正在加载图片...

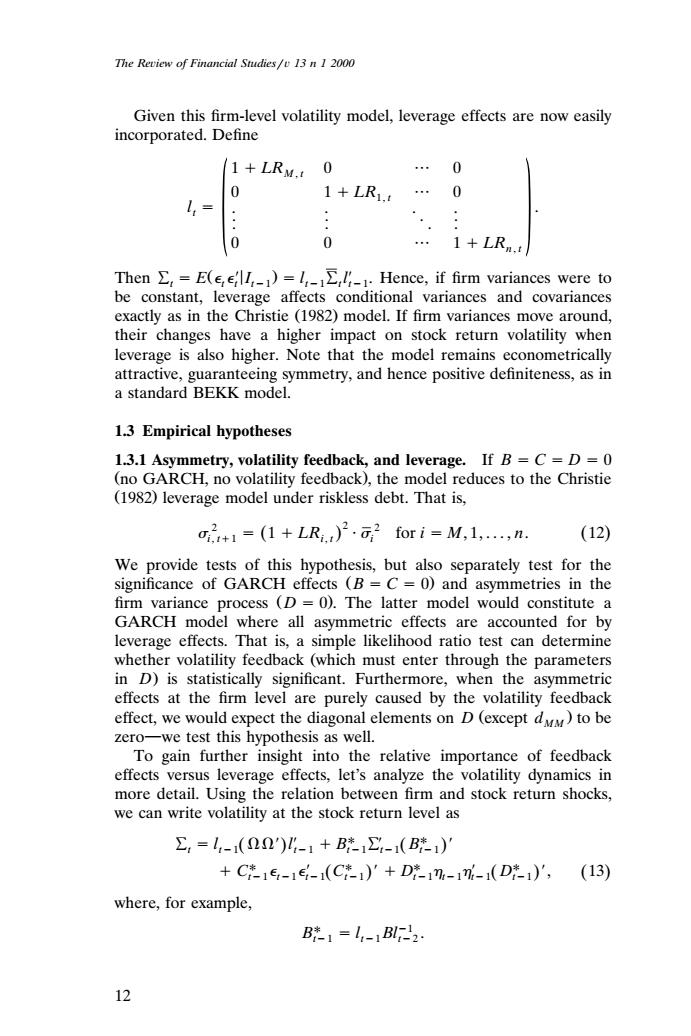

The Review of Financial Studies/v 13 n 1 2000 Given this firm-level volatility model,leverage effects are now easily incorporated.Define 1+LRM. 0 0 0 1+LR1, 。。 0 0 0 1+LRn.t Then E =E(el1)=I1.Hence,if firm variances were to be constant,leverage affects conditional variances and covariances exactly as in the Christie (1982)model.If firm variances move around, their changes have a higher impact on stock return volatility when leverage is also higher.Note that the model remains econometrically attractive,guaranteeing symmetry,and hence positive definiteness,as in a standard BEKK model. 1.3 Empirical hypotheses 1.3.1 Asymmetry,volatility feedback,and leverage.If B =C=D =0 (no GARCH,no volatility feedback),the model reduces to the Christie (1982)leverage model under riskless debt.That is, =(1+LRi)2.for i=M,1.....n. (12) We provide tests of this hypothesis,but also separately test for the significance of GARCH effects (B=C=0)and asymmetries in the firm variance process (D =0).The latter model would constitute a GARCH model where all asymmetric effects are accounted for by leverage effects.That is,a simple likelihood ratio test can determine whether volatility feedback (which must enter through the parameters in D)is statistically significant.Furthermore,when the asymmetric effects at the firm level are purely caused by the volatility feedback effect,we would expect the diagonal elements on D(except d)to be zero-we test this hypothesis as well. To gain further insight into the relative importance of feedback effects versus leverage effects,let's analyze the volatility dynamics in more detail.Using the relation between firm and stock return shocks, we can write volatility at the stock return level as E,=1-1(nn)-1+B*-(B*)川 +C*15-1e-1(C*)'+D*1-1-1(D*)',(13) where,for example, B*1=l,-1Bl2 12The Reiew of Financial Studies 13 n 1 2000 Given this firm-level volatility model, leverage effects are now easily incorporated. Define 1 LRM , t 0 0 0 1 LR1, t 0 l . . .. . t . . .. . . .. 0 0 0 1 LRn, t Then Ýt tt t EŽ I 1. lt1Ýt t l 1. Hence, if firm variances were to be constant, leverage affects conditional variances and covariances exactly as in the Christie 1982 model. If firm variances move around, Ž . their changes have a higher impact on stock return volatility when leverage is also higher. Note that the model remains econometrically attractive, guaranteeing symmetry, and hence positive definiteness, as in a standard BEKK model. 1.3 Empirical hypotheses 1.3.1 Asymmetry, volatility feedback, and leverage. If B C D 0 Ž . no GARCH, no volatility feedback , the model reduces to the Christie Ž . 1982 leverage model under riskless debt. That is, 2 2 2 i, t1 Ž . Ž. 1 LRi, t i for i M,1,..., n. 12 We provide tests of this hypothesis, but also separately test for the significance of GARCH effects Ž . B C 0 and asymmetries in the firm variance process Ž . D 0 . The latter model would constitute a GARCH model where all asymmetric effects are accounted for by leverage effects. That is, a simple likelihood ratio test can determine whether volatility feedback which must enter through the parameters Ž in D. is statistically significant. Furthermore, when the asymmetric effects at the firm level are purely caused by the volatility feedback effect, we would expect the diagonal elements on D Ž . except dM M to be zerowe test this hypothesis as well. To gain further insight into the relative importance of feedback effects versus leverage effects, let’s analyze the volatility dynamics in more detail. Using the relation between firm and stock return shocks, we can write volatility at the stock return level as Ý l l B Ý B Ž. Ž. t t1 t1 t1 t1 t1 C C D D t1 t1 t1Ž . Ž . Ž. t1 t1 t1 t1 t1 , 13 where, for example, B l Bl1 . t1 t1 t2 12������