正在加载图片...

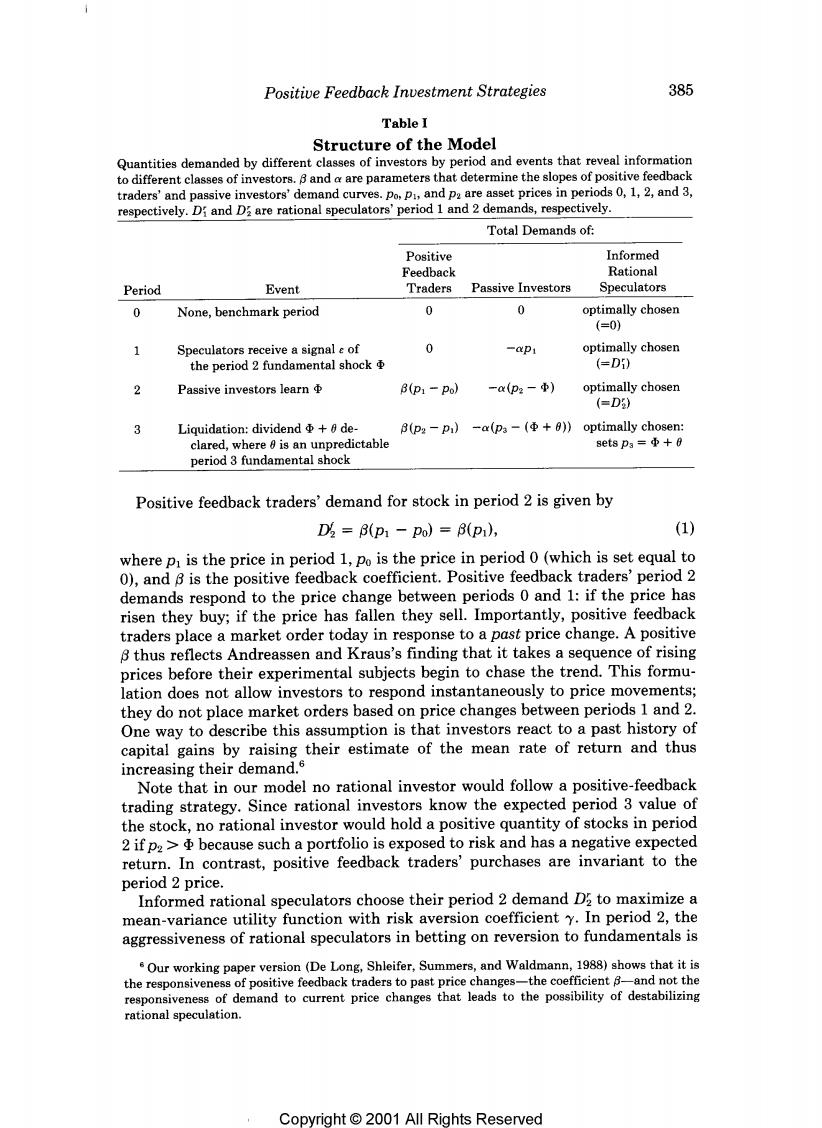

Positive Feedback Investment Strategies 385 Table I Structure of the Model Quantities demanded by different classes of investors by period and events that reveal information to different classes of investors.8 and a are parameters that determine the slopes of positive feedback traders'and passive investors'demand curves.po,p,and pa are asset prices in periods 0,1,2,and 3, respectively.Di and Dare rational speculators'period 1 and 2 demands,respectively. Total Demands of: Positive Informed Feedback Rational Period Event Traders Passive Investors Speculators 0 None,benchmark period 0 0 optimally chosen (=0) 1 Speculators receive a signal e of 0 -P1 optimally chosen the period 2 fundamental shock (=Di) 2 Passive investors learn B(p1-Po) -x(p2-中) optimally chosen (=D) 3 Liquidation:dividend +6 de- B(p2-p)-a(p-(Φ+a)optimally chosen: clared,where is an unpredictable 8etsp3=Φ+0 period 3 fundamental shock Positive feedback traders'demand for stock in period 2 is given by D3=(p1-po)=(p1), (1) where p is the price in period 1,po is the price in period 0(which is set equal to 0),and 8 is the positive feedback coefficient.Positive feedback traders'period 2 demands respond to the price change between periods 0 and 1:if the price has risen they buy;if the price has fallen they sell.Importantly,positive feedback traders place a market order today in response to a past price change.A positive 8 thus reflects Andreassen and Kraus's finding that it takes a sequence of rising prices before their experimental subjects begin to chase the trend.This formu- lation does not allow investors to respond instantaneously to price movements; they do not place market orders based on price changes between periods 1 and 2. One way to describe this assumption is that investors react to a past history of capital gains by raising their estimate of the mean rate of return and thus increasing their demand.s Note that in our model no rational investor would follow a positive-feedback trading strategy.Since rational investors know the expected period 3 value of the stock,no rational investor would hold a positive quantity of stocks in period 2 if pz>because such a portfolio is exposed to risk and has a negative expected return.In contrast,positive feedback traders'purchases are invariant to the period 2 price. Informed rational speculators choose their period 2 demand D2 to maximize a mean-variance utility function with risk aversion coefficient y.In period 2,the aggressiveness of rational speculators in betting on reversion to fundamentals is Our working paper version (De Long,Shleifer,Summers,and Waldmann,1988)shows that it is the responsiveness of positive feedback traders to past price changes-the coefficient 8-and not the responsiveness of demand to current price changes that leads to the possibility of destabilizing rational speculation. Copyright 2001 All Riahts Reserved