THE JOURNAL OF FINANCE.VOL.XLV,NO.2.JUNE 1990 Positive Feedback Investment Strategies and Destabilizing Rational Speculation J.BRADFORD DE LONG,ANDREI SHLEIFER,LAWRENCE H.SUMMERS, and ROBERT J.WALDMANN* ABSTRACT Analyses of rational speculation usually presume that it dampens fluctuations caused by "noise"traders.This is not necessarily the case if noise traders follow positive- feedback strategies-buy when prices rise and sell when prices fall.It may pay to jump on the bandwagon and purchase ahead of noise demand.If rational speculators'early buying triggers positive-feedback trading,then an increase in the number of forward- looking speculators can increase volatility about fundamentals.This model is consistent with a number of empirical observations about the correlation of asset returns,the overreaction of prices to news,price bubbles,and expectations. WHAT EFFECT DO RATIONAL speculators have on asset prices?The standard answer,dating back at least to Friedman(1953),is that rational speculators must stabilize asset prices.Speculators who destabilize asset prices do so by,on average, buying when prices are high and selling when prices are low;such destabilizing speculators are quickly eliminated from the market.By contrast,speculators who earn positive profits do so by trading against the less rational investors who move prices away from fundamentals.Such speculators rationally counter the devia- tions of prices from fundamentals and so stabilize them. Recent work on noise trading and market efficiency has accepted this argument (Figlewski,1979;Kyle,1985;Campbell and Kyle,1988;DeLong,Shleifer,Sum- mers,and Waldmann,1987).In this work,risk aversion keeps rational speculators from taking large arbitrage positions,so noise traders can affect prices.Nonethe- less,the effect of rational speculators'trades is to move prices in the direction of,even if not all the way to,fundamentals.Rational speculators buck noise- driven price movements and so dampen,but do not eliminate,them. In this paper we present a possibly empirically important exception to this argument,based on the prevalence of positive feedback investors in financial markets.Positive feedback investors are those who buy securities when prices rise and sell when prices fall.Many forms of behavior common in financial markets can be described as positive feedback trading.It can result from extrap- olative expectations about prices,or trend chasing.It can also result from stop- loss orders,which effectively prompt selling in response to price declines.A De Long is from Harvard University and NBER;Shleifer is from University of Chicago and NBER;Summers is from Harvard University and NBER;Waldmann is from European University Institute.We would like to thank the Russel Sage and Alfred P.Sloan Foundations for financial support and Robert Barsky,Oliver Hart,Kevin Murphy,Jeremy Stein,Hans Stoll,Rene Stulz,and Robert Vishny for helpful comments. 379 Copyright O 2001 All Rights Reserved

380 The Journal of Finance similar form of positive feedback trading is the liquidation of the positions of investors unable to meet margin calls.Positive feedback trading is also exhibited by buyers of portfolio insurance,who might engage in this practice because their willingness to bear risk rises sharply with wealth(Black,1988). In the presence of positive feedback traders,rational speculation can be destabilizing.When rational speculators receive good news and trade on this news,they recognize that the initial price increase will stimulate buying by positive feedback traders tomorrow.In anticipation of these purchases,informed rational speculators buy more today,and so drive prices up today higher than fundamental news warrants.Tomorrow,positive feedback traders buy in response to today's price increase and so keep prices above fundamentals even as rational speculators are selling out and stabilizing prices.The key point is that,although part of the price rise is rational,part of it results from rational speculators anticipatory trades and from positive feedback traders'reaction to such trades. Trading by rational speculators destabilizes prices because it triggers positive feedback trading by other investors. This view of rational speculation has been motivated in part by George Soros' (1987)description of his own investment strategy.Soros has apparently been successful over the past two decades by betting not on fundamentals but,he claims,on future crowd behavior.Soros finds clear examples of the trading opportunities he seeks in the 1960's conglomerate and the 1970's Real Estate Investment Trust(REIT)booms.1 In his view,the 1960's saw a number of poorly informed investors become excited about rises in the reported annual earnings of conglomerates.The truly informed investment strategy in this case,says Soros, was not to sell short in anticipation of the eventual collapse of conglomerate shares(for that would not happen until 1970)but instead to buy in anticipation of further buying by uninformed investors.The initial price rise in conglomerate stocks,caused in part by purchases by speculators like Soros,stimulated the appetites of uninformed investors since it created a trend of increasing prices and allowed conglomerates to report earnings increases through acquisitions.As uninformed investors bought more,prices rose further.Eventually price increases stopped,conglomerates failed to perform up to uninformed investors'expecta- tions,and stock prices collapsed.Although in the end disinvestment and perhaps short sales by smart money brought the prices of conglomerate stocks down to fundamentals,the initial buying by smart money,by raising the expectations of uninformed investors about future returns,may have amplified the total move of prices away from fundamentals.Soros'analysis of REITs tells the same story. Soros'view of self-feeding bubbles has a distinguished history,dating back at least to Bagehot (1872).According to Bagehot,"owners of savings...rush into anything that promises speciously,and when they find that these specious investments can be disposed of at a high profit,they rush into them more and more.The first taste is for high interest [i.e.,large fundamental returns],but that taste soon becomes secondary.There is a second appetite for large gains to be made by selling the principal which is to yield the interest.So long as such sales can be effected the mania continues...."Kindleberger (1978)also sees For similar accounts,see Tobias(1971),Goodman (1972),and Graham(1974). Copyright 2001 All-Rights Reserved

Positive Feedback Investment Strategies 381 speculative price movements as involving "insiders [who]destabilize by driving the price up and up,selling out at the top to the outsiders who buy at the top and sell out at the bottom....[T]he professional insiders initially destabilize by exaggerating the upswings and the falls,while the outsider amateurs who buy high and sell low are...the victims of euphoria,which infects them late in the day.” In addition to its historical distinction,the view that the interaction of informed rational speculators and positive feedback traders leads to price destabilization has several plausible empirical implications.Our model generates a positive correlation of stock returns at short horizons,as positive feedback traders respond to past price increases by flowing into the market,and negative correlations of stock returns at long horizons,as prices eventually return to fundamentals.This feature of realized returns has found some empirical support in recent studies of stock prices (Fama and French,1988;Poterba and Summers,1988;Lo and MacKinlay,1988).Our model also predicts that the stock market overreacts to news because such news triggers positive feedback trading.Campbell and Kyle (1988)estimate a model in which innovations to news and to noise are highly positively correlated in U.S.stock prices. Our paper follows a significant literature addressing the question of destabil- izing speculation.Respondents to Friedman(1953)have previously stressed that, in the presence of rule of thumb investors,it might pay a large speculator to destabilize prices (for example,Baumol,1957;Telser,1959;Kemp,1963;Farrell, 1966;and Hart,1977).Although our work is related,we focus on small competitive rational speculators who cannot individually affect prices.Hart and Kreps(1986) construct a model in which competitive rational speculators are the only investors able to perform physical storage.Their activity can change commodity supplies in a way that makes equilibrium prices more volatile.It is difficult to compare our results to those of Hart and Kreps (1986)because in their model price- destabilizing speculation results from the effect of storage on quantities,while in our model quantities are fixed,but equilibrium prices are still less stable in the presence of rational speculators.Stein(1987)observed that imperfectly informed rational speculators introduce noise as well as information into asset prices and can make prices carry less information about the state of the economy and be less stable.Stein's ingenious idea is perhaps more applicable to dramatic events like the October 1987 market crash,when much uncertainty surrounds the value of fundamentals,than to speculative (but probably not fully rational)bubbles like the conglomerate boom. This paper is organized as follows.Section I describes some evidence suggesting that positive feedback portfolio strategies are common.Section II presents a simple model that combines speculators'trading in anticipation of noise demand with positive feedback strategies to show that the addition of rational speculators can destabilize prices.Section III concludes. I.Positive Feedback Trading A wide variety of trading strategies call for buying stocks when their prices rise and selling stocks when their prices fall.These strategies include portfolio choice Copyright O 2001 All Rights Reserved

382 The Journal of Finance based on extrapolative expectations,the use of stop-loss orders,purchases on margin which are liquidated when the stock drops below a certain point,as well as dynamic trading strategies such as portfolio insurance.Below we summarize some of the experimental and survey evidence suggesting that positive feedback trading,especially of the extrapolative expectations variety,is common. The most telling experimental evidence on the tendency of investors to chase the price trend comes from the work of Andreassen and Kraus (1988).2 In their experiments,Andreassen and Kraus show subjects with some training in econom- ics authentic stock price patterns,tell them that these stock prices are authentic, and ask them to trade at given prices.Subjects begin with some endowment and with knowledge of a current stock price and are then asked to alter their positions with every new observation of the stock price,without having an effect on this price. Andreassen and Kraus's results are striking.When over some period of obser- vations the level of the stock price does not change very much relative to the period-to-period variability,subjects track this average price level:they sell when prices rise and buy when prices fall.If,however,over a period prices exhibit a trend relative to the period-to-period variability,subjects begin to chase the trend,buying more when prices rise and selling when prices fall.3 Instead of extrapolating price levels to arrive at a forecast of future prices,subjects switch to extrapolating price changes.This switch to chasing the trend appears to be a virtually universal phenomenon among the subjects that Andreassen and Kraus study.Interestingly,the switch to trend chasing seems to occur only in response to significant changes in the price level over a substantial number of observations, not in response to the most recent price changes alone. In addition to experimental evidence,significant survey evidence points to the prevalence of extrapolative expectations.Case and Shiller(1988)find that home buyers in cities where house prices have risen rapidly in the past anticipate much greater future price appreciation than home buyers in cities where prices have been stagnant or have fallen.Shiller(1988)surveys investors in the wake of the 1987 market crash and finds that most sellers in the market cite price declines as the reason that they have sold-presumably because they anticipate further price declines. Perhaps the most interesting survey evidence on extrapolative expectations is presented in Frankel and Froot's(1988)work on the dollar exchange rate in the 1980's.Frankel and Froot evaluate the forecast and recommendations of a number of exchange rate forecasting services during the period in the mid-1980's when the dollar had been rising for some time without a widening in U.S.-rest of world interest rate differentials and with a rising U.S.trade deficit.During this period, Frankel and Froot find that the typical forecaster expected the dollar to continue to appreciate over the next month but also to depreciate within a year in accordance with underlying fundamentals.Consistent with these expectations, 2 The evidence from market experiments reported in Smith,Suchanek,and Williams (1988)is consistent with trend-chasing by experimental subjects. Andreassen and Kraus'trending series increased or decreased by nine percent over forty simulated trading days.Their trendless series were adjusted so that the last price quoted in a forty simulated trading day interval was equal to the first price. Copyriaht 2001 All Riahts Reserved

Positive Feedback Investment Strategies 383 forecasting services were issuing buy recommendations while maintaining that the dollar was overpriced relative to its fundamental value.Such trend-chasing short-run expectations,combined with a belief in a long-run return to fundamen- tals,are hard (though not impossible)to reconcile with a fully rational model. Extrapolative expectations resulting from biases in judgment under uncertainty are probably the most common form of positive feedback trading,but they are by no means the only form.For example,such strategies can be rational if preferences exhibit risk aversion that declines rapidly with wealth(Black,1988; Leland and Rubinstein,1988).In our framework,however,usual portfolio insurance strategies are not rational,since stock prices do not follow random walks and positive feedback traders get clobbered in the market.We therefore must assume that positive feedback traders are simply noise traders who buy according to a fixed demand curve when prices rise and sell when prices fall. An important objection to this approach is that such positive feedback traders are really dumb:they do not realize how much money they lose by chasing the trend.Why don't positive feedback traders either learn that they are making mistakes or else lose all their wealth and disappear from the market?We do not find this objection fully compelling.First,every episode might look different to positive feedback traders,and so their learning from past mistakes might be limited.Learning might be especially limited if each episode of divergence of prices from fundamentals takes several years,as might have been the case with conglomerates and real estate investment trusts.By the time the new bubble comes along,many investors have forgotten the old one or have been replaced by younger investors who have never experienced the old one at all.Second,even when noise traders take a bath they may save and return to the market later, especially if several years pass between bubbles.Finally,as we showed in earlier work,if traders'mistakes cause them to take positions that carry more market risk than rational investors'positions,they can earn higher returns in the market even if they make judgment errors.Although we do not model this effect here,in principle it can be a significant deterrent to learning.For these three reasons, positive feedback trading may well persist in the long run. Importantly,instances of positive feedback occur at many horizons.Investment pools whose organizers buy stock,spread rumors,and then sell the stock slowly as positive feedback demand picks up rely on extrapolative expectations over a horizon of a few days.Frankel and Froot's forecasters have a horizon of several months,which also appears relevant for bubbles like those that may have occurred in 1929 and 1987.The conglomerate boom,by contrast,lasted several years What distinguishes these examples is the historical frame over which extrapola- tive expectations are formed.In some cases people react to a price rise over a few days.In other instances much longer records of high realized returns are used. As long as people expect a price rise over the particular horizon on which they focus to continue,they form extrapolative expectations that may support positive feedback trading patterns.For this reason,we think that our model applies to a variety of horizons.However,the learning argument suggests that the application +As we discuss below,however,positive feedback behavior would not result from dynamic hedging strategies by rational investors in our model. Copyright 2001 All Riahts Reserved

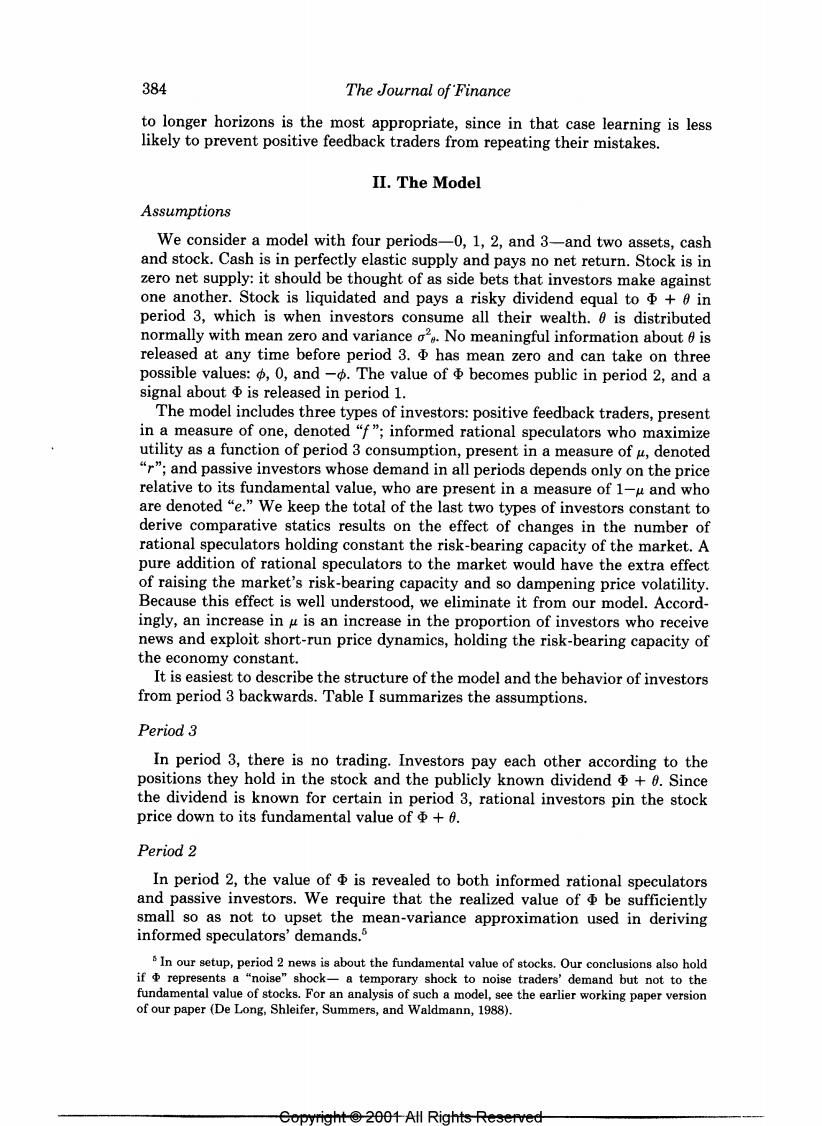

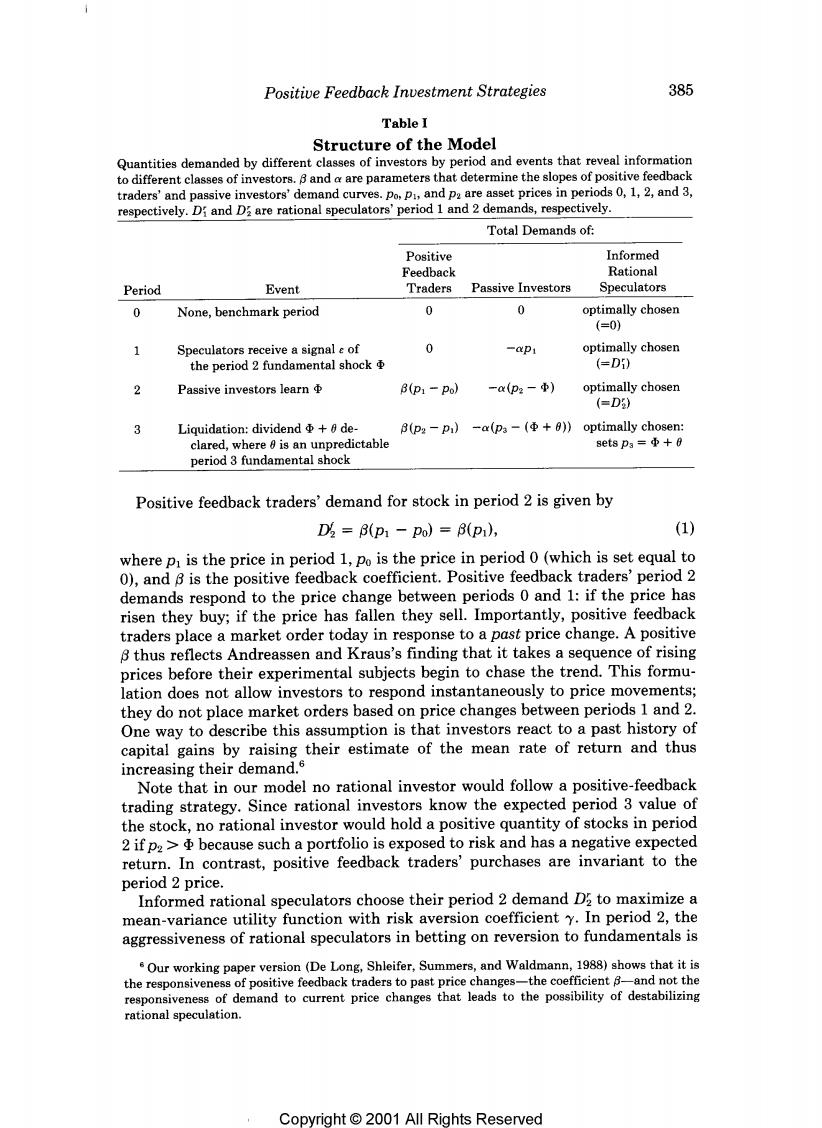

384 The Journal of Finance to longer horizons is the most appropriate,since in that case learning is less likely to prevent positive feedback traders from repeating their mistakes. II.The Model Assumptions We consider a model with four periods-0,1,2,and 3-and two assets,cash and stock.Cash is in perfectly elastic supply and pays no net return.Stock is in zero net supply:it should be thought of as side bets that investors make against one another.Stock is liquidated and pays a risky dividend equal to in period 3,which is when investors consume all their wealth.0 is distributed normally with mean zero and variance o.No meaningful information about 6 is released at any time before period 3.has mean zero and can take on three possible values::φ,0,and-p.The value ofΦbecomes public in period2,anda signal about is released in period 1. The model includes three types of investors:positive feedback traders,present in a measure of one,denoted "f";informed rational speculators who maximize utility as a function of period 3 consumption,present in a measure of denoted "r";and passive investors whose demand in all periods depends only on the price relative to its fundamental value,who are present in a measure of 1-u and who are denoted "e."We keep the total of the last two types of investors constant to derive comparative statics results on the effect of changes in the number of rational speculators holding constant the risk-bearing capacity of the market.A pure addition of rational speculators to the market would have the extra effect of raising the market's risk-bearing capacity and so dampening price volatility. Because this effect is well understood,we eliminate it from our model.Accord- ingly,an increase in u is an increase in the proportion of investors who receive news and exploit short-run price dynamics,holding the risk-bearing capacity of the economy constant. It is easiest to describe the structure of the model and the behavior of investors from period 3 backwards.Table I summarizes the assumptions. Period 3 In period 3,there is no trading.Investors pay each other according to the positions they hold in the stock and the publicly known dividend+0.Since the dividend is known for certain in period 3,rational investors pin the stock price down to its fundamental value of+6. Period 2 In period 2,the value of is revealed to both informed rational speculators and passive investors.We require that the realized value of be sufficiently small so as not to upset the mean-variance approximation used in deriving informed speculators'demands.5 In our setup,period 2 news is about the fundamental value of stocks.Our conclusions also hold if represents a "noise"shock-a temporary shock to noise traders'demand but not to the fundamental value of stocks.For an analysis of such a model,see the earlier working paper version of our paper(De Long,Shleifer,Summers,and Waldmann,1988). Copyright©2o0升All Rights Reserved

Positive Feedback Investment Strategies 385 Table I Structure of the Model Quantities demanded by different classes of investors by period and events that reveal information to different classes of investors.8 and a are parameters that determine the slopes of positive feedback traders'and passive investors'demand curves.po,p,and pa are asset prices in periods 0,1,2,and 3, respectively.Di and Dare rational speculators'period 1 and 2 demands,respectively. Total Demands of: Positive Informed Feedback Rational Period Event Traders Passive Investors Speculators 0 None,benchmark period 0 0 optimally chosen (=0) 1 Speculators receive a signal e of 0 -P1 optimally chosen the period 2 fundamental shock (=Di) 2 Passive investors learn B(p1-Po) -x(p2-中) optimally chosen (=D) 3 Liquidation:dividend +6 de- B(p2-p)-a(p-(Φ+a)optimally chosen: clared,where is an unpredictable 8etsp3=Φ+0 period 3 fundamental shock Positive feedback traders'demand for stock in period 2 is given by D3=(p1-po)=(p1), (1) where p is the price in period 1,po is the price in period 0(which is set equal to 0),and 8 is the positive feedback coefficient.Positive feedback traders'period 2 demands respond to the price change between periods 0 and 1:if the price has risen they buy;if the price has fallen they sell.Importantly,positive feedback traders place a market order today in response to a past price change.A positive 8 thus reflects Andreassen and Kraus's finding that it takes a sequence of rising prices before their experimental subjects begin to chase the trend.This formu- lation does not allow investors to respond instantaneously to price movements; they do not place market orders based on price changes between periods 1 and 2. One way to describe this assumption is that investors react to a past history of capital gains by raising their estimate of the mean rate of return and thus increasing their demand.s Note that in our model no rational investor would follow a positive-feedback trading strategy.Since rational investors know the expected period 3 value of the stock,no rational investor would hold a positive quantity of stocks in period 2 if pz>because such a portfolio is exposed to risk and has a negative expected return.In contrast,positive feedback traders'purchases are invariant to the period 2 price. Informed rational speculators choose their period 2 demand D2 to maximize a mean-variance utility function with risk aversion coefficient y.In period 2,the aggressiveness of rational speculators in betting on reversion to fundamentals is Our working paper version (De Long,Shleifer,Summers,and Waldmann,1988)shows that it is the responsiveness of positive feedback traders to past price changes-the coefficient 8-and not the responsiveness of demand to current price changes that leads to the possibility of destabilizing rational speculation. Copyright 2001 All Riahts Reserved

386 The Journal of Finance limited only by period 3 dividend risk.The demand of a rational speculator is given by D5=④-P四=a0-p, 2ya号 (2) where we set a =(yo2)for notational convenience. A passive investor's period 2 demand is also negatively related to price: D5=a(④=p2) (3) where we assume that a is the same as in equation(2).We make the slope of passive investors'demands and rational speculators'period 2 demands equal and set the numbers of rational speculators and passive investors equal to u and 1- u,respectively.This allows us to examine the consequences of introducing informed rational speculators without changing the risk-bearing capacity of the market,since changes in u keep the risk-bearing capacity of the economy constant. In the absence of passive investors,an increase in the number of informed rational investors has two opposite effects:it destabilizes prices because it enhances the stimulus of rational investors'purchases to positive-feedback trading,and it stabilizes prices because it increases the risk-bearing capacity of the market.The second role of rational speculators has been stressed by Friedman (1953)and Stein(1987).In this paper,however,we abstract from this effect and to this end include passive investors in the model.'If we perform the experiment of simply adding rational speculators,there are cases in which the risk-sharing stabilizing effect is less important than the destabilizing effect of anticipatory purchases. For the model to have stable solutions,we require &B. (4) Because rational speculation makes period 1 prices rise one-for-one with expected period 2 prices,unless a>B the model will have no stable equilibrium:for high correctly anticipated values of p2,demand will exceed supply. Period 1 In period 1,informed rational speculators receive a signal e∈{-中,0,p}about period 2 fundamental news We consider two different assumptions about the signal e.First,the signal could be noiseless:e=.Second,the signal could be a noisy signal that satisfies: Prob(e=中,Φ=)=.25, Prob(c=中,Φ=0)=.25, (5) Prob(e=-中,Φ=-)=,25, Prob(e=-中,重=0)=.25 In the case of a noisy signal,when the speculators'signal e is o,the expectation Passive investors are not simply uninformed rational speculators.Since the price in period 1 reveals what rational speculators have learned,any rational investor can infer the period 1 signal from prices.Such a rational investor would then want to get into the speculative game as well. Passive investors,by contrast,neither receive the period 1 signal nor infer this signal from prices. Copvriaht O 2001 All Riahts Reserved

Positive Feedback Investment Strategies 387 of the subsequent value of is /2;when the speculators'signal e is-,the expectation of the subsequent value of is -/2.In period 1,informed rational speculators choose their demand Di to maximize the same mean-variance utility function as in period 2 over the distribution they face as of period 1 of their certain-equivalent wealth in period 2.8 Passive investors'demand in period 1 takes the same form as in period 2.They buy low and sell high,and their demand is given by D1=-ap1· (6) Positive feedback traders'demand in period 1 is equal to zero: D=0. (7) Since the form of positive feedback behavior we study reacts to past price movements but not to current price changes,positive feedback traders do not trade in period 1. Period 0 Period 0 is a reference period.No signals are received.As a result,the price is set at its initial fundamental value of zero,and there is no trading.Period 0 provides a benchmark against which the positive feedback traders can measure the appreciation or depreciation of stock from period 0 to periods 1 and 2 and so form their positive feedback demands in periods 1 and 2. Since there is no trading in periods 0 or 3,the market clearing conditions are automatically satisfied in those periods.For periods 1 and 2,since there are u informed rational speculators and 1-g passive investors,the market clearing conditions are,respectively, 0=D+uD+(1-4)D, (8) 0=D%+uD5+(1-)D5. (9) Solution with a Noiseless Signal We consider the case of a positive demand shock,=+.The argument is symmetric in the case of a negative demand shock.If the rational speculators signal e is perfectly correlated with the period 2 demand shock then from their point of view there is no uncertainty in period 1 about the period 2 stock price. As long as informed rational speculators are present in positive measure (u>0) arbitrage guarantees the equality of prices in periods 1 and 2.If no informed rational speculators are present (=0),then the period 1 price equals zero,for no one has any information about the period 3 value of +6. p1=P2ifμ>0, (10) P1=0 if4=0. Imposing market clearing in period 2,and substituting in the period 2 demands These preferences are time consistent up to the approximation error from using the mean- variance formulation. Copyright 2001 All Riahts Reserved

388 The Journal of Finance (1),(2),and(3)into(9),yields the period 2 equilibrium condition: 0=p1+a(中-p2) (11) Combining (10)and (11),we obtain D1 =p2 =ap &-B if4>0, (12) P1=0,p2=φ if u=0. (13) If B>a/2,then the price is strictly further away from fundamentals in all periods when rational informed speculators are present than when they are absent.In the case of a noiseless signal,therefore,the addition of informed rational speculators can push prices away from fundamentals. The path of prices in the case of a noiseless signal is discontinuous:u=0 and 0<u<1 are not nearly equivalent.Moreover,once u0,the path of prices is invariant to changes in u.These peculiarities arise from the fact that the period 1 signal of is noiseless.For an informed rational speculator,the round-trip trade that involves a purchase in period 1 and a sale in period 2 carries no risk since no uncertainty is resolved in period 2.Even a very small measure u of informed rational speculators is consequently willing to undertake an arbitrarily large amount of arbitrage trades.To make holding stocks between periods 1 and 2 risky,we next consider the case in which rational speculators'signal e of is imperfect. Solution with an Imperfectly Informative Signal Suppose that rational speculators receive a noisy signal,as in equation (5). Once again we consider the case of a(possible)positive shock to fundamentals: e=中,which implies thatΦ=+中with probability and thatΦ=0with probability 12.We call the first resolution of uncertainty state 2a and the second resolution state 26. There are now two market clearing conditions for period 2,which together replace equation (11)for states 2a and 26,respectively: 0=p1+a(中-p2a), (14a) 0=p1-p2b (14b) The market clearing condition for period 1 is simply 0=uD-(1-4p, (15) with informed rational investors'period 1 demand Di still to be determined. The expected value of the investment opportunities open to informed rational speculators in period 2 is such as to provide them,for given purchases Di in period 1,with certain-equivalent wealth as of period 2 in the two states a and b The symmetric case obtains when e=-. Copyraht e 2001 All Riahts Reserved