正在加载图片...

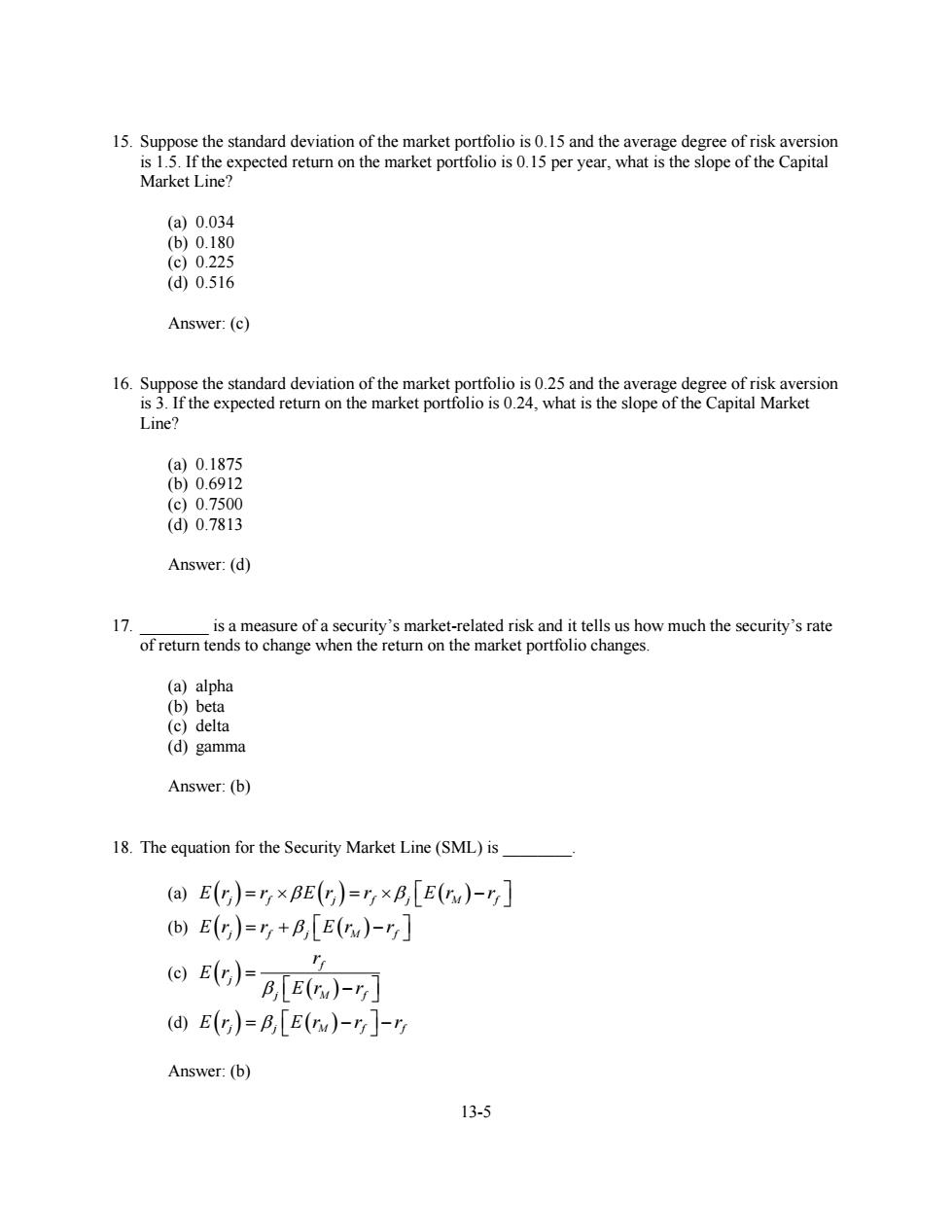

15.Suppose the standard deviation of the market portfolio is 0.15 and the average degree of risk aversion is 1.5.If the expected return on the market portfolio is 0.15 per year,what is the slope of the Capital Market Line? (a)0.034 (b)0.180 (c)0.225 (d0.516 Answer:(c) 16.Suppose the standard deviation of the market portfolio is 0.25 and the average degree of risk aversion is 3.If the expected return on the market portfolio is 0.24,what is the slope of the Capital Market Line? (a0.1875 (b)0.6912 (c)0.7500 (d0.7813 Answer:(d) 17. is a measure of a security's market-related risk and it tells us how much the security's rate of return tends to change when the return on the market portfolio changes. (a)alpha (b)beta (c)delta (d)gamma Answer:(b) 18.The equation for the Security Market Line(SML)is (a)Ey)=r×BE(g)=r×p,E(w)-y] (b)E(r)=+B,E(rx)- a(FgG-7 (@E(G)=B,E(u)-r]- Answer:(b) 13-513-5 15. Suppose the standard deviation of the market portfolio is 0.15 and the average degree of risk aversion is 1.5. If the expected return on the market portfolio is 0.15 per year, what is the slope of the Capital Market Line? (a) 0.034 (b) 0.180 (c) 0.225 (d) 0.516 Answer: (c) 16. Suppose the standard deviation of the market portfolio is 0.25 and the average degree of risk aversion is 3. If the expected return on the market portfolio is 0.24, what is the slope of the Capital Market Line? (a) 0.1875 (b) 0.6912 (c) 0.7500 (d) 0.7813 Answer: (d) 17. ________ is a measure of a security’s market-related risk and it tells us how much the security’s rate of return tends to change when the return on the market portfolio changes. (a) alpha (b) beta (c) delta (d) gamma Answer: (b) 18. The equation for the Security Market Line (SML) is ________. (a) E r r E r r E r r j f j f j M f (b) E r r E r r j f j M f (c) f j j M f r E r E r r (d) E r E r r r j j M f f Answer: (b)