正在加载图片...

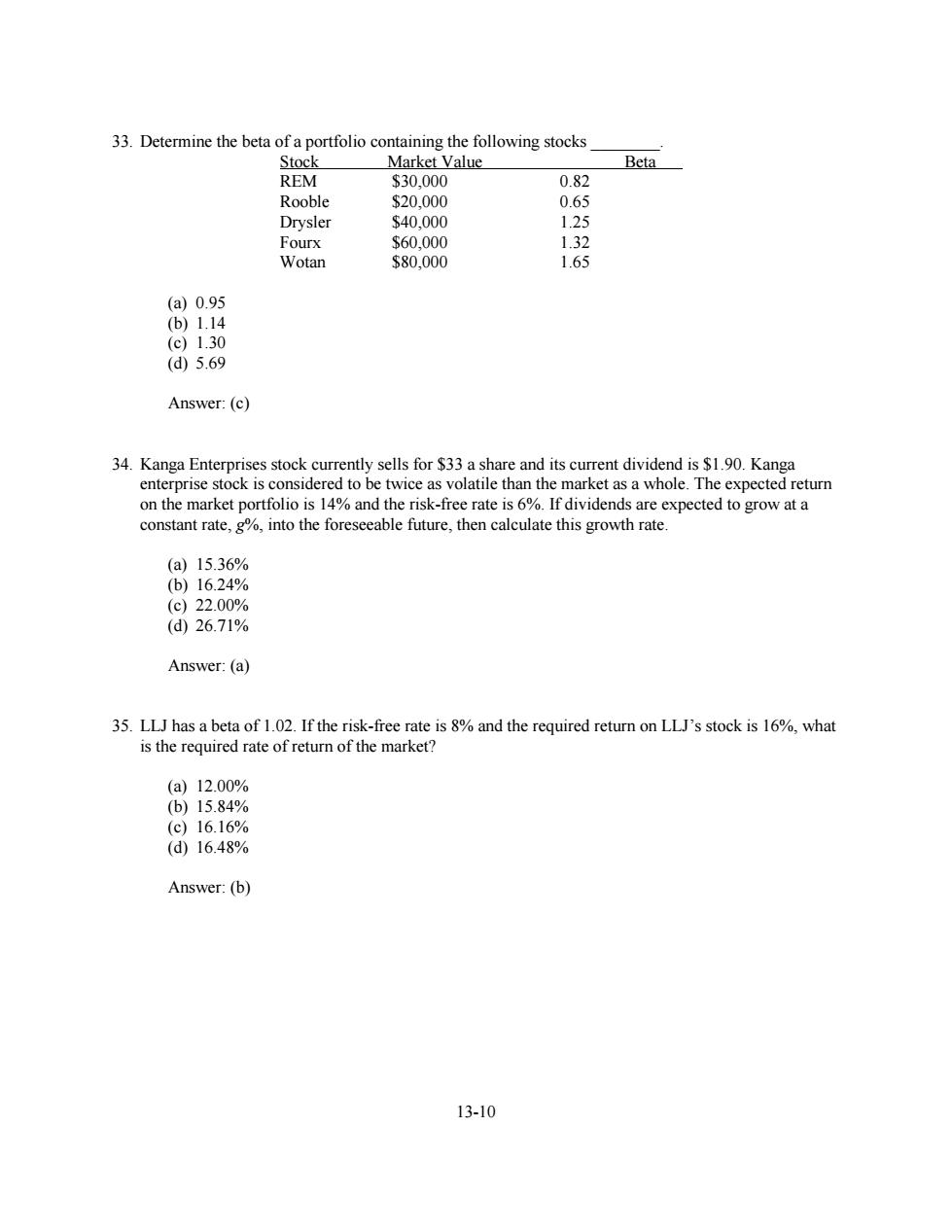

33.Determine the beta of a portfolio containing the following stocks Stock Market Value Beta REM $30,000 0.82 Rooble $20,000 0.65 Drysler $40,000 1.25 Fourx $60,000 1.32 Wotan $80,000 1.65 (a)0.95 (b)1.14 (c)1.30 (d5.69 Answer:(c) 34.Kanga Enterprises stock currently sells for $33 a share and its current dividend is $1.90.Kanga enterprise stock is considered to be twice as volatile than the market as a whole.The expected return on the market portfolio is 14%and the risk-free rate is 6%.If dividends are expected to grow at a constant rate,g%,into the foreseeable future,then calculate this growth rate. (a)15.36% (b)16.24% (c)22.00% (d26.71% Answer:(a) 35.LLJ has a beta of 1.02.If the risk-free rate is 8%and the required return on LLJ's stock is 16%,what is the required rate of return of the market? (a)12.00% (b)15.84% (c)16.16% (d16.48% Answer:(b) 13-1013-10 33. Determine the beta of a portfolio containing the following stocks ________. Stock Market Value Beta REM $30,000 0.82 Rooble $20,000 0.65 Drysler $40,000 1.25 Fourx $60,000 1.32 Wotan $80,000 1.65 (a) 0.95 (b) 1.14 (c) 1.30 (d) 5.69 Answer: (c) 34. Kanga Enterprises stock currently sells for $33 a share and its current dividend is $1.90. Kanga enterprise stock is considered to be twice as volatile than the market as a whole. The expected return on the market portfolio is 14% and the risk-free rate is 6%. If dividends are expected to grow at a constant rate, g%, into the foreseeable future, then calculate this growth rate. (a) 15.36% (b) 16.24% (c) 22.00% (d) 26.71% Answer: (a) 35. LLJ has a beta of 1.02. If the risk-free rate is 8% and the required return on LLJ’s stock is 16%, what is the required rate of return of the market? (a) 12.00% (b) 15.84% (c) 16.16% (d) 16.48% Answer: (b)