正在加载图片...

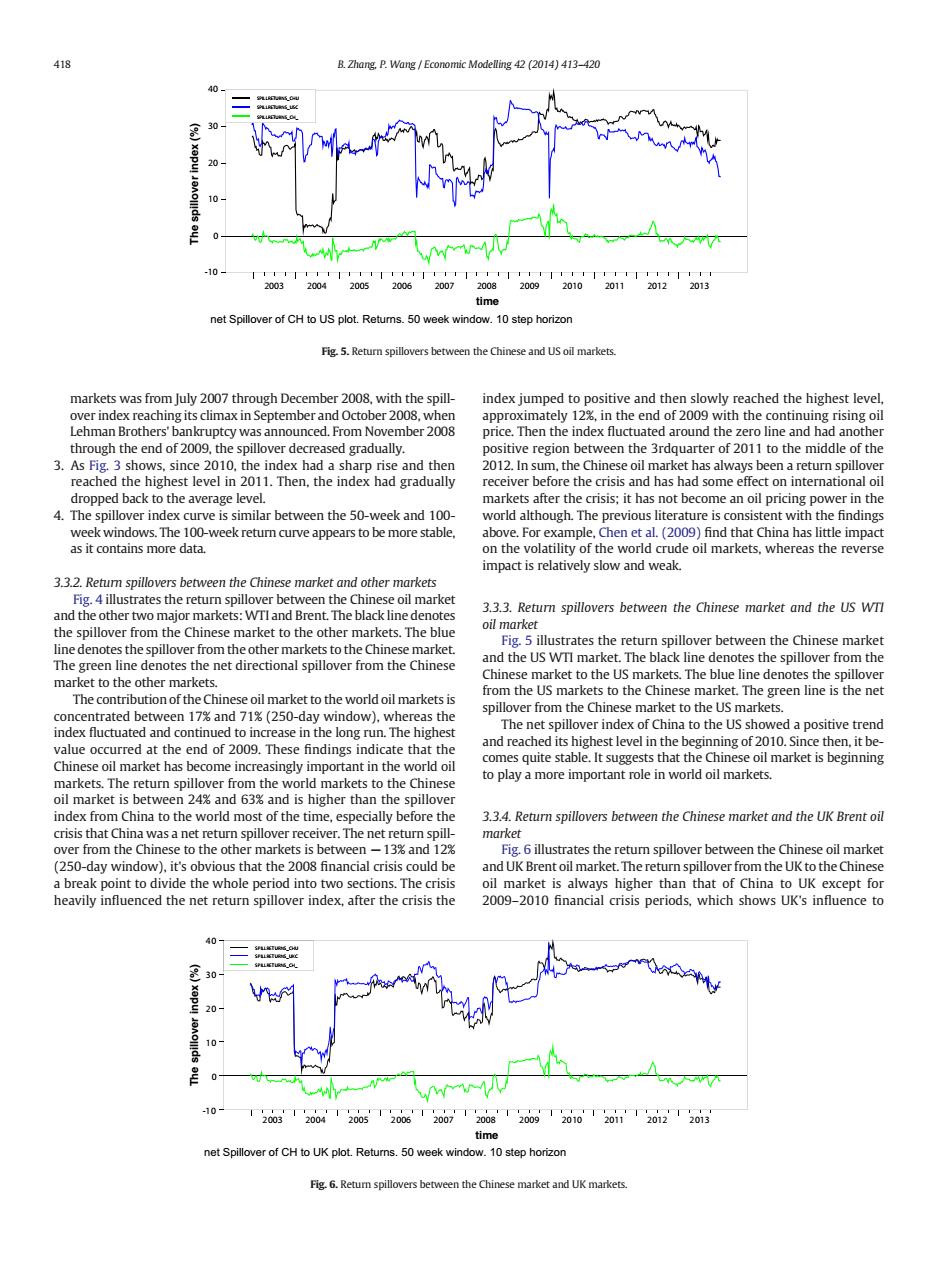

418 B.Zhang.P.Wang Economic Modelling 42 (2014)413-420 40 930 20 10 2003 20042005 2006 20072008 20092010 201120122013 time net Spillover of CH to US plot.Retums.50 week window.10 step horizon Fig.5.Return spillovers between the Chinese and US oil markets. markets was from July 2007 through December 2008,with the spill- index jumped to positive and then slowly reached the highest level over index reaching its climax in September and October 2008,when approximately 12%,in the end of 2009 with the continuing rising oil Lehman Brothers'bankruptcy was announced.From November 2008 price.Then the index fluctuated around the zero line and had another through the end of 2009,the spillover decreased gradually. positive region between the 3rdquarter of 2011 to the middle of the 3.As Fig.3 shows,since 2010,the index had a sharp rise and then 2012.In sum,the Chinese oil market has always been a return spillover reached the highest level in 2011.Then,the index had gradually receiver before the crisis and has had some effect on international oil dropped back to the average level. markets after the crisis;it has not become an oil pricing power in the 4.The spillover index curve is similar between the 50-week and 100- world although.The previous literature is consistent with the findings week windows.The 100-week return curve appears to be more stable, above.For example,Chen et al.(2009)find that China has little impact as it contains more data on the volatility of the world crude oil markets,whereas the reverse impact is relatively slow and weak. 3.3.2.Retum spillovers between the Chinese market and other markets Fig.4illustrates the return spillover between the Chinese oil market and the other two major markets:WTI and Brent.The black line denotes 3.3.3.Return spillovers between the Chinese market and the US WTI the spillover from the Chinese market to the other markets.The blue oil market Fig.5 illustrates the return spillover between the Chinese market line denotes the spillover from the other markets to the Chinese market. The green line denotes the net directional spillover from the Chinese and the US WTI market.The black line denotes the spillover from the Chinese market to the US markets.The blue line denotes the spillover market to the other markets. from the US markets to the Chinese market.The green line is the net The contribution of the Chinese oil market to the world oil markets is spillover from the Chinese market to the US markets. concentrated between 17%and 71%(250-day window).whereas the index fluctuated and continued to increase in the long run.The highest The net spillover index of China to the US showed a positive trend value occurred at the end of 2009.These findings indicate that the and reached its highest level in the beginning of 2010.Since then,it be- Chinese oil market has become increasingly important in the world oil comes quite stable.It suggests that the Chinese oil market is beginning markets.The return spillover from the world markets to the Chinese to play a more important role in world oil markets. oil market is between 24%and 63%and is higher than the spillover index from China to the world most of the time,especially before the 3.3.4.Return spillovers between the Chinese market and the UK Brent oil crisis that China was a net return spillover receiver.The net return spill- market over from the Chinese to the other markets is between-13%and 12% Fig.6 illustrates the return spillover between the Chinese oil market (250-day window),it's obvious that the 2008 financial crisis could be and UK Brent oil market.The return spillover from the UK to the Chinese a break point to divide the whole period into two sections.The crisis oil market is always higher than that of China to UK except for heavily influenced the net return spillover index,after the crisis the 2009-2010 financial crisis periods,which shows UK's influence to 0 30 20 10- 10 2003T'20041200s'2061200712008T'20091'20101201'1'201212013 time net Spillover of CH to UK plot.Returns.50 week window.10 step horizon Fig.6.Return spillovers between the Chinese market and UK markets.markets was from July 2007 through December 2008, with the spillover index reaching its climax in September and October 2008, when Lehman Brothers' bankruptcy was announced. From November 2008 through the end of 2009, the spillover decreased gradually. 3. As Fig. 3 shows, since 2010, the index had a sharp rise and then reached the highest level in 2011. Then, the index had gradually dropped back to the average level. 4. The spillover index curve is similar between the 50-week and 100- week windows. The 100-week return curve appears to be more stable, as it contains more data. 3.3.2. Return spillovers between the Chinese market and other markets Fig. 4 illustrates the return spillover between the Chinese oil market and the other two major markets:WTI and Brent. The black line denotes the spillover from the Chinese market to the other markets. The blue line denotes the spillover from the other markets to the Chinese market. The green line denotes the net directional spillover from the Chinese market to the other markets. The contribution of the Chinese oil market to the world oil markets is concentrated between 17% and 71% (250-day window), whereas the index fluctuated and continued to increase in the long run. The highest value occurred at the end of 2009. These findings indicate that the Chinese oil market has become increasingly important in the world oil markets. The return spillover from the world markets to the Chinese oil market is between 24% and 63% and is higher than the spillover index from China to the world most of the time, especially before the crisis that China was a net return spillover receiver. The net return spillover from the Chinese to the other markets is between −13% and 12% (250-day window), it's obvious that the 2008 financial crisis could be a break point to divide the whole period into two sections. The crisis heavily influenced the net return spillover index, after the crisis the index jumped to positive and then slowly reached the highest level, approximately 12%, in the end of 2009 with the continuing rising oil price. Then the index fluctuated around the zero line and had another positive region between the 3rdquarter of 2011 to the middle of the 2012. In sum, the Chinese oil market has always been a return spillover receiver before the crisis and has had some effect on international oil markets after the crisis; it has not become an oil pricing power in the world although. The previous literature is consistent with the findings above. For example, Chen et al. (2009) find that China has little impact on the volatility of the world crude oil markets, whereas the reverse impact is relatively slow and weak. 3.3.3. Return spillovers between the Chinese market and the US WTI oil market Fig. 5 illustrates the return spillover between the Chinese market and the US WTI market. The black line denotes the spillover from the Chinese market to the US markets. The blue line denotes the spillover from the US markets to the Chinese market. The green line is the net spillover from the Chinese market to the US markets. The net spillover index of China to the US showed a positive trend and reached its highest level in the beginning of 2010. Since then, it becomes quite stable. It suggests that the Chinese oil market is beginning to play a more important role in world oil markets. 3.3.4. Return spillovers between the Chinese market and the UK Brent oil market Fig. 6 illustrates the return spillover between the Chinese oil market and UK Brent oil market. The return spillover from the UK to the Chinese oil market is always higher than that of China to UK except for 2009–2010 financial crisis periods, which shows UK's influence to time The spillover index (%) 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 -10 0 10 20 30 40 net Spillover of CH to US plot. Returns. 50 week window. 10 step horizon SPILLRETURNS_CHU SPILLRETURNS_USC SPILLRETURNS_CH_ Fig. 5. Return spillovers between the Chinese and US oil markets. time The spillover index (%) 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 -10 0 10 20 30 40 SPILLRETURNS_CHU SPILLRETURNS_UKC SPILLRETURNS_CH_ net Spillover of CH to UK plot. Returns. 50 week window. 10 step horizon Fig. 6. Return spillovers between the Chinese market and UK markets. 418 B. Zhang, P. Wang / Economic Modelling 42 (2014) 413–420