正在加载图片...

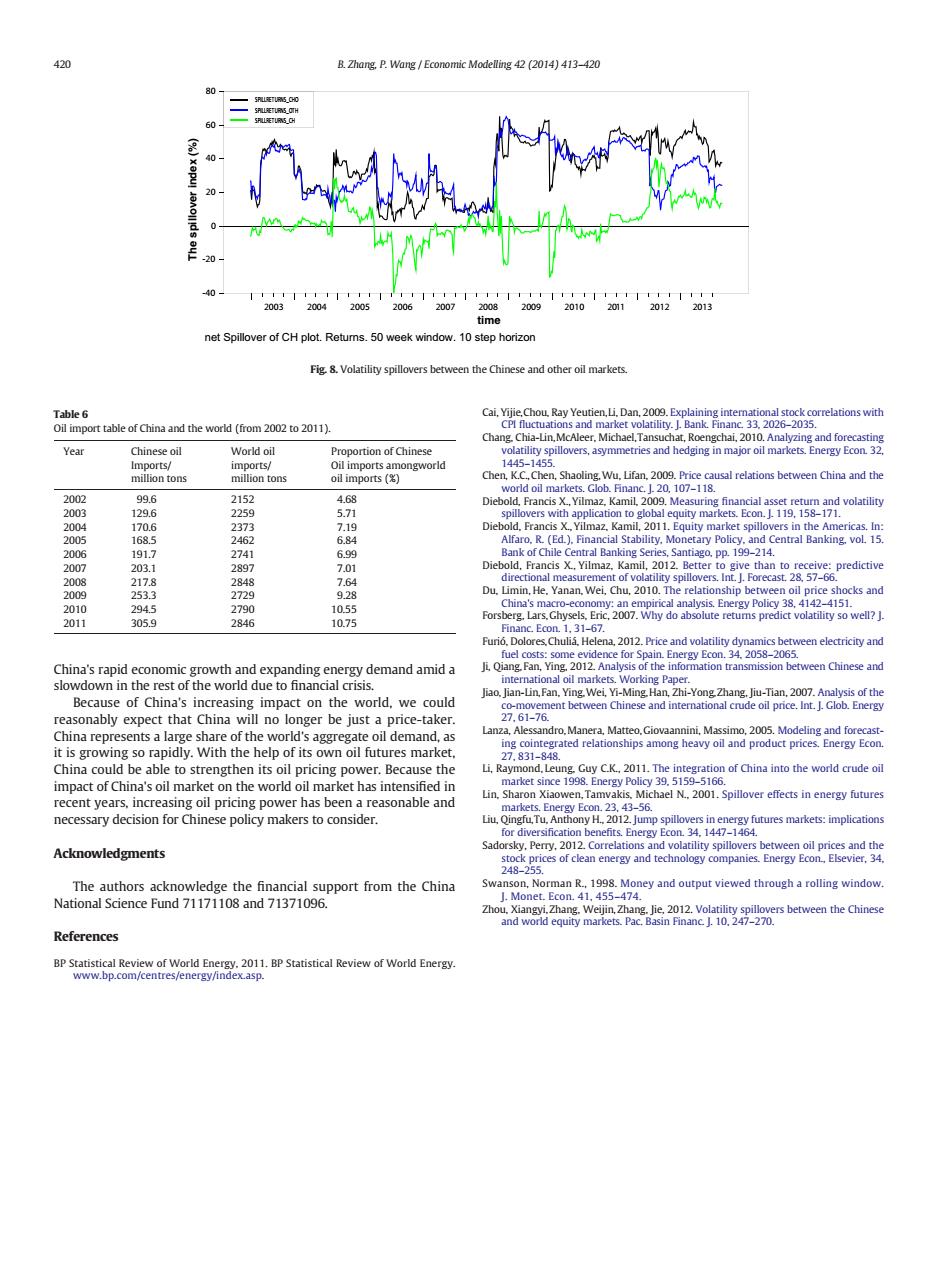

420 B.Zhang.P.Wang Economic Modelling 42 (2014)413-420 80 2003 2004 2005 2006 .2007 2008 200920102011 20122013 time net Spillover of CH plot.Retums.50 week window.10 step horizon Fig 8.Volatility spillovers between the Chinese and other oil markets. Table6 Cai,Yijie,Chou.Ray Yeutien,Li.Dan,2009.Explaining international stock correlations with Oil import table of China and the world (from 2002 to 2011). CPI fluctuations and market volatility.L Bank.Financ.33.2026-2035. Chang.Chia-Lin,McAleer.Michael,Tansuchat,Roengchai,2010.Analyzing and forecasting Year Chinese oil World oil Proportion of Chinese volatility spillovers,asymmetries and hedging in major oil markets.Energy Econ.32. Imports/ imports/ Oil imports amongworld 1445-1455. million tons million tons oil imports ( Chen,K.C.Chen,Shaoling.Wu,Lifan,2009.Price causal relations between China and the world oil markets.Glob.Financ.I.20,107-118. 2002 q96 2152 4.68 Diebold.Francis X..Yilmaz,Kamil,2009.Measuring financial asset return and volatility 2003 129.6 2259 5.71 spillovers with application to global equity markets.Econ.I.119,158-171. 2004 170.6 2373 7.19 Diebold.Francis X.Yilmaz,Kamil,2011.Equity market spillovers in the Americas.In: 2005 168.5 2462 6.84 Alfaro.R.(Ed.).Financial Stability.Monetary Policy.and Central Banking.vol.15. 2006 191.7 2741 6.99 Bank of Chile Central Banking Series,Santiago.pp.199-214. 2007 203.1 2897 7.01 Diebold,Francis X..Yilmaz.Kamil,2012.Better to give than to receive:predictive 2008 217.8 2848 7.64 directional measurement of volatility spillovers.Int.J.Forecast.28,57-66. 2009 2533 2729 9.28 Du,Limin,He.Yanan,Wei,Chu,2010.The relationship between oil price shocks and 2010 294.5 2790 10.55 China's macro-economy:an empirical analysis.Energy Policy 38,4142-4151. 305.9 10.75 Forsberg.Lars.Ghysels,Eric,2007.Why do absolute retums predict volatility so well?J. 2011 2846 Financ.Econ.1.31-6/. Furio.Dolores.Chulia.Helena,2012.Price and volatility dynamics between electricity and fuel costs:some evidence for Spain.Energy Econ.34.2058-2065. China's rapid economic growth and expanding energy demand amid a Ji.Qiang.Fan,Ying.2012.Analysis of the information transmission between Chinese and slowdown in the rest of the world due to financial crisis. nternational oil markets.Working Paper. Jiao,Jian-Lin,Fan,Ying.Wei,Yi-Ming.Han,Zhi-Yong Zhang.Jiu-Tian,2007.Analysis of the Because of China's increasing impact on the world,we could 6 vement between Chinese and international crude oil price.Int.J.Glob.Energy reasonably expect that China will no longer be just a price-taker. China represents a large share of the world's aggregate oil demand,as Lanza,Alessandro.Manera,Matteo,Giovaannini,Massimo,2005.Modeling and forecast- ing cointegrated relationships among heavy oil and product prices.Energy Econ it is growing so rapidly.With the help of its own oil futures market. 27.831-848. China could be able to strengthen its oil pricing power.Because the Li,Raymond.Leung Guy C.K..2011.The integration of China into the world crude oil impact of China's oil market on the world oil market has intensified in market since 1998.Energy Policy 39.5159-5166. Lin.Sharon Xiaowen,Tamvakis,Michael N.2001.Spillover effects in energy futures recent years,increasing oil pricing power has been a reasonable and markets.Energy Econ.23,43-56. necessary decision for Chinese policy makers to consider. Liu,Qingfu,Tu,Anthony H..2012.Jump spillovers in energy futures markets:implications for diversification benefits.Energy Econ.34,1447-1464. Acknowledgments Sadorsky.Perry,2012.Correlations and volatility spillovers between oil prices and the stock prices of clean energy and technology companies.Energy Econ,Elsevier,34. 248-255. The authors acknowledge the financial support from the China Swanson,Norman R.,1998.Money and output viewed through a rolling window. National Science Fund 71171108 and 71371096. J.Monet.Econ.41,455-474. Zhou.Xiangyi.Zhang.Weijin,Zhang.Jie,2012.Volatility spillovers between the Chinese and world equity markets.Pac.Basin Financ J.10.247-270. References BP Statistical Review of World Energy.2011.BP Statistical Review of World Energy www.bp.com/centres/energy/index.asp.China's rapid economic growth and expanding energy demand amid a slowdown in the rest of the world due to financial crisis. Because of China's increasing impact on the world, we could reasonably expect that China will no longer be just a price-taker. China represents a large share of the world's aggregate oil demand, as it is growing so rapidly. With the help of its own oil futures market, China could be able to strengthen its oil pricing power. Because the impact of China's oil market on the world oil market has intensified in recent years, increasing oil pricing power has been a reasonable and necessary decision for Chinese policy makers to consider. Acknowledgments The authors acknowledge the financial support from the China National Science Fund 71171108 and 71371096. References BP Statistical Review of World Energy, 2011. BP Statistical Review of World Energy. www.bp.com/centres/energy/index.asp. Cai, Yijie,Chou, Ray Yeutien,Li, Dan, 2009. Explaining international stock correlations with CPI fluctuations and market volatility. J. Bank. Financ. 33, 2026–2035. Chang, Chia-Lin,McAleer, Michael,Tansuchat, Roengchai, 2010. Analyzing and forecasting volatility spillovers, asymmetries and hedging in major oil markets. Energy Econ. 32, 1445–1455. Chen, K.C., Chen, Shaoling,Wu, Lifan, 2009. Price causal relations between China and the world oil markets. Glob. Financ. J. 20, 107–118. Diebold, Francis X., Yilmaz, Kamil, 2009. Measuring financial asset return and volatility spillovers with application to global equity markets. Econ. J. 119, 158–171. Diebold, Francis X., Yilmaz, Kamil, 2011. Equity market spillovers in the Americas. In: Alfaro, R. (Ed.), Financial Stability, Monetary Policy, and Central Banking, vol. 15. Bank of Chile Central Banking Series, Santiago, pp. 199–214. Diebold, Francis X., Yilmaz, Kamil, 2012. Better to give than to receive: predictive directional measurement of volatility spillovers. Int. J. Forecast. 28, 57–66. Du, Limin, He, Yanan, Wei, Chu, 2010. The relationship between oil price shocks and China's macro-economy: an empirical analysis. Energy Policy 38, 4142–4151. Forsberg, Lars,Ghysels, Eric, 2007. Why do absolute returns predict volatility so well? J. Financ. Econ. 1, 31–67. Furió, Dolores,Chuliá, Helena, 2012. Price and volatility dynamics between electricity and fuel costs: some evidence for Spain. Energy Econ. 34, 2058–2065. Ji, Qiang, Fan, Ying, 2012. Analysis of the information transmission between Chinese and international oil markets. Working Paper. Jiao, Jian-Lin, Fan, Ying,Wei, Yi-Ming,Han, Zhi-Yong,Zhang, Jiu-Tian, 2007. Analysis of the co-movement between Chinese and international crude oil price. Int. J. Glob. Energy 27, 61–76. Lanza, Alessandro,Manera, Matteo,Giovaannini, Massimo, 2005. Modeling and forecasting cointegrated relationships among heavy oil and product prices. Energy Econ. 27, 831–848. Li, Raymond, Leung, Guy C.K., 2011. The integration of China into the world crude oil market since 1998. Energy Policy 39, 5159–5166. Lin, Sharon Xiaowen, Tamvakis, Michael N., 2001. Spillover effects in energy futures markets. Energy Econ. 23, 43–56. Liu, Qingfu,Tu, Anthony H., 2012. Jump spillovers in energy futures markets: implications for diversification benefits. Energy Econ. 34, 1447–1464. Sadorsky, Perry, 2012. Correlations and volatility spillovers between oil prices and the stock prices of clean energy and technology companies. Energy Econ., Elsevier, 34, 248–255. Swanson, Norman R., 1998. Money and output viewed through a rolling window. J. Monet. Econ. 41, 455–474. Zhou, Xiangyi, Zhang, Weijin, Zhang, Jie, 2012. Volatility spillovers between the Chinese and world equity markets. Pac. Basin Financ. J. 10, 247–270. time The spillover index (%) 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 -40 -20 0 20 40 60 80 SPILLRETURNS_CHO SPILLRETURNS_OTH SPILLRETURNS_CH net Spillover of CH plot. Returns. 50 week window. 10 step horizon Fig. 8. Volatility spillovers between the Chinese and other oil markets. Table 6 Oil import table of China and the world (from 2002 to 2011). Year Chinese oil Imports/ million tons World oil imports/ million tons Proportion of Chinese Oil imports amongworld oil imports (%) 2002 99.6 2152 4.68 2003 129.6 2259 5.71 2004 170.6 2373 7.19 2005 168.5 2462 6.84 2006 191.7 2741 6.99 2007 203.1 2897 7.01 2008 217.8 2848 7.64 2009 253.3 2729 9.28 2010 294.5 2790 10.55 2011 305.9 2846 10.75 420 B. Zhang, P. Wang / Economic Modelling 42 (2014) 413–420