正在加载图片...

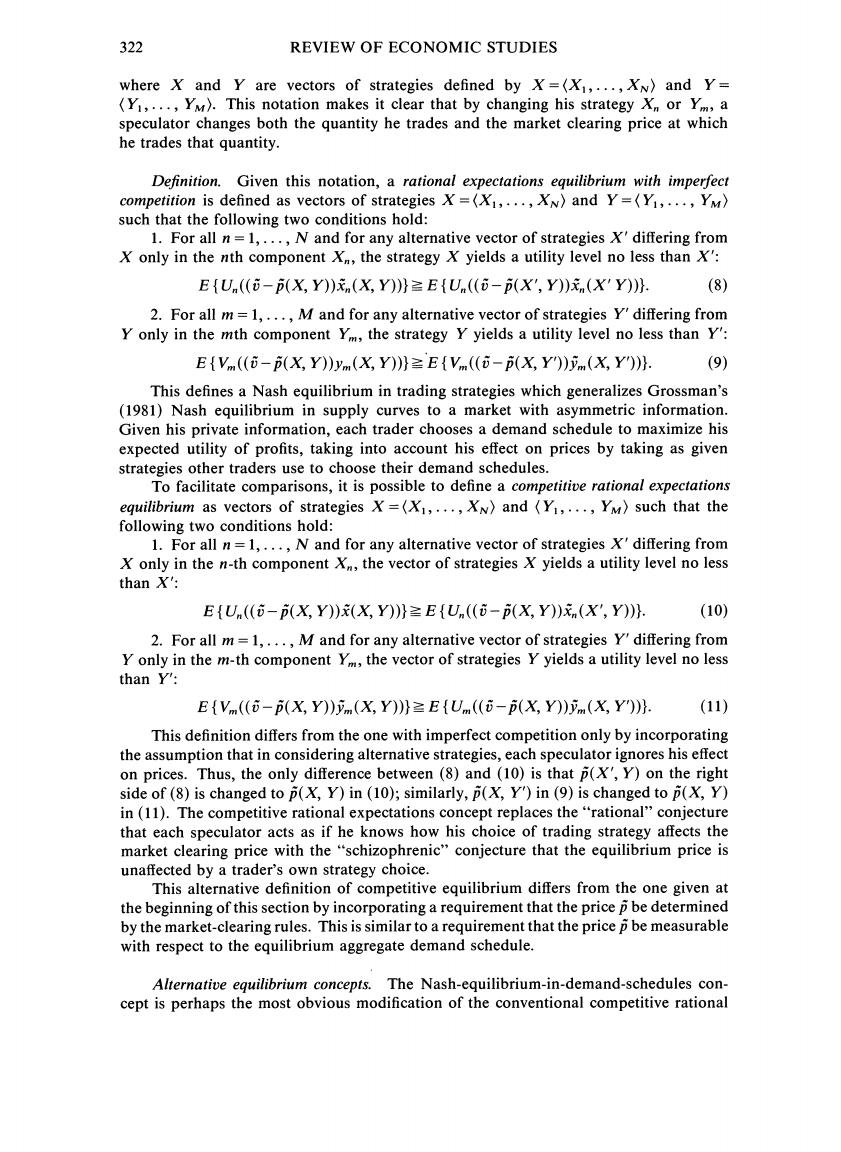

322 REVIEW OF ECONOMIC STUDIES where X and Y are vectors of strategies defined by X=(X1,...,XN)and Y= (Y1,...,YM).This notation makes it clear that by changing his strategy X or Yim,a speculator changes both the quantity he trades and the market clearing price at which he trades that quantity. Definition.Given this notation,a rational expectations equilibrium with imperfect competition is defined as vectors of strategies X=(X1,...,XN)and Y=(Y1,...,YM) such that the following two conditions hold: 1.For all n=1,...,N and for any alternative vector of strategies X'differing from X only in the nth component X,the strategy X yields a utility level no less than X': EU(((X,Y))(X,Y))EU((-(X',Y))(X'Y))) (8) 2.For all m=1,...,M and for any alternative vector of strategies Y'differing from Y only in the mth component Yim,the strategy Y yields a utility level no less than Y': EV ((-(X,Y))vm(X,Y))EV ((6-p(X,Y))(X,Y))) (9) This defines a Nash equilibrium in trading strategies which generalizes Grossman's (1981)Nash equilibrium in supply curves to a market with asymmetric information. Given his private information,each trader chooses a demand schedule to maximize his expected utility of profits,taking into account his effect on prices by taking as given strategies other traders use to choose their demand schedules. To facilitate comparisons,it is possible to define a competitive rational expectations equilibrium as vectors of strategies X=(X1,...,XN)and (Y1,...,Ym)such that the following two conditions hold: 1.For all n=1,...,N and for any alternative vector of strategies X'differing from X only in the n-th component X,the vector of strategies X yields a utility level no less than X': EU((-(X,Y))X,Y)))EU((-(X,Y))(X',Y))). (10) 2.For all m=1,...,M and for any alternative vector of strategies Y'differing from Y only in the m-th component Ym,the vector of strategies Y yields a utility level no less than Y: EV((-p(X,Y))(X,Y))EU((-(X,Y))(X,Y))). (11) This definition differs from the one with imperfect competition only by incorporating the assumption that in considering alternative strategies,each speculator ignores his effect on prices.Thus,the only difference between (8)and (10)is that p(X',Y)on the right side of (8)is changed to p(X,Y)in (10);similarly,p(X,Y')in (9)is changed to p(X,Y) in (11).The competitive rational expectations concept replaces the"rational"conjecture that each speculator acts as if he knows how his choice of trading strategy affects the market clearing price with the "schizophrenic"conjecture that the equilibrium price is unaffected by a trader's own strategy choice. This alternative definition of competitive equilibrium differs from the one given at the beginning of this section by incorporating a requirement that the price p be determined by the market-clearing rules.This is similar to a requirement that the price p be measurable with respect to the equilibrium aggregate demand schedule. Alternative equilibrium concepts.The Nash-equilibrium-in-demand-schedules con- cept is perhaps the most obvious modification of the conventional competitive rational