正在加载图片...

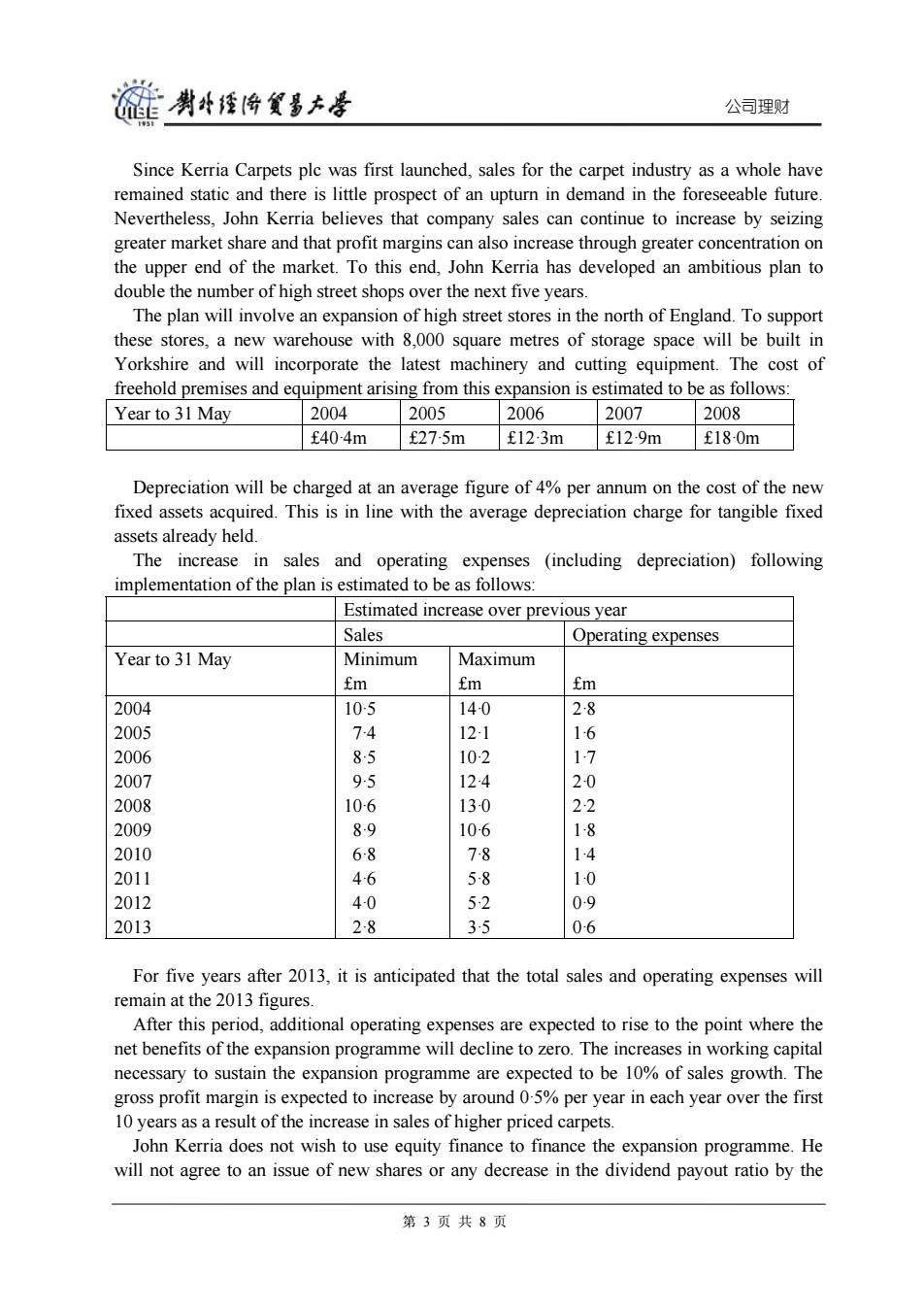

旋剥经降贸多去号 公司理财 Since Kerria Carpets plc was first launched,sales for the carpet industry as a whole have remained static and there is little prospect of an upturn in demand in the foreseeable future. Nevertheless,John Kerria believes that company sales can continue to increase by seizing greater market share and that profit margins can also increase through greater concentration on the upper end of the market.To this end,John Kerria has developed an ambitious plan to double the number of high street shops over the next five years. The plan will involve an expansion of high street stores in the north of England.To support these stores,a new warehouse with 8,000 square metres of storage space will be built in Yorkshire and will incorporate the latest machinery and cutting equipment.The cost of freehold premises and equipment arising from this expansion is estimated to be as follows: Year to 31 May 2004 2005 2006 2007 2008 f404m f27-5m £12-3m £129m £180m Depreciation will be charged at an average figure of 4%per annum on the cost of the new fixed assets acquired.This is in line with the average depreciation charge for tangible fixed assets already held. The increase in sales and operating expenses (including depreciation)following implementation of the plan is estimated to be as follows: Estimated increase over previous year Sales Operating expenses Year to 31 May Minimum Maximum fm fm fm 2004 10-5 140 28 2005 74 12-1 1-6 2006 85 102 17 2007 95 124 20 2008 10-6 13-0 22 2009 89 10-6 1-8 2010 68 78 14 2011 46 58 10 2012 40 52 09 2013 2-8 35 0-6 For five years after 2013,it is anticipated that the total sales and operating expenses will remain at the 2013 figures. After this period,additional operating expenses are expected to rise to the point where the net benefits of the expansion programme will decline to zero.The increases in working capital necessary to sustain the expansion programme are expected to be 10%of sales growth.The gross profit margin is expected to increase by around 0-5%per year in each year over the first 10 years as a result of the increase in sales of higher priced carpets. John Kerria does not wish to use equity finance to finance the expansion programme.He will not agree to an issue of new shares or any decrease in the dividend payout ratio by the 第3页共8页公司理财 Since Kerria Carpets plc was first launched, sales for the carpet industry as a whole have remained static and there is little prospect of an upturn in demand in the foreseeable future. Nevertheless, John Kerria believes that company sales can continue to increase by seizing greater market share and that profit margins can also increase through greater concentration on the upper end of the market. To this end, John Kerria has developed an ambitious plan to double the number of high street shops over the next five years. The plan will involve an expansion of high street stores in the north of England. To support these stores, a new warehouse with 8,000 square metres of storage space will be built in Yorkshire and will incorporate the latest machinery and cutting equipment. The cost of freehold premises and equipment arising from this expansion is estimated to be as follows: Year to 31 May 2004 2005 2006 2007 2008 £40·4m £27·5m £12·3m £12·9m £18·0m Depreciation will be charged at an average figure of 4% per annum on the cost of the new fixed assets acquired. This is in line with the average depreciation charge for tangible fixed assets already held. The increase in sales and operating expenses (including depreciation) following implementation of the plan is estimated to be as follows: Estimated increase over previous year Sales Operating expenses Year to 31 May Minimum £m Maximum £m £m 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 10·5 7·4 8·5 9·5 10·6 8·9 6·8 4·6 4·0 2·8 14·0 12·1 10·2 12·4 13·0 10·6 7·8 5·8 5·2 3·5 2·8 1·6 1·7 2·0 2·2 1·8 1·4 1·0 0·9 0·6 For five years after 2013, it is anticipated that the total sales and operating expenses will remain at the 2013 figures. After this period, additional operating expenses are expected to rise to the point where the net benefits of the expansion programme will decline to zero. The increases in working capital necessary to sustain the expansion programme are expected to be 10% of sales growth. The gross profit margin is expected to increase by around 0·5% per year in each year over the first 10 years as a result of the increase in sales of higher priced carpets. John Kerria does not wish to use equity finance to finance the expansion programme. He will not agree to an issue of new shares or any decrease in the dividend payout ratio by the 第 3 页 共 8 页