questions 2 and 3: 2/29/98 Treasury 1-10 yr 5.58% 10+yr 5.72 Corporate 1-10 yr High Qlty 5.98 Med Qlty 6.17 Corporate 10+yr High Qlty 6.26 Med Qlty 6.57 2.Calculate the yield spread for Treasury bonds with maturity 10+years and corporate bonds of high quality of the same maturity. Answer:Yield Spread 6.26-5.72% =0.54% 3.Calculate the yield spread for Treasury bonds with maturity 1-10 years and corporate bonds of medium quality of the same maturity. Answer:Yield Spread =6.17-5.58% =0.59% 4.Discuss the level and shape of the Treasury yield curves that have appeared in the latest media Answer:Answers will vary depending on media announcements at the time 2-142-14 Short Problems 1. Give a brief definition of financial intermediaries. Provide three examples of financial intermediaries and the products they offer. Answer: Financial intermediaries are defined as firms whose primary business is to provide financial services and products. Among the main types of intermediaries are banks, investment companies and insurance companies. Products offered include checking accounts, commercial loans, mortgages, mutual funds and a wide range of insurance contracts. Consider the following yield data and answer questions 2 and 3: 2/29/98 Treasury 1-10 yr 5.58% 10+ yr 5.72 Corporate 1-10 yr High Qlty 5.98 Med Qlty 6.17 Corporate 10+ yr High Qlty 6.26 Med Qlty 6.57 2. Calculate the yield spread for Treasury bonds with maturity 10+ years and corporate bonds of high quality of the same maturity. Answer: Yield Spread = 6.26 – 5.72% = 0.54% 3. Calculate the yield spread for Treasury bonds with maturity 1-10 years and corporate bonds of medium quality of the same maturity. Answer: Yield Spread = 6.17 – 5.58% = 0.59% 4. Discuss the level and shape of the Treasury yield curves that have appeared in the latest media. Answer: Answers will vary depending on media announcements at the time