正在加载图片...

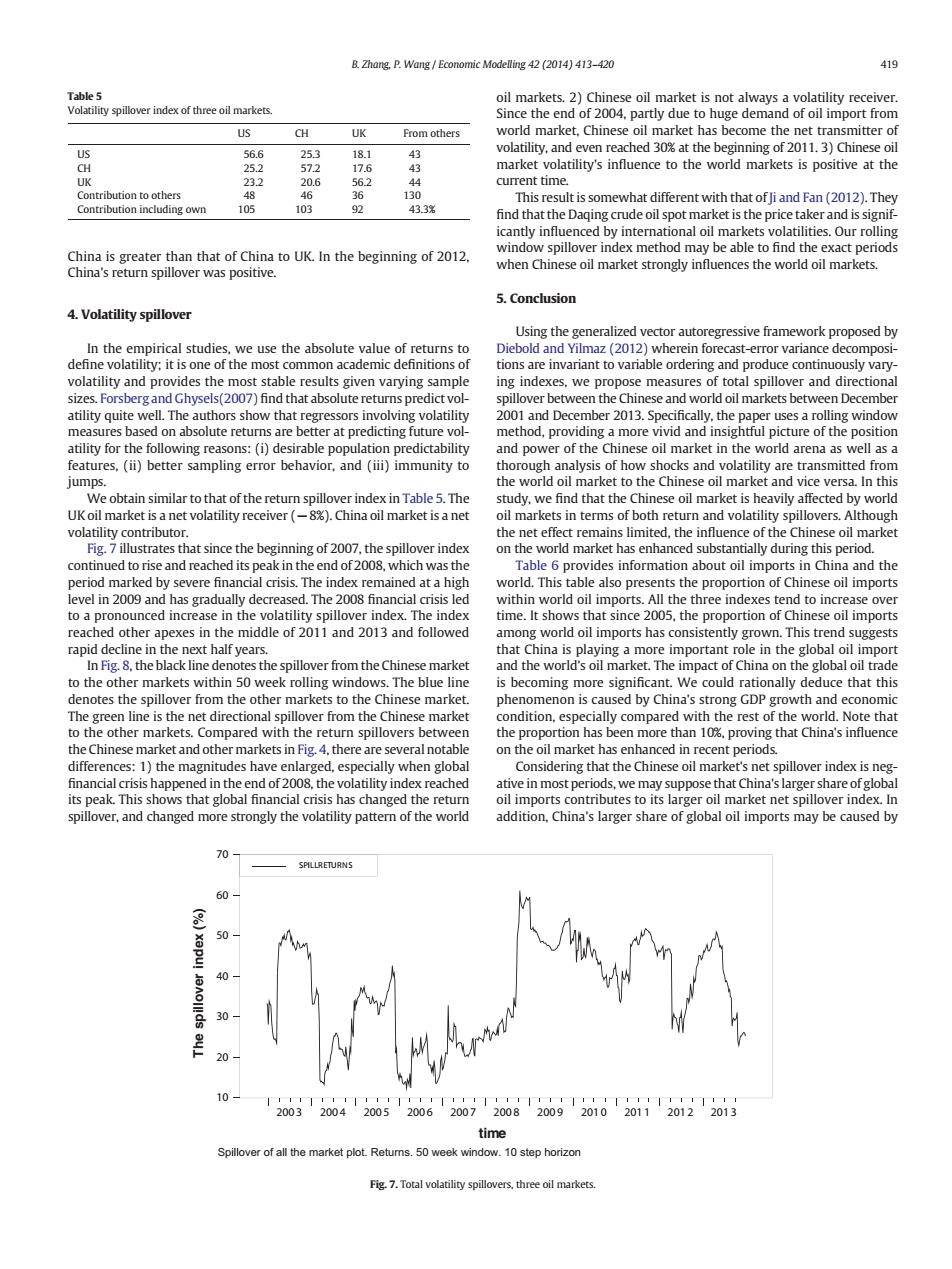

B.Zhang.P.Wang Economic Modelling 42 (2014)413-420 419 Table 5 oil markets.2)Chinese oil market is not always a volatility receiver. Volatility spillover index of three oil markets. Since the end of 2004,partly due to huge demand of oil import from US UK From others world market,Chinese oil market has become the net transmitter of US 56.6 253 18.1 43 volatility,and even reached 30%at the beginning of 2011.3)Chinese oil CH 25.2 57.2 17.6 43 market volatility's influence to the world markets is positive at the UK 23.2 20.6 562 44 current time. Contributon to others 48 46 36 130 This result is somewhat different with that of Ji and Fan(2012).They Contribution including own 105 103 92 43.3% find that the Daqing crude oil spot market is the price taker and is signif- icantly influenced by international oil markets volatilities.Our rolling window spillover index method may be able to find the exact periods China is greater than that of China to UK.In the beginning of 2012. China's return spillover was positive. when Chinese oil market strongly influences the world oil markets. 5.Conclusion 4.Volatility spillover Using the generalized vector autoregressive framework proposed by In the empirical studies,we use the absolute value of returns to Diebold and Yilmaz(2012)wherein forecast-error variance decomposi- define volatility:it is one of the most common academic definitions of tions are invariant to variable ordering and produce continuously vary- volatility and provides the most stable results given varying sample ing indexes,we propose measures of total spillover and directional sizes.Forsberg and Ghysels(2007)find that absolute returns predict vol- spillover between the Chinese and world oil markets between December atility quite well.The authors show that regressors involving volatility 2001 and December 2013.Specifically,the paper uses a rolling window measures based on absolute returns are better at predicting future vol- method,providing a more vivid and insightful picture of the position atility for the following reasons:(i)desirable population predictability and power of the Chinese oil market in the world arena as well as a features,(ii)better sampling error behavior,and (iii)immunity to thorough analysis of how shocks and volatility are transmitted from jumps. the world oil market to the Chinese oil market and vice versa.In this We obtain similar to that of the return spillover index in Table 5.The study,we find that the Chinese oil market is heavily affected by world UKoil market is a net volatility receiver(8%).China oil market is a net oil markets in terms of both return and volatility spillovers.Although volatility contributor. the net effect remains limited,the influence of the Chinese oil market Fig.7 illustrates that since the beginning of 2007,the spillover index on the world market has enhanced substantially during this period. continued to rise and reached its peak in the end of 2008,which was the Table 6 provides information about oil imports in China and the period marked by severe financial crisis.The index remained at a high world.This table also presents the proportion of Chinese oil imports level in 2009 and has gradually decreased.The 2008 financial crisis led within world oil imports.All the three indexes tend to increase over to a pronounced increase in the volatility spillover index.The index time.It shows that since 2005,the proportion of Chinese oil imports reached other apexes in the middle of 2011 and 2013 and followed among world oil imports has consistently grown.This trend suggests rapid decline in the next half years. that China is playing a more important role in the global oil import In Fig.8,the black line denotes the spillover from the Chinese market and the world's oil market.The impact of China on the global oil trade to the other markets within 50 week rolling windows.The blue line is becoming more significant.We could rationally deduce that this denotes the spillover from the other markets to the Chinese market. phenomenon is caused by China's strong GDP growth and economic The green line is the net directional spillover from the Chinese market condition,especially compared with the rest of the world.Note that to the other markets.Compared with the return spillovers between the proportion has been more than 10%,proving that China's influence the Chinese market and other markets in Fig.4,there are several notable on the oil market has enhanced in recent periods. differences:1)the magnitudes have enlarged,especially when global Considering that the Chinese oil market's net spillover index is neg- financial crisis happened in the end of 2008,the volatility index reached ative in most periods,we may suppose that China's larger share of global its peak.This shows that global financial crisis has changed the return oil imports contributes to its larger oil market net spillover index.In spillover,and changed more strongly the volatility pattern of the world addition,China's larger share of global oil imports may be caused by 70 SPILLRETURNS 60 10 1111111111111111111111111111111111111111 2003 2004200520062007200820092010201120122013 time Spillover of all the market plot.Retums.50 week window.10 step horizon Fig.7.Total volatility spillovers,three oil markets.China is greater than that of China to UK. In the beginning of 2012, China's return spillover was positive. 4. Volatility spillover In the empirical studies, we use the absolute value of returns to define volatility; it is one of the most common academic definitions of volatility and provides the most stable results given varying sample sizes. Forsberg and Ghysels(2007) find that absolute returns predict volatility quite well. The authors show that regressors involving volatility measures based on absolute returns are better at predicting future volatility for the following reasons: (i) desirable population predictability features, (ii) better sampling error behavior, and (iii) immunity to jumps. We obtain similar to that of the return spillover index in Table 5. The UK oil market is a net volatility receiver (−8%). China oil market is a net volatility contributor. Fig. 7 illustrates that since the beginning of 2007, the spillover index continued to rise and reached its peak in the end of 2008, which was the period marked by severe financial crisis. The index remained at a high level in 2009 and has gradually decreased. The 2008 financial crisis led to a pronounced increase in the volatility spillover index. The index reached other apexes in the middle of 2011 and 2013 and followed rapid decline in the next half years. In Fig. 8, the black line denotes the spillover from the Chinese market to the other markets within 50 week rolling windows. The blue line denotes the spillover from the other markets to the Chinese market. The green line is the net directional spillover from the Chinese market to the other markets. Compared with the return spillovers between the Chinese market and other markets in Fig. 4, there are several notable differences: 1) the magnitudes have enlarged, especially when global financial crisis happened in the end of 2008, the volatility index reached its peak. This shows that global financial crisis has changed the return spillover, and changed more strongly the volatility pattern of the world oil markets. 2) Chinese oil market is not always a volatility receiver. Since the end of 2004, partly due to huge demand of oil import from world market, Chinese oil market has become the net transmitter of volatility, and even reached 30% at the beginning of 2011. 3) Chinese oil market volatility's influence to the world markets is positive at the current time. This result is somewhat different with that of Ji and Fan (2012). They find that the Daqing crude oil spot market is the price taker and is significantly influenced by international oil markets volatilities. Our rolling window spillover index method may be able to find the exact periods when Chinese oil market strongly influences the world oil markets. 5. Conclusion Using the generalized vector autoregressive framework proposed by Diebold and Yilmaz (2012) wherein forecast-error variance decompositions are invariant to variable ordering and produce continuously varying indexes, we propose measures of total spillover and directional spillover between the Chinese and world oil markets between December 2001 and December 2013. Specifically, the paper uses a rolling window method, providing a more vivid and insightful picture of the position and power of the Chinese oil market in the world arena as well as a thorough analysis of how shocks and volatility are transmitted from the world oil market to the Chinese oil market and vice versa. In this study, we find that the Chinese oil market is heavily affected by world oil markets in terms of both return and volatility spillovers. Although the net effect remains limited, the influence of the Chinese oil market on the world market has enhanced substantially during this period. Table 6 provides information about oil imports in China and the world. This table also presents the proportion of Chinese oil imports within world oil imports. All the three indexes tend to increase over time. It shows that since 2005, the proportion of Chinese oil imports among world oil imports has consistently grown. This trend suggests that China is playing a more important role in the global oil import and the world's oil market. The impact of China on the global oil trade is becoming more significant. We could rationally deduce that this phenomenon is caused by China's strong GDP growth and economic condition, especially compared with the rest of the world. Note that the proportion has been more than 10%, proving that China's influence on the oil market has enhanced in recent periods. Considering that the Chinese oil market's net spillover index is negative in most periods, we may suppose that China's larger share of global oil imports contributes to its larger oil market net spillover index. In addition, China's larger share of global oil imports may be caused by Table 5 Volatility spillover index of three oil markets. US CH UK From others US 56.6 25.3 18.1 43 CH 25.2 57.2 17.6 43 UK 23.2 20.6 56.2 44 Contribution to others 48 46 36 130 Contribution including own 105 103 92 43.3% time The spillover index (%) 200 3 200 4 200 5 200 6 200 7 200 8 200 9 201 0 201 1 201 2 201 3 10 20 30 40 50 60 70 SPILLRETURNS Spillover of all the market plot. Returns. 50 week window. 10 step horizon Fig. 7. Total volatility spillovers, three oil markets. B. Zhang, P. Wang / Economic Modelling 42 (2014) 413–420 419