正在加载图片...

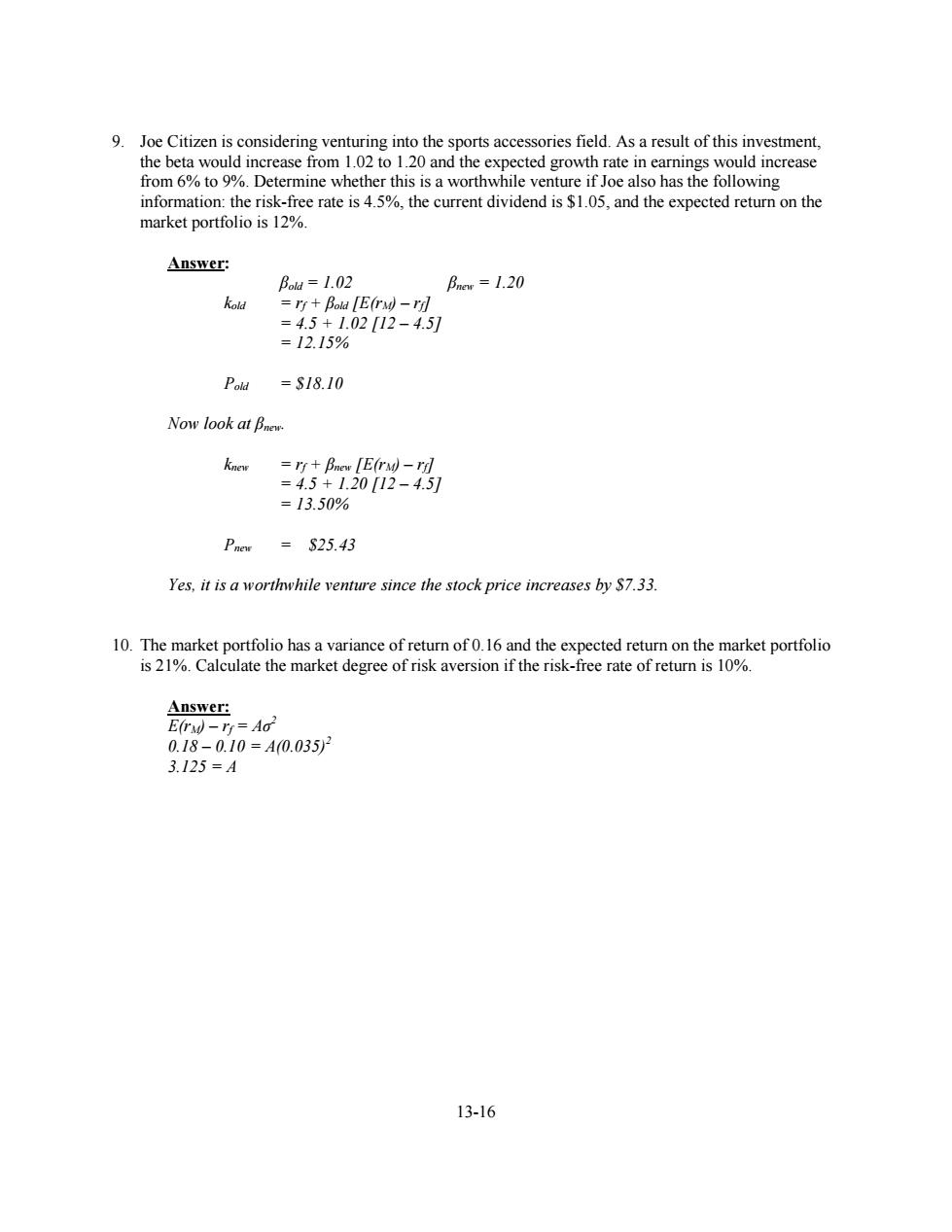

9.Joe Citizen is considering venturing into the sports accessories field.As a result of this investment, the beta would increase from 1.02 to 1.20 and the expected growth rate in earnings would increase from 6%to 9%.Determine whether this is a worthwhile venture if Joe also has the following information:the risk-free rate is 4.5%,the current dividend is $1.05,and the expected return on the market portfolio is 12%. Answer: Bold=1.02 Bnew =1.20 kold =rf+Bold [E(rM)-rfl =4.5+1.0212-4.51 =12.15% Pold =S18.10 Now look at Bnew knew =rf+Bnew [E(rM)-rfl =4.5+1.2012-4.5] =13.50% Pnew =525.43 Yes,it is a worthwhile venture since the stock price increases by $7.33. 10.The market portfolio has a variance of return of 0.16 and the expected return on the market portfolio is 21%.Calculate the market degree of risk aversion if the risk-free rate of return is 10%. Answer: E(rM)-rt=Ao2 0.18-0.10=A0.0352 3.125=A 13-1613-16 9. Joe Citizen is considering venturing into the sports accessories field. As a result of this investment, the beta would increase from 1.02 to 1.20 and the expected growth rate in earnings would increase from 6% to 9%. Determine whether this is a worthwhile venture if Joe also has the following information: the risk-free rate is 4.5%, the current dividend is $1.05, and the expected return on the market portfolio is 12%. Answer: βold = 1.02 βnew = 1.20 kold = rf + βold [E(rM) – rf] = 4.5 + 1.02 [12 – 4.5] = 12.15% Pold = $18.10 Now look at βnew. knew = rf + βnew [E(rM) – rf] = 4.5 + 1.20 [12 – 4.5] = 13.50% Pnew = $25.43 Yes, it is a worthwhile venture since the stock price increases by $7.33. 10. The market portfolio has a variance of return of 0.16 and the expected return on the market portfolio is 21%. Calculate the market degree of risk aversion if the risk-free rate of return is 10%. Answer: E(rM) – rf = Aσ 2 0.18 – 0.10 = A(0.035)2 3.125 = A