正在加载图片...

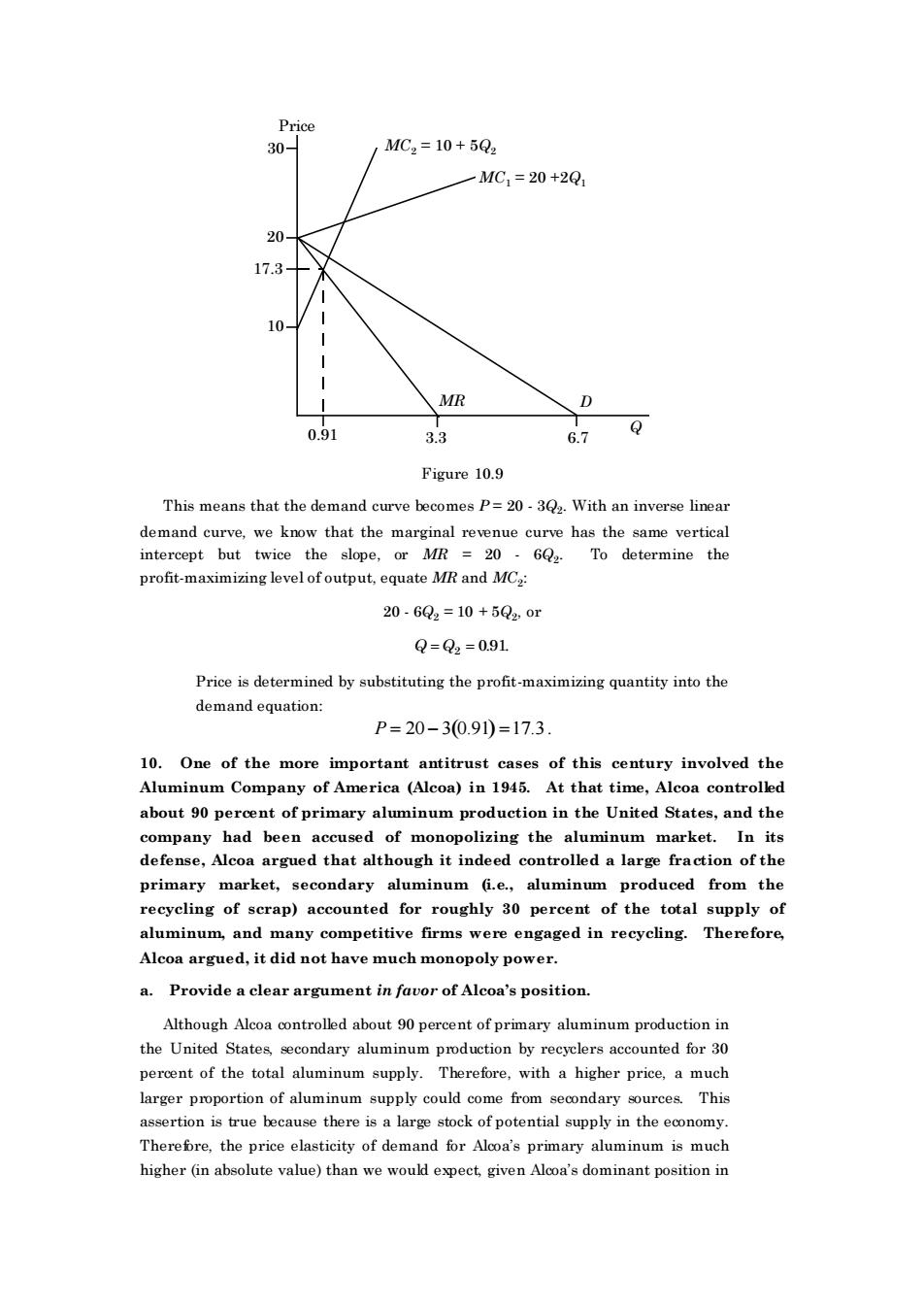

Price 20 /MC2=10+5Q2 一MC1=20+2Q 20 17.3 10 MR D 0.91 3.3 6.7 Figure 10.9 This means that the demand curve an inverse inear demand curve,we know that the marginal revenue curve has the same vertical intercept but twice the slope,or MR =20-6Q2. To determine the profit-maximizing level of output,equate MR and MCa: 20.6Q2=10+5Q4,or Q=Q2=091 Price is determined by substituting the profit-maximizing quantity into the demand equation P=20-30.91)=17.3 10.One of the more important antitrust cases of this century involved the Aluminum Company of America (Alcoa)in 1945.At that time,Alcoa controlled about 90 percent of primary aluminum production in the United States,and the cused of mon opolizing the aluminum market.In its t altho ugh it indeed on of the primary market,secondary aluminum (i.e.,aluminum produced from the recyeling of scrap)accounted for roughly 30 percent of the total supply of aluminum,and many competitive firms were engaged in recycling.Therefore, Alcoa argued,it did not have much monopoly power. a.Provide a clear argument in favor of Alcoa's position Although Alcoa controlled about 90 percent of primary aluminum production in the United State ondary alumi um P oduction by eeyclers accounted for30 percent of the total aluminum supply.Therefore,with a higher price,a much larger proportion of aluminum supply could come from secondary sources.This assertion is true because there is a large stock of potential supply in the economy. Therefre,the price elasticity of demand for Alooa's primary aluminum is much higher (in absolute value)than we would expect given Alcoa's dominant position in Price Q 10 20 30 3.3 6.7 MR D MC1 = 20 +2Q1 MC2 = 10 + 5Q2 17.3 0.91 Figure 10.9 This means that the demand curve becomes P = 20 - 3Q2 . With an inverse linear demand curve, we know that the marginal revenue curve has the same vertical intercept but twice the slope, or MR = 20 - 6Q2 . To determine the profit-maximizing level of output, equate MR and MC2 : 20 - 6Q2 = 10 + 5Q2 , or Q = Q2 = 0.91. Price is determined by substituting the profit-maximizing quantity into the demand equation: P = 20− 3(0.91) =17.3 . 10. One of the more important antitrust cases of this century involved the Aluminum Company of America (Alcoa) in 1945. At that time, Alcoa controlled about 90 percent of primary aluminum production in the United States, and the company had been accused of monopolizing the aluminum market. In its defense, Alcoa argued that although it indeed controlled a large fraction of the primary market, secondary aluminum (i.e., aluminum produced from the recycling of scrap) accounted for roughly 30 percent of the total supply of aluminum, and many competitive firms were engaged in recycling. Therefore, Alcoa argued, it did not have much monopoly power. a. Provide a clear argument in favor of Alcoa’s position. Although Alcoa controlled about 90 percent of primary aluminum production in the United States, secondary aluminum production by recyclers accounted for 30 percent of the total aluminum supply. Therefore, with a higher price, a much larger proportion of aluminum supply could come from secondary sources. This assertion is true because there is a large stock of potential supply in the economy. Therefore, the price elasticity of demand for Alcoa’s primary aluminum is much higher (in absolute value) than we would expect, given Alcoa’s dominant position in