正在加载图片...

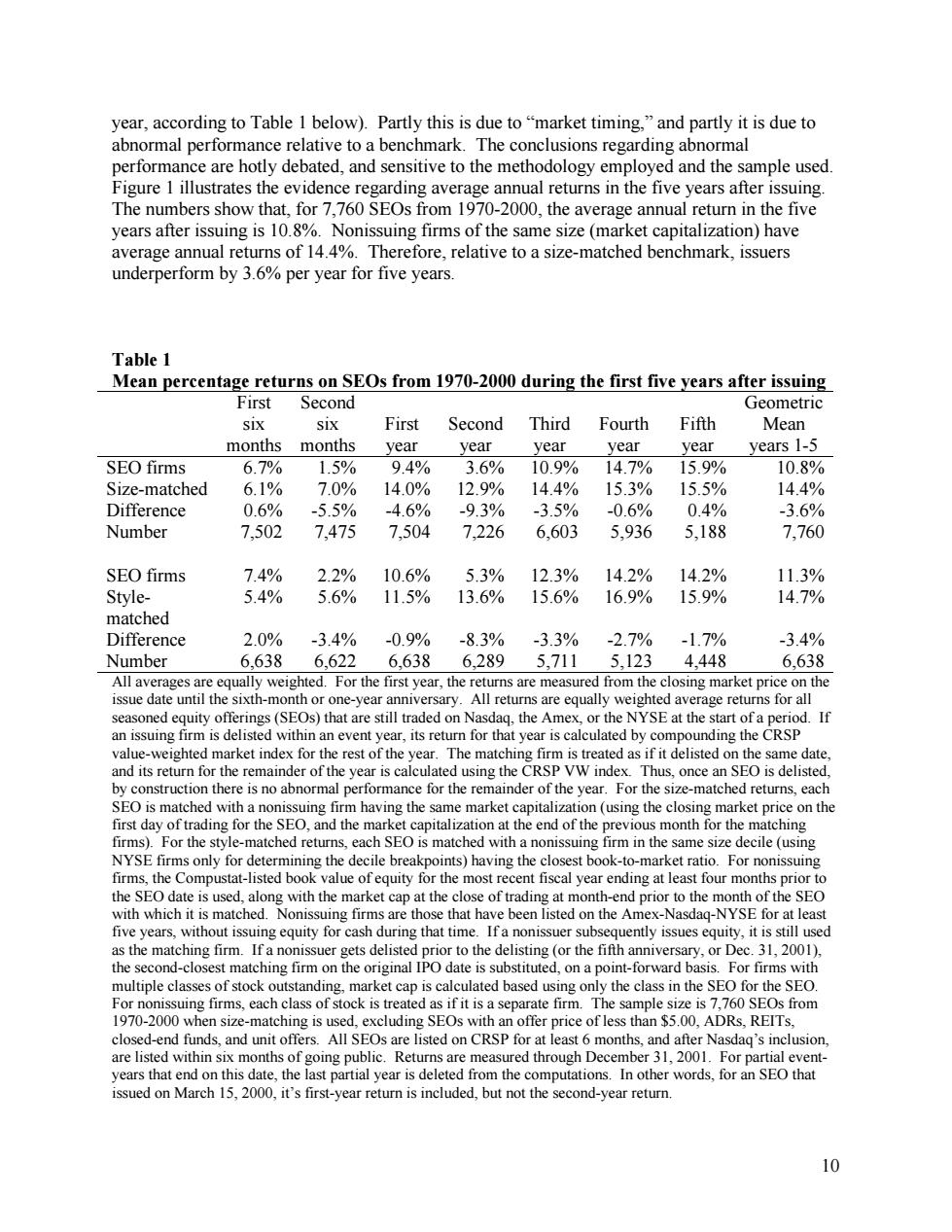

year,according to Table 1 below).Partly this is due to"market timing,"and partly it is due to abnormal performance relative to a benchmark.The conclusions regarding abnormal performance are hotly debated,and sensitive to the methodology employed and the sample used Figure 1 illustrates the evidence regarding average annual returns in the five years after issuing. The numbers show that,for 7,760 SEOs from 1970-2000,the average annual return in the five years after issuing is 10.8%.Nonissuing firms of the same size(market capitalization)have average annual returns of 14.4%.Therefore,relative to a size-matched benchmark,issuers underperform by 3.6%per year for five years. Table 1 Mean percentage returns on SEOs from 1970-2000 during the first five years after issuing First Second Geometric Six Six First Second Third Fourth Fifth Mean monthsmonths year year year year year years 1-5 SEO firms 6.7% 1.5% 9.4% 3.6% 10.9% 14.7% 15.9% 10.8% Size-matched 6.1% 7.0% 14.0% 12.9% 14.4% 15.3% 15.5% 14.4% Difference 0.6% -5.5% -4.6% -9.3% -3.5% -0.6% 0.4% -3.6% Number 7,502 7,475 7,504 7,226 6.603 5.936 5,188 7,760 SEO firms 7.4% 2.2% 10.6% 5.3% 12.3% 14.2% 14.2% 11.3% Style- 5.4% 5.6% 11.5% 13.6% 15.6% 16.9% 15.9% 14.7% matched Difference 2.0% -3.4% -0.9% -8.3% -3.3% -2.7% -1.7% -3.4% Number 6,638 6,622 6,638 6,289 5,711 5,123 4,448 6,638 All averages are equally weighted.For the first year,the returns are measured from the closing market price on the issue date until the sixth-month or one-year anniversary.All returns are equally weighted average returns for all seasoned equity offerings(SEOs)that are still traded on Nasdag,the Amex,or the NYSE at the start of a period.If an issuing firm is delisted within an event year,its return for that year is calculated by compounding the CRSP value-weighted market index for the rest of the year.The matching firm is treated as if it delisted on the same date. and its return for the remainder of the year is calculated using the CRSP VW index.Thus,once an SEO is delisted, by construction there is no abnormal performance for the remainder of the year.For the size-matched returns,each SEO is matched with a nonissuing firm having the same market capitalization (using the closing market price on the first day of trading for the SEO,and the market capitalization at the end of the previous month for the matching firms).For the style-matched returns,each SEO is matched with a nonissuing firm in the same size decile (using NYSE firms only for determining the decile breakpoints)having the closest book-to-market ratio.For nonissuing firms,the Compustat-listed book value of equity for the most recent fiscal year ending at least four months prior to the SEO date is used,along with the market cap at the close of trading at month-end prior to the month of the SEO with which it is matched.Nonissuing firms are those that have been listed on the Amex-Nasdag-NYSE for at least five years,without issuing equity for cash during that time.If a nonissuer subsequently issues equity,it is still used as the matching firm.If a nonissuer gets delisted prior to the delisting(or the fifth anniversary,or Dec.31,2001), the second-closest matching firm on the original IPO date is substituted,on a point-forward basis.For firms with multiple classes of stock outstanding,market cap is calculated based using only the class in the SEO for the SEO. For nonissuing firms,each class of stock is treated as if it is a separate firm.The sample size is 7,760 SEOs from 1970-2000 when size-matching is used,excluding SEOs with an offer price of less than $5.00,ADRs,REITs, closed-end funds,and unit offers.All SEOs are listed on CRSP for at least 6 months,and after Nasdag's inclusion, are listed within six months of going public.Returns are measured through December 31,2001.For partial event- years that end on this date,the last partial year is deleted from the computations.In other words,for an SEO that issued on March 15,2000,it's first-year return is included,but not the second-year return. 1010 year, according to Table 1 below). Partly this is due to “market timing,” and partly it is due to abnormal performance relative to a benchmark. The conclusions regarding abnormal performance are hotly debated, and sensitive to the methodology employed and the sample used. Figure 1 illustrates the evidence regarding average annual returns in the five years after issuing. The numbers show that, for 7,760 SEOs from 1970-2000, the average annual return in the five years after issuing is 10.8%. Nonissuing firms of the same size (market capitalization) have average annual returns of 14.4%. Therefore, relative to a size-matched benchmark, issuers underperform by 3.6% per year for five years. Table 1 Mean percentage returns on SEOs from 1970-2000 during the first five years after issuing First six months Second six months First year Second year Third year Fourth year Fifth year Geometric Mean years 1-5 SEO firms 6.7% 1.5% 9.4% 3.6% 10.9% 14.7% 15.9% 10.8% Size-matched 6.1% 7.0% 14.0% 12.9% 14.4% 15.3% 15.5% 14.4% Difference 0.6% -5.5% -4.6% -9.3% -3.5% -0.6% 0.4% -3.6% Number 7,502 7,475 7,504 7,226 6,603 5,936 5,188 7,760 SEO firms 7.4% 2.2% 10.6% 5.3% 12.3% 14.2% 14.2% 11.3% Stylematched 5.4% 5.6% 11.5% 13.6% 15.6% 16.9% 15.9% 14.7% Difference 2.0% -3.4% -0.9% -8.3% -3.3% -2.7% -1.7% -3.4% Number 6,638 6,622 6,638 6,289 5,711 5,123 4,448 6,638 All averages are equally weighted. For the first year, the returns are measured from the closing market price on the issue date until the sixth-month or one-year anniversary. All returns are equally weighted average returns for all seasoned equity offerings (SEOs) that are still traded on Nasdaq, the Amex, or the NYSE at the start of a period. If an issuing firm is delisted within an event year, its return for that year is calculated by compounding the CRSP value-weighted market index for the rest of the year. The matching firm is treated as if it delisted on the same date, and its return for the remainder of the year is calculated using the CRSP VW index. Thus, once an SEO is delisted, by construction there is no abnormal performance for the remainder of the year. For the size-matched returns, each SEO is matched with a nonissuing firm having the same market capitalization (using the closing market price on the first day of trading for the SEO, and the market capitalization at the end of the previous month for the matching firms). For the style-matched returns, each SEO is matched with a nonissuing firm in the same size decile (using NYSE firms only for determining the decile breakpoints) having the closest book-to-market ratio. For nonissuing firms, the Compustat-listed book value of equity for the most recent fiscal year ending at least four months prior to the SEO date is used, along with the market cap at the close of trading at month-end prior to the month of the SEO with which it is matched. Nonissuing firms are those that have been listed on the Amex-Nasdaq-NYSE for at least five years, without issuing equity for cash during that time. If a nonissuer subsequently issues equity, it is still used as the matching firm. If a nonissuer gets delisted prior to the delisting (or the fifth anniversary, or Dec. 31, 2001), the second-closest matching firm on the original IPO date is substituted, on a point-forward basis. For firms with multiple classes of stock outstanding, market cap is calculated based using only the class in the SEO for the SEO. For nonissuing firms, each class of stock is treated as if it is a separate firm. The sample size is 7,760 SEOs from 1970-2000 when size-matching is used, excluding SEOs with an offer price of less than $5.00, ADRs, REITs, closed-end funds, and unit offers. All SEOs are listed on CRSP for at least 6 months, and after Nasdaq’s inclusion, are listed within six months of going public. Returns are measured through December 31, 2001. For partial eventyears that end on this date, the last partial year is deleted from the computations. In other words, for an SEO that issued on March 15, 2000, it’s first-year return is included, but not the second-year return