正在加载图片...

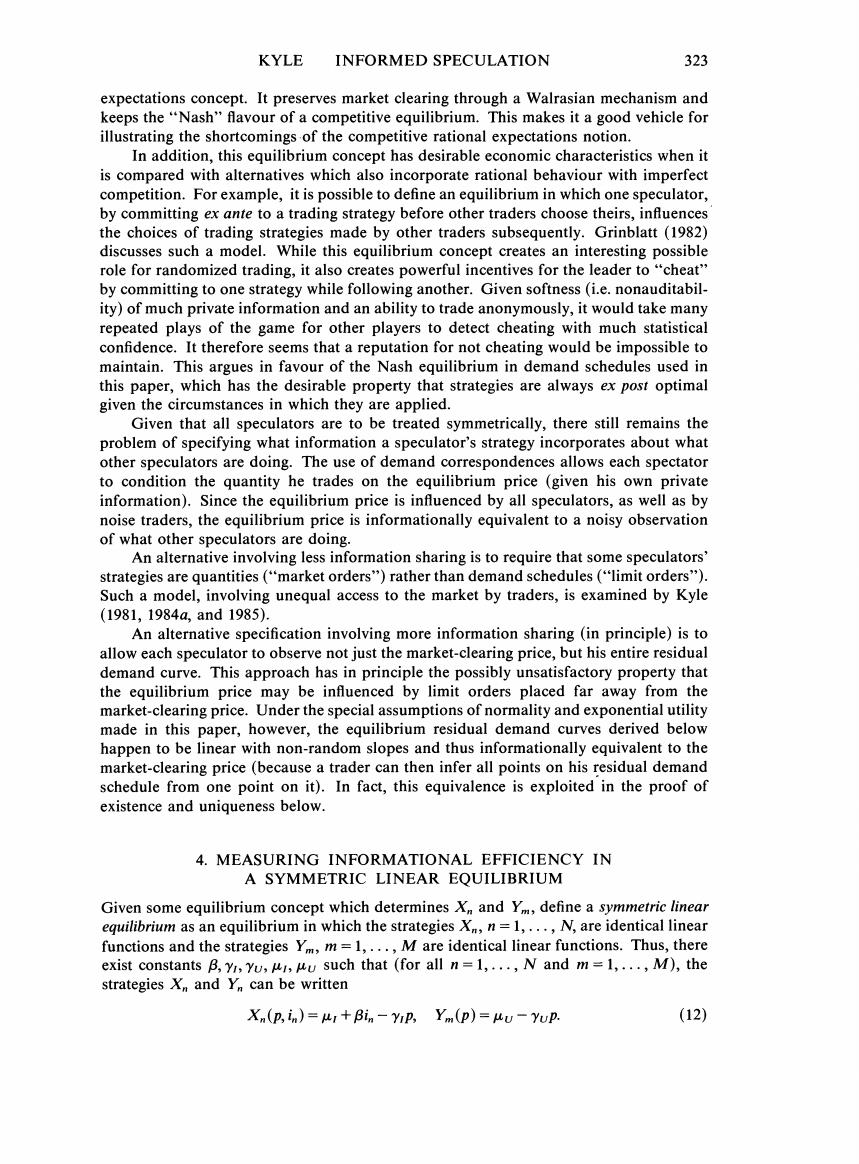

KYLE INFORMED SPECULATION 323 expectations concept.It preserves market clearing through a Walrasian mechanism and keeps the"Nash"flavour of a competitive equilibrium.This makes it a good vehicle for illustrating the shortcomings of the competitive rational expectations notion. In addition.this equilibrium concept has desirable economic characteristics when it is compared with alternatives which also incorporate rational behaviour with imperfect competition.For example,it is possible to define an equilibrium in which one speculator, by committing ex ante to a trading strategy before other traders choose theirs,influences the choices of trading strategies made by other traders subsequently.Grinblatt(1982) discusses such a model.While this equilibrium concept creates an interesting possible role for randomized trading,it also creates powerful incentives for the leader to"cheat" by committing to one strategy while following another.Given softness(i.e.nonauditabil- ity)of much private information and an ability to trade anonymously,it would take many repeated plays of the game for other players to detect cheating with much statistical confidence.It therefore seems that a reputation for not cheating would be impossible to maintain.This argues in favour of the Nash equilibrium in demand schedules used in this paper,which has the desirable property that strategies are always ex post optimal given the circumstances in which they are applied. Given that all speculators are to be treated symmetrically,there still remains the problem of specifying what information a speculator's strategy incorporates about what other speculators are doing.The use of demand correspondences allows each spectator to condition the quantity he trades on the equilibrium price (given his own private information).Since the equilibrium price is influenced by all speculators,as well as by noise traders,the equilibrium price is informationally equivalent to a noisy observation of what other speculators are doing. An alternative involving less information sharing is to require that some speculators' strategies are quantities("market orders")rather than demand schedules("limit orders"). Such a model,involving unequal access to the market by traders,is examined by Kyle (1981,1984a,and1985). An alternative specification involving more information sharing (in principle)is to allow each speculator to observe not just the market-clearing price,but his entire residual demand curve.This approach has in principle the possibly unsatisfactory property that the equilibrium price may be influenced by limit orders placed far away from the market-clearing price.Under the special assumptions of normality and exponential utility made in this paper,however,the equilibrium residual demand curves derived below happen to be linear with non-random slopes and thus informationally equivalent to the market-clearing price (because a trader can then infer all points on his residual demand schedule from one point on it).In fact,this equivalence is exploited in the proof of existence and uniqueness below. 4.MEASURING INFORMATIONAL EFFICIENCY IN A SYMMETRIC LINEAR EQUILIBRIUM Given some equilibrium concept which determines Xn and Ym,define a symmetric linear equilibrium as an equilibrium in which the strategies X,n=1,...,N,are identical linear functions and the strategies Ym,m=1,...,M are identical linear functions.Thus,there exist constants B,yr,Yu,uu such that (for all n=1,...,N and m=1,...,M),the strategies X and Y can be written Xn(p,in)=ur+Bin-Yip,Ym(p)=uu-Yup. (12)