Noise Trader Risk in Financial Markets J.Bradford De Long Harvard University and National Bureau of Economic Research Andrei Shleifer University of Chicago and National Bureau of Economic Research Lawrence H.Summers Harvard University and National Bureau of Economic Research Robert J.Waldmann European University Institute We present a simple overlapping generations model of an asset mar- ket in which irrational noise traders with erroneous stochastic beliefs both affect prices and earn higher expected returns.The unpredict- ability of noise traders'beliefs creates a risk in the price of the asset that deters rational arbitrageurs from aggressively betting against them.As a result,prices can diverge significantly from fundamental values even in the absence of fundamental risk.Moreover,bearing a disproportionate amount of risk that they themselves create enables noise traders to earn a higher expected return than rational inves- tors do.The model sheds light on a number of financial anomalies, including the excess volatility of asset prices,the mean reversion of stock returns,the underpricing of closed-end mutual funds,and the Mehra-Prescott equity premium puzzle. We would like to thank the National Science,Russell Sage,and Alfred P.Sloan foundations for financial support.We have benefited from comments from Robert Barsky,Fischer Black,John Campbell,Andrew Caplin,Peter Diamond,Miles Kimball, Bruce Lehmann,Charles Perry,Robert Vishny,Michael Woodford,and especially from Kevin M.Murphy and Barry Nalebuff. [Journal of Polncal Economy,1990.vol.98,no.4] 1990 by The University of Chicago.All rights reserved.0022-3808/90/9804-0004$01.50 703

704 JOURNAL OF POLITICAL ECONOMY If the reader interjects that there must surely be large profits to be gained...in the long run by a skilled individual who...purchase[s]investments on the best genuine long-term expectation he can frame,he must be answered...that there are such serious-minded individuals and that it makes a vast difference to an investment market whether or not they predominate. ..But we must also add that there are several factors which jeopardise the predominance of such individuals in modern investment markets.Investment based on genuine long-term expectation is so difficult...as to be scarcely practicable.He who attempts it must surely... run greater risks than he who tries to guess better than the crowd how the crowd will behave.[KEYNES 1936,p. 157] There is considerable evidence that many investors do not follow economists'advice to buy and hold the market portfolio.Individual investors typically fail to diversify,holding instead a single stock or a small number of stocks (Lewellen,Schlarbaum,and Lease 1974). They often pick stocks through their own research or on the advice of the likes of Joe Granville or "Wall Street Week."When investors do diversify,they entrust their money to stock-picking mutual funds that charge them high fees while failing to beat the market(Jensen 1968). Black (1986)believes that such investors,with no access to inside information,irrationally act on noise as if it were information that would give them an edge.Following Kyle (1985),Black calls such investors "noise traders." Despite the recognition of the abundance of noise traders in the market,economists feel safe ignoring them in most discussions of asset price formation.The argument against the importance of noise traders for price formation has been forcefully made by Friedman (1953)and Fama(1965).Both authors point out that irrational inves- tors are met in the market by rational arbitrageurs who trade against them and in the process drive prices close to fundamental values. Moreover,in the course of such trading,those whose judgments of asset values are sufficiently mistaken to affect prices lose money to arbitrageurs and so eventually disappear from the market.The argu- ment"that speculation is...destabilizing...is largely equivalent to saying that speculators lose money,since speculation can be destabiliz- ing in general only if speculators on...average sell...low...and buy...high"(Friedman 1953,p.175).Noise traders thus cannot affect prices too much and,even if they can,will not do so for long. In this paper we examine these arguments by focusing explicitly on

NOISE TRADER RISK 705 the limits of arbitrage dedicated to exploiting noise traders'misper- ceptions.We recognize that arbitrageurs are likely to be risk averse and to have reasonably short horizons.As a result,their willingness to take positions against noise traders is limited.One source of risk that limits the power of arbitrage-fundamental risk-is well understood. Figlewski(1979)shows that it might take a very long time for noise traders to lose most of their money if arbitrageurs must bear funda- mental risk in betting against them and so take limited positions. Shiller(1984)and Campbell and Kyle (1987)focus on arbitrageurs aversion to fundamental risk in discussing the effect of noise traders on stock market prices.Their results show that aversion to fundamen- tal risk can by itself severely limit arbitrage,even when arbitrageurs have infinite horizons. But there is another important source of risk borne by short- horizon investors engaged in arbitrage against noise traders:the risk that noise traders'beliefs will not revert to their mean for a long time and might in the meantime become even more extreme.If noise traders today are pessimistic about an asset and have driven down its price,an arbitrageur buying this asset must recognize that in the near future noise traders might become even more pessimistic and drive the price down even further.If the arbitrageur has to liquidate before the price recovers,he suffers a loss.Fear of this loss should limit his original arbitrage position. Conversely,an arbitrageur selling an asset short when bullish noise traders have driven its price up must remember that noise traders might become even more bullish tomorrow,and so must take a posi- tion that accounts for the risk of a further price rise when he has to buy back the stock.This risk of a further change of noise traders' opinion away from its mean-which we refer to as "noise trader risk"-must be borne by any arbitrageur with a short time horizon and must limit his willingness to bet against noise traders. Because the unpredictability of noise traders'future opinions de- ters arbitrage,prices can diverge significantly from fundamental values even when there is no fundamental risk.Noise traders thus create their own space.All the main results of our paper come from the observation that arbitrage does not eliminate the effects of noise because noise itself creates risk. The risk resulting from stochastic changes in noise traders'opin- ions raises the possibility that noise traders who are on average bullish Our paper is related to other examinations of Friedman's arguments,including Hart and Kreps(1986),Ingram(1987),and Stein(1987).Also relevant are Haltiwanger and Waldman (1985)and Russell and Thaler (1985).We discuss these papers after presenting our model

706 JOURNAL OF POLITICAL ECONOMY earn a higher expected return than rational,sophisticated investors engaged in arbitrage against noise trading.This result obtains be- cause noise trader risk makes assets less attractive to risk-averse arbi- trageurs and so drives down prices.If noise traders on average over- estimate returns or underestimate risk,they invest more in the risky asset on average than sophisticated investors and may earn higher average returns.This result is more interesting than the point that if noise traders bear more fundamental risk they earn higher returns: our point is that noise traders can earn higher expected returns solely by bearing more of the risk that they themselves create.Noise traders can earn higher expected returns from their own destabilizing in- fluence,not because they perform the useful social function of bear- ing fundamental risk. Our model also has several implications for asset price behavior. Because noise trader risk limits the effectiveness of arbitrage,prices in our model are excessively volatile.If noise traders'opinions follow a stationary process,there is a mean-reverting component in stock returns.Our model also shows how assets subject to noise trader risk can be underpriced relative to fundamental values.We apply this idea to explain the underpricing of closed-end mutual funds,as well as the long-run underpricing of stocks known as the Mehra-Prescott(1985) puzzle.Finally,our model has several implications for the optimal investment strategy of sophisticated investors and for the possible role of long-term investors in stabilizing asset prices. We develop our two main arguments-that bearing noise trader risk raises noise traders'returns and that noise trader risk can explain several financial anomalies-in five sections.Section I presents a model of noise trader risk and shows how prices can diverge signifi- cantly from fundamental values.Section II calculates the relative ex- pected returns of noise traders and of sophisticated investors.Section III analyzes the persistence of noise traders in an extended model in which successful investors are imitated (as in Denton [1985]).Section IV presents qualitative implications of the model for the behavior of asset prices and market participants.Section V presents conclusions. I.Noise Trading as a Source of Risk The model contains noise traders and sophisticated investors.Noise traders falsely believe that they have special information about the future price of the risky asset.They may get their pseudosignals from technical analysts,stockbrokers,or economic consultants and irration- ally believe that these signals carry information.Or in formulating their investment strategies,they may exhibit the fallacy of excessive subjective certainty that has been repeatedly demonstrated in experi-

NOISE TRADER RISK 707 mental contexts since Alpert and Raiffa(1982).Noise traders select their portfolios on the basis of such incorrect beliefs.In response to noise traders'actions,it is optimal for sophisticated investors to ex- ploit noise traders'irrational misperceptions.Sophisticated traders buy when noise traders depress prices and sell when noise traders push prices up.Such active contrarian investment strategies push prices toward fundamentals,but not all the way. A.The Model Our basic model is a stripped-down overlapping generations model with two-period-lived agents(Samuelson 1958).For simplicity,there is no first-period consumption,no labor supply decision,and no be- quest.As a result,the resources agents have to invest are exogenous. The only decision agents make is to choose a portfolio when young. The economy contains two assets that pay identical dividends.One of the assets,the safe assets,pays a fixed real dividendr.Asset s is in perfectly elastic supply:a unit of it can be created out of,and a unit of it turned back into,a unit of the consumption good in any period. With consumption each period taken as numeraire,the price of the safe asset is always fixed at one.The dividend r paid on asset s is thus the riskless rate.The other asset,the unsafe asset u,always pays the same fixed real dividend r as asset s.But u is not in elastic supply:it is in fixed and unchangeable quantity,normalized at one unit.The price of u in period t is denoted If the price of each asset were equal to the net present value of its future dividends,then assets u and s would be perfect substitutes and would sell for the same price of one in all periods.But this is not how the price of u is determined in the presence of noise traders. We usually interpret s as a riskless short-term bond and u as aggre- gate equities.It is important for the analysis below that noise trader risk be marketwide rather than idiosyncratic.If noise traders'misper- ceptions of the returns to individual assets are uncorrelated and if each asset is small relative to the market,arbitrageurs would eliminate any possible mispricing for the same reasons that idiosyncratic risk is not priced in the standard capital asset pricing model. There are two types of agents:sophisticated investors(denoted i) who have rational expectations and noise traders (denoted n).We assume that noise traders are present in the model in measure u,that sophisticated investors are present in measure 1 -H,and that all agents of a given type are identical.Both types of agents choose their portfolios when young to maximize perceived expected utility given their own beliefs about the ex ante mean of the distribution of the price of u at t 1.The representative sophisticated investor young in

708 JOURNAL OF POLITICAL ECONOMY period t accurately perceives the distribution of returns from holding the risky asset,and so maximizes expected utility given that distribu- tion.The representative noise trader young in period t misperceives the expected price of the risky asset by an independent and identically distributed normal random variable p: p~N(p*,σ). (1) The mean misperception p*is a measure of the average"bullishness" of the noise traders,and o is the variance of noise traders'mispercep- tions of the expected return per unit of the risky asset.?Noise traders thus maximize their own expectation of utility given the next-period dividend,the one-period variance of,and their false belief that the distribution of the price of u next period has mean p above its true value. Each agent's utility is a constant absolute risk aversion function of wealth when old: U=-e-(2y)w. (2) where y is the coefficient of absolute risk aversion.With normally distributed returns to holding a unit of the risky asset,maximizing the expected value of(2)is equivalent to maximizing 而-yo2, (3) where w is the expected final wealth,and o is the one-period-ahead variance of wealth.The sophisticated investor chooses the amountA of the risky asset u held to maximize E(U)=w-yo (4) =c0+入r+p+1-p1+]-y2(oa., where co is a function of first-period labor income,an anterior sub- script denotes the time at which an expectation is taken,and we define o,=Ep+1-Ep+]門 (5) to be the one-period variance of p+1.The representative noise trader maximizes E(U)=而-yσ品 (6) =c0+入[r+p+1-(1+]-y入)(o)+入2(p) 2 The assumption that noise traders misperceive the expected price hides the fact that the expected price is itself a function of the parameters p*and o Thus we are implicitly assuming that noise traders know how to factor the effect of future price volatility into their calculations of values.This assumption is made for simplicity.We have also solved a more complicated model that parameterizes noise traders'beliefs by their expectations of future prices,not by their misperceptions of future returns.The thrust of the results is the same

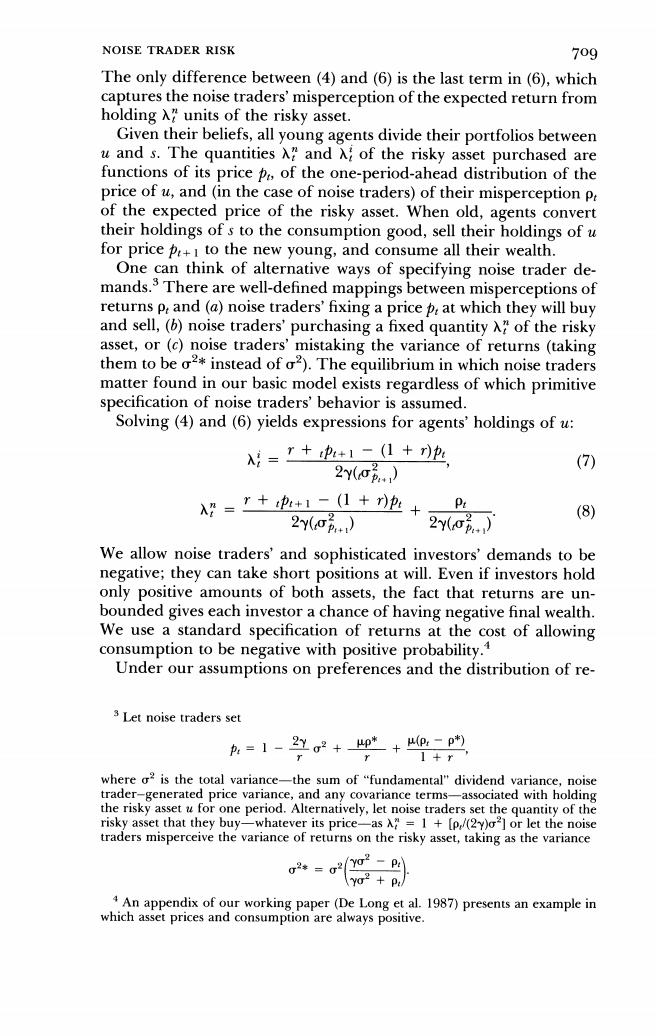

NOISE TRADER RISK 709 The only difference between(4)and(6)is the last term in(6),which captures the noise traders'misperception of the expected return from holding A"units of the risky asset. Given their beliefs,all young agents divide their portfolios between u and s.The quantities A and of the risky asset purchased are functions of its price pa,of the one-period-ahead distribution of the price of u,and(in the case of noise traders)of their misperception pe of the expected price of the risky asset.When old,agents convert their holdings of s to the consumption good,sell their holdings of u for pricep+I to the new young,and consume all their wealth. One can think of alternative ways of specifying noise trader de- mands.3 There are well-defined mappings between misperceptions of returns p and(a)noise traders'fixing a price p at which they will buy and sell,(b)noise traders'purchasing a fixed quantity A"of the risky asset,or (c)noise traders'mistaking the variance of returns (taking them to be o2*instead of o2).The equilibrium in which noise traders matter found in our basic model exists regardless of which primitive specification of noise traders'behavior is assumed. Solving(4)and(6)yields expressions for agents'holdings of u: x=T++1-((1+p (7) 2y(o.) N=+0+地+ P (8) 2yo.) 2() We allow noise traders'and sophisticated investors'demands to be negative;they can take short positions at will.Even if investors hold only positive amounts of both assets,the fact that returns are un- bounded gives each investor a chance of having negative final wealth. We use a standard specification of returns at the cost of allowing consumption to be negative with positive probability.4 Under our assumptions on preferences and the distribution of re- 3 Let noise traders set p:=1-2Yg2+p*+®-p 1+r where o2 is the total variance-the sum of "fundamental"dividend variance,noise trader-generated price variance,and any covariance terms-associated with holding the risky asset u for one period.Alternatively,let noise traders set the quantity of the risky asset that they buy-whatever its price-asA=1 [p/(2y)o2]or let the noise traders misperceive the variance of returns on the risky asset,taking as the variance 2*=g2Y02-p4 yo2 pr 4 An appendix of our working paper(De Long et al.1987)presents an example in which asset prices and consumption are always positive

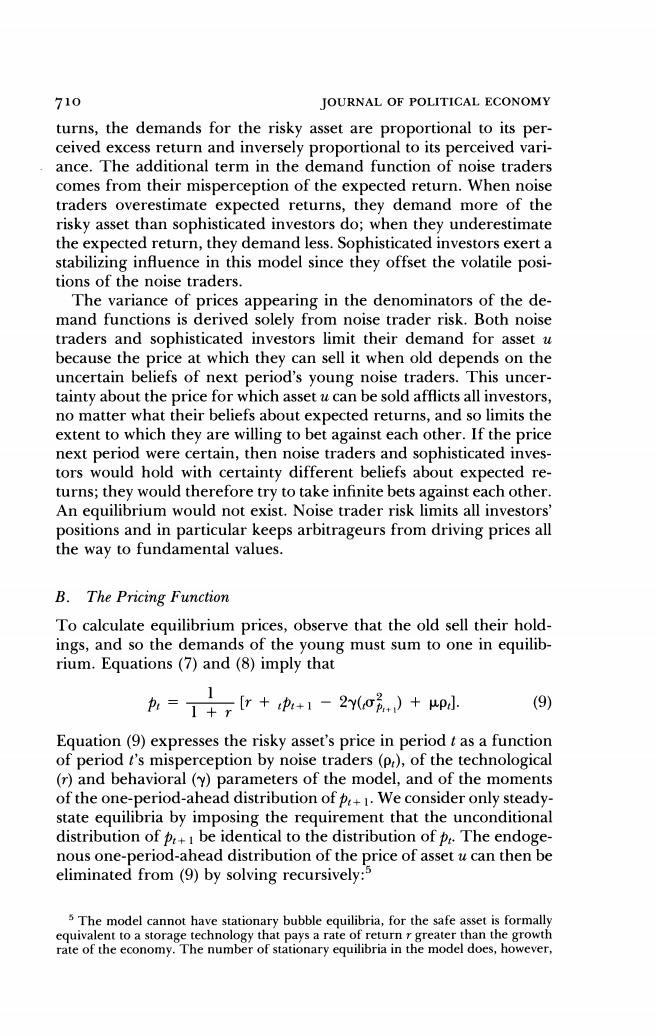

710 JOURNAL OF POLITICAL ECONOMY turns,the demands for the risky asset are proportional to its per- ceived excess return and inversely proportional to its perceived vari- ance.The additional term in the demand function of noise traders comes from their misperception of the expected return.When noise traders overestimate expected returns,they demand more of the risky asset than sophisticated investors do;when they underestimate the expected return,they demand less.Sophisticated investors exert a stabilizing influence in this model since they offset the volatile posi- tions of the noise traders. The variance of prices appearing in the denominators of the de- mand functions is derived solely from noise trader risk.Both noise traders and sophisticated investors limit their demand for asset u because the price at which they can sell it when old depends on the uncertain beliefs of next period's young noise traders.This uncer- tainty about the price for which asset u can be sold afflicts all investors, no matter what their beliefs about expected returns,and so limits the extent to which they are willing to bet against each other.If the price next period were certain,then noise traders and sophisticated inves- tors would hold with certainty different beliefs about expected re- turns;they would therefore try to take infinite bets against each other. An equilibrium would not exist.Noise trader risk limits all investors' positions and in particular keeps arbitrageurs from driving prices all the way to fundamental values. B.The Pricing Function To calculate equilibrium prices,observe that the old sell their hold- ings,and so the demands of the young must sum to one in equilib- rium.Equations(7)and(8)imply that A=+,+A1-2)+pl (9) Equation(9)expresses the risky asset's price in period t as a function of period t's misperception by noise traders(P),of the technological (r)and behavioral(Y)parameters of the model,and of the moments of the one-period-ahead distribution ofp+1.We consider only steady- state equilibria by imposing the requirement that the unconditional distribution of+be identical to the distribution ofp The endoge- nous one-period-ahead distribution of the price of asset u can then be eliminated from(9)by solving recursively: s The model cannot have stationary bubble equilibria,for the safe asset is formally equivalent to a storage technology that pays a rate of return r greater than the growth rate of the economy.The number of stationary equilibria in the model does,however

NOISE TRADER RISK 711 办=1+的+p-2(o (10) 1+r Inspection of(10)reveals that only the second term is variable,for y, p*,and r are all constants,and the one-step-ahead variance of is a simple unchanging function of the constant variance of a generation of noise traders'misperception Pe: 乐吸 (11) The final form of the pricing rule for u,in which the price depends only on exogenous parameters of the model and on public informa- tion about present and future misperception by noise traders,is ,=1+p,-p+p*-2Yμ2o r1+r)2 (12) 1+m C.Interpretation The last three terms that appear in(12)and(10)show the impact of noise traders on the price of asset u.As the distribution of p,con- verges to a point mass at zero,the equilibrium pricing function(12) converges to its fundamental value of one. The second term in(12)captures the fluctuations in the price of the risky asset u due to the variation of noise traders'misperceptions Even though asset u is not subject to any fundamental uncertainty and is so known by a large class of investors,its price varies substantially as noise traders'opinions shift.When a generation of noise traders is more bullish than the average generation,they bid up the price of u. When they are more bearish than average,they bid down the price. When they hold their average misperception-when pa=p*-the term is zero.As one would expect,the more numerous noise traders are relative to sophisticated investors,the more volatile asset prices are. The third term in(12)captures the deviations ofp from its funda- mental value due to the fact that the average misperception by noise traders is not zero.If noise traders are bullish on average,this "price pressure"effect makes the price of the risky asset higher than it depend on the primitive specification of noise traders'behavior.For example,if noise traders randomly pick each period the price p at which they will buy and sell unlimited quantities of the risky asset,then(trivially)there is only one equilibrium.If the noise traders randomly pick the quantitythat they purchase,then the fundamental solu- tion in whichp,is always equal to one is an equilibrium in addition to the equilibrium in which noise traders matter

712 JOURNAL OF POLITICAL ECONOMY would otherwise be.Optimistic noise traders bear a greater than aver- age share of price risk.Since sophisticated investors bear a smaller share of price risk the higher p*is,they require a lower expected excess return and so are willing to pay a higher price for asset u. The final term in (12)is the heart of the model.Sophisticated investors would not hold the risky asset unless compensated for bear- ing the risk that noise traders will become bearish and the price of the risky asset will fall.Both noise traders and sophisticated investors present in periodtbelieve that asset u is mispriced,but becausepis uncertain,neither group is willing to bet too much on this mispricing. At the margin,the return from enlarging one's position in an asset that everyone agrees is mispriced (but different types think is mis- priced in different directions)is offset by the additional price risk that must be run.Noise traders thus "create their own space":the uncer- tainty over what next period's noise traders will believe makes the otherwise riskless asset u risky and drives its price down and its return up.This is so despite the fact that both sophisticated investors and noise traders always hold portfolios that possess the same amount of fundamental risk:zero.Any intuition to the effect that investors in the risky asset "ought"to receive higher expected returns because they perform the valuable social function of risk bearing neglects to consider that noise traders'speculation is the only source of risk.For the economy as a whole,there is no risk to be borne. The reader might suspect that our results are critically dependent on the overlapping generations structure of the model,but this is not quite accurate.Equilibrium exists as long as the returns to holding the risky asset are always uncertain.In the overlapping generations struc- ture,this is assured by the absence of a last period.For if there is a last period in which the risky asset pays a nonstochastic dividend and is liquidated,then both noise traders and sophisticated investors will seek to exploit what they see as riskless arbitrage.If,say,the liq- uidation value of the risky asset is 1 r,previous-period sophis- ticated investors will try to trade arbitrarily large amounts of asset u at any price other than one,and noise traders will try to trade arbitrarily large amounts at any price other than A=1+, (13) The excess demand function for the risky asset will be undefined and the model will have no equilibrium.But in a model with fundamental dividend risk the assumption that there is no last period and,hence, the overlapping generations structure are not necessary.With funda- mental dividend risk,no agent is ever subjectively certain what the return on the risky asset will be,and so the qualitative properties of