正在加载图片...

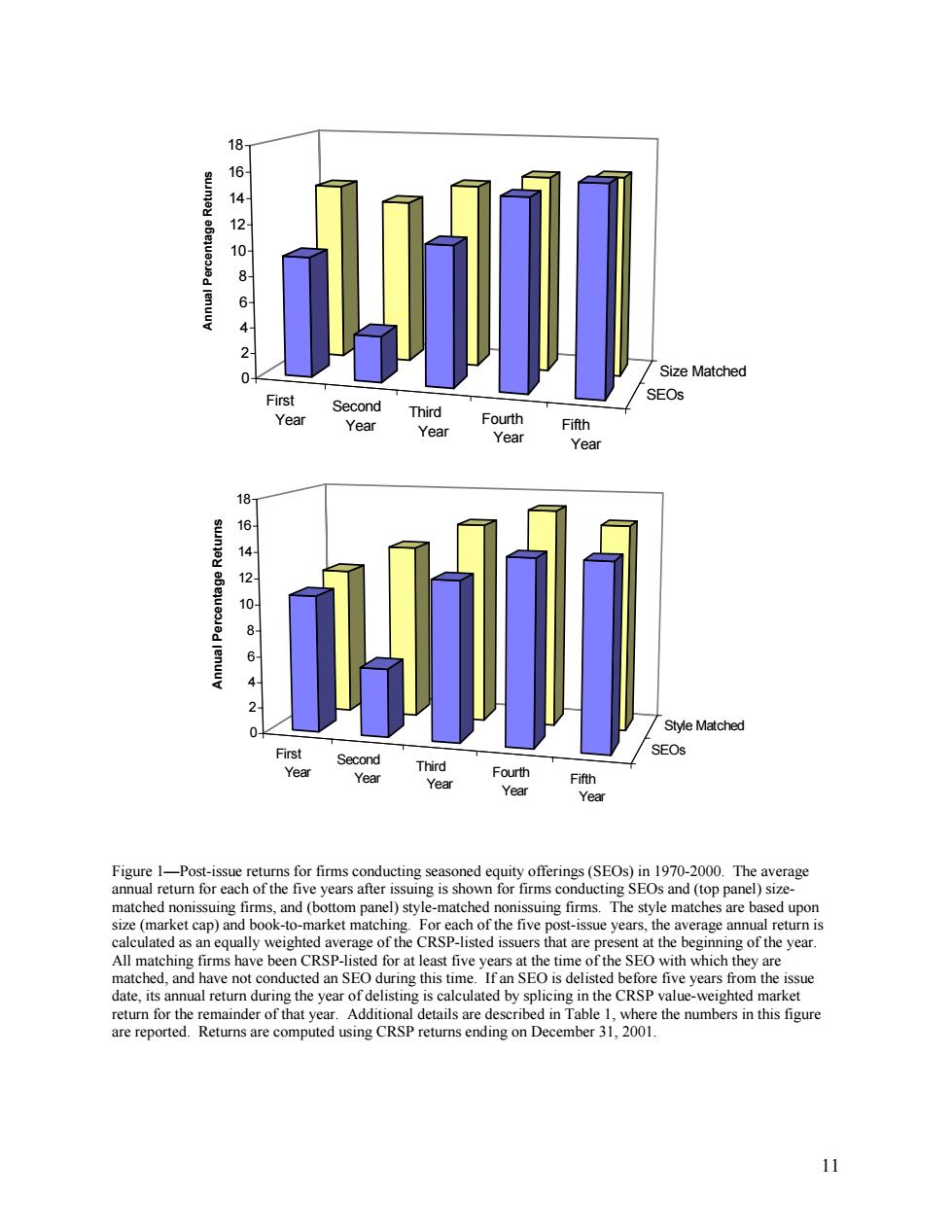

18 64 20 8 6 4 2 0 Size Matched First SEOs Second Third Year Year Fourth Year Fifth Year Year 18 1 12 10 8 7 StMle Matched First SEOs Second Year Third Year Fourth Year Fifth Year Year Figure 1-Post-issue returns for firms conducting seasoned equity offerings(SEOs)in 1970-2000.The average annual return for each of the five years after issuing is shown for firms conducting SEOs and(top panel)size- matched nonissuing firms,and (bottom panel)style-matched nonissuing firms.The style matches are based upon size(market cap)and book-to-market matching.For each of the five post-issue years,the average annual return is calculated as an equally weighted average of the CRSP-listed issuers that are present at the beginning of the year. All matching firms have been CRSP-listed for at least five years at the time of the SEO with which they are matched,and have not conducted an SEO during this time.If an SEO is delisted before five years from the issue date,its annual return during the year of delisting is calculated by splicing in the CRSP value-weighted market return for the remainder of that year.Additional details are described in Table 1,where the numbers in this figure are reported.Returns are computed using CRSP returns ending on December 31,2001. 1111 First Year Second Year Third Year Fourth Year Fifth Year SEOs Size Matched 0 2 4 6 8 10 12 14 16 18 Annual Percentage Returns First Year Second Year Third Year Fourth Year Fifth Year SEOs Style Matched 0 2 4 6 8 10 12 14 16 18 Annual Percentage Returns Figure 1—Post-issue returns for firms conducting seasoned equity offerings (SEOs) in 1970-2000. The average annual return for each of the five years after issuing is shown for firms conducting SEOs and (top panel) sizematched nonissuing firms, and (bottom panel) style-matched nonissuing firms. The style matches are based upon size (market cap) and book-to-market matching. For each of the five post-issue years, the average annual return is calculated as an equally weighted average of the CRSP-listed issuers that are present at the beginning of the year. All matching firms have been CRSP-listed for at least five years at the time of the SEO with which they are matched, and have not conducted an SEO during this time. If an SEO is delisted before five years from the issue date, its annual return during the year of delisting is calculated by splicing in the CRSP value-weighted market return for the remainder of that year. Additional details are described in Table 1, where the numbers in this figure are reported. Returns are computed using CRSP returns ending on December 31, 2001