正在加载图片...

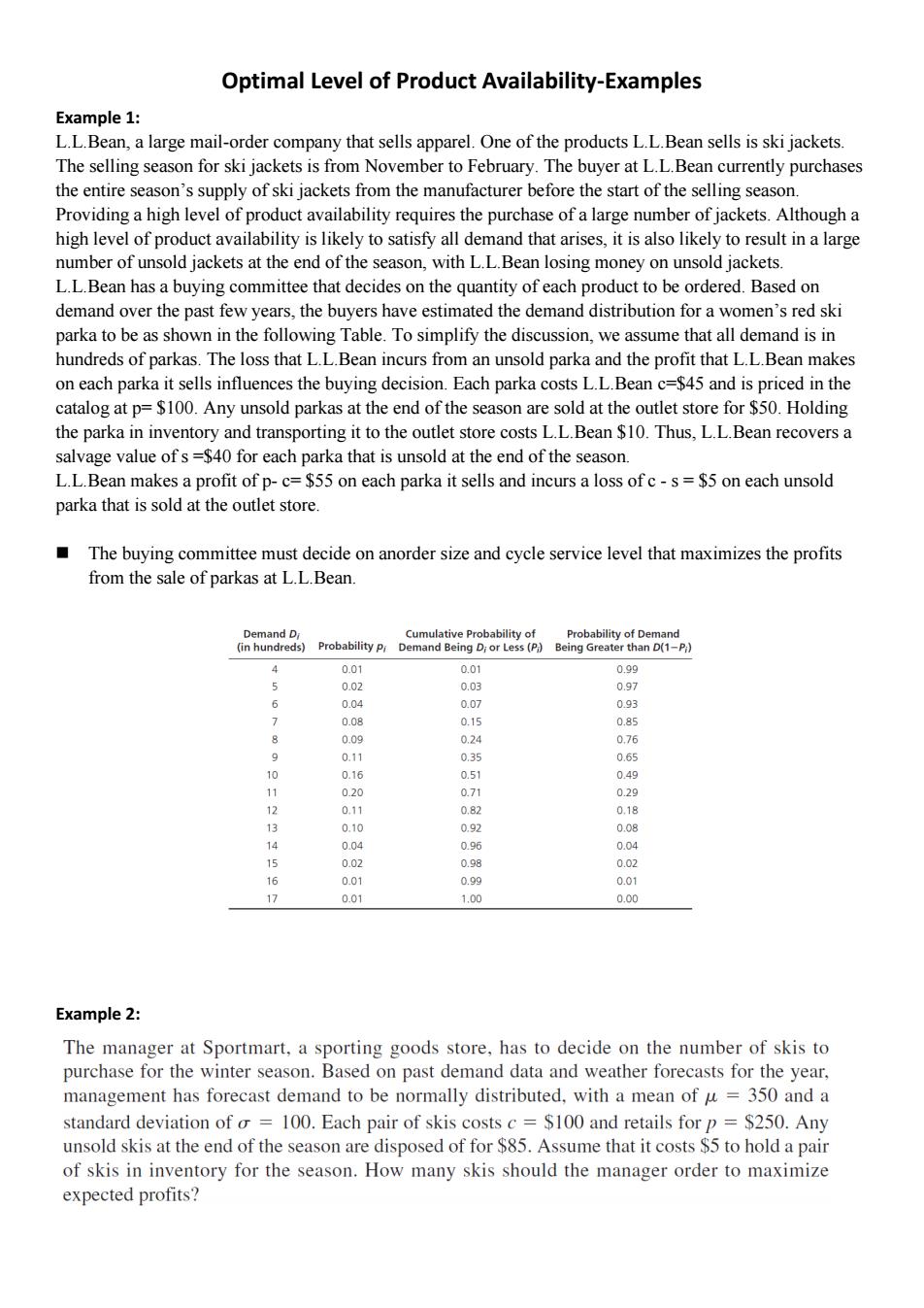

Optimal Level of Product Availability-Examples Example 1: L.L.Bean,a large mail-order company that sells apparel.One of the products L.L.Bean sells is ski jackets. The selling season for ski jackets is from November to February.The buyer at L.L.Bean currently purchases the entire season's supply of ski jackets from the manufacturer before the start of the selling season. Providing a high level of product availability requires the purchase of a large number of jackets.Although a high level of product availability is likely to satisfy all demand that arises,it is also likely to result in a large number of unsold jackets at the end of the season,with L.L.Bean losing money on unsold jackets. L.L.Bean has a buying committee that decides on the quantity of each product to be ordered.Based on demand over the past few years,the buyers have estimated the demand distribution for a women's red ski parka to be as shown in the following Table.To simplify the discussion,we assume that all demand is in hundreds of parkas.The loss that L.L.Bean incurs from an unsold parka and the profit that L.L.Bean makes on each parka it sells influences the buying decision.Each parka costs L.L.Bean c=$45 and is priced in the catalog at p=$100.Any unsold parkas at the end of the season are sold at the outlet store for $50.Holding the parka in inventory and transporting it to the outlet store costs L.L.Bean $10.Thus,L.L.Bean recovers a salvage value ofs =$40 for each parka that is unsold at the end of the season. L.L.Bean makes a profit of p-c=$55 on each parka it sells and incurs a loss of c-s=$5 on each unsold parka that is sold at the outlet store. The buying committee must decide on anorder size and cycle service level that maximizes the profits from the sale of parkas at L.L.Bean. Demand Di Cumulative Probability of Probability of Demand (in hundreds)Probability p Demand Being D;or Less(P)Being Greater than D(1-P;) 4 0.01 0.01 0.99 0.02 0.03 0.97 6 0.04 0.07 0.93 0.08 0.15 0.85 8 0.09 0.24 0.76 9 0.11 0.35 0.65 10 0.16 0.51 0.49 11 0.20 0.71 0.29 12 0.11 0.82 0.18 13 0.10 0.92 0.08 14 0.04 0.96 0.04 15 0.02 0.98 0.02 16 0.01 0.99 0.01 1) 0.01 1.00 0.00 Example 2: The manager at Sportmart,a sporting goods store,has to decide on the number of skis to purchase for the winter season.Based on past demand data and weather forecasts for the year, management has forecast demand to be normally distributed,with a mean of u=350 and a standard deviation of o 100.Each pair of skis costs c $100 and retails for p $250.Any unsold skis at the end of the season are disposed of for $85.Assume that it costs $5 to hold a pair of skis in inventory for the season.How many skis should the manager order to maximize expected profits?Optimal Level of Product Availability-Examples Example 1: L.L.Bean, a large mail-order company that sells apparel. One of the products L.L.Bean sells is ski jackets. The selling season for ski jackets is from November to February. The buyer at L.L.Bean currently purchases the entire season’s supply of ski jackets from the manufacturer before the start of the selling season. Providing a high level of product availability requires the purchase of a large number of jackets. Although a high level of product availability is likely to satisfy all demand that arises, it is also likely to result in a large number of unsold jackets at the end of the season, with L.L.Bean losing money on unsold jackets. L.L.Bean has a buying committee that decides on the quantity of each product to be ordered. Based on demand over the past few years, the buyers have estimated the demand distribution for a women’s red ski parka to be as shown in the following Table. To simplify the discussion, we assume that all demand is in hundreds of parkas. The loss that L.L.Bean incurs from an unsold parka and the profit that L.L.Bean makes on each parka it sells influences the buying decision. Each parka costs L.L.Bean c=$45 and is priced in the catalog at p= $100. Any unsold parkas at the end of the season are sold at the outlet store for $50. Holding the parka in inventory and transporting it to the outlet store costs L.L.Bean $10. Thus, L.L.Bean recovers a salvage value of s =$40 for each parka that is unsold at the end of the season. L.L.Bean makes a profit of p- c= $55 on each parka it sells and incurs a loss of c - s = $5 on each unsold parka that is sold at the outlet store. The buying committee must decide on anorder size and cycle service level that maximizes the profits from the sale of parkas at L.L.Bean. Example 2: