How Markets Process Information:News Releases and Volatility T● Louis H.Ederington;Jae Ha Lee The Journal of Finance,Volume 48,Issue 4(Sep.,1993),1161-1191. Stable URL: hutp://links.istor.org/sici?sici=0022-1082%28199309%2948%3A4%3C1161%3AHMPINR%3E2.0.CO%3B2-V Your use of the JSTOR archive indicates your acceptance of JSTOR's Terms and Conditions of Use,available at http://www.jstor.org/about/terms.html.JSTOR's Terms and Conditions of Use provides,in part,that unless you have obtained prior permission,you may not download an entire issue of a journal or multiple copies of articles,and you may use content in the JSTOR archive only for your personal,non-commercial use. Each copy of any part of a JSTOR transmission must contain the same copyright notice that appears on the screen or printed page of such transmission. The Journal of Finance is published by American Finance Association.Please contact the publisher for further permissions regarding the use of this work.Publisher contact information may be obtained at http://www.jstor.org/journals/afina.html. The Journal of Finance 1993 American Finance Association JSTOR and the JSTOR logo are trademarks of JSTOR,and are Registered in the U.S.Patent and Trademark Office. For more information on JSTOR contact jstor-info@umich.edu. ©2003 JSTOR http://www.jstor.org/ Tue Feb1801:50:432003

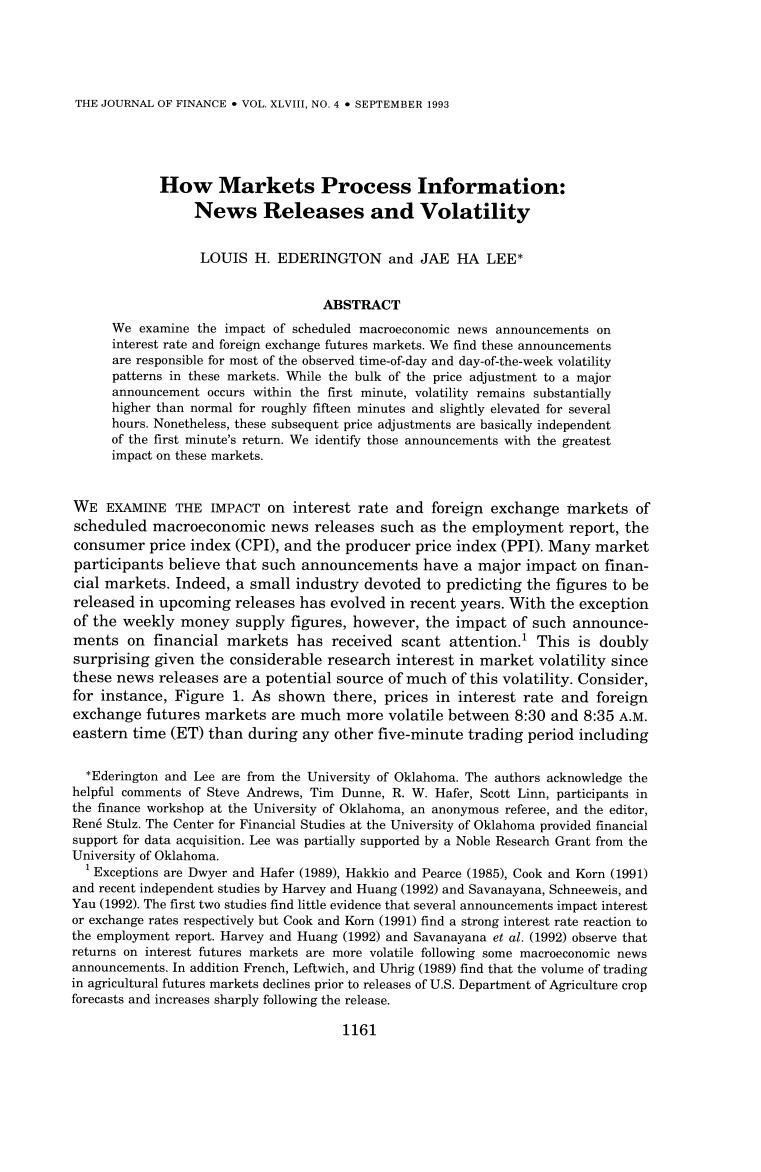

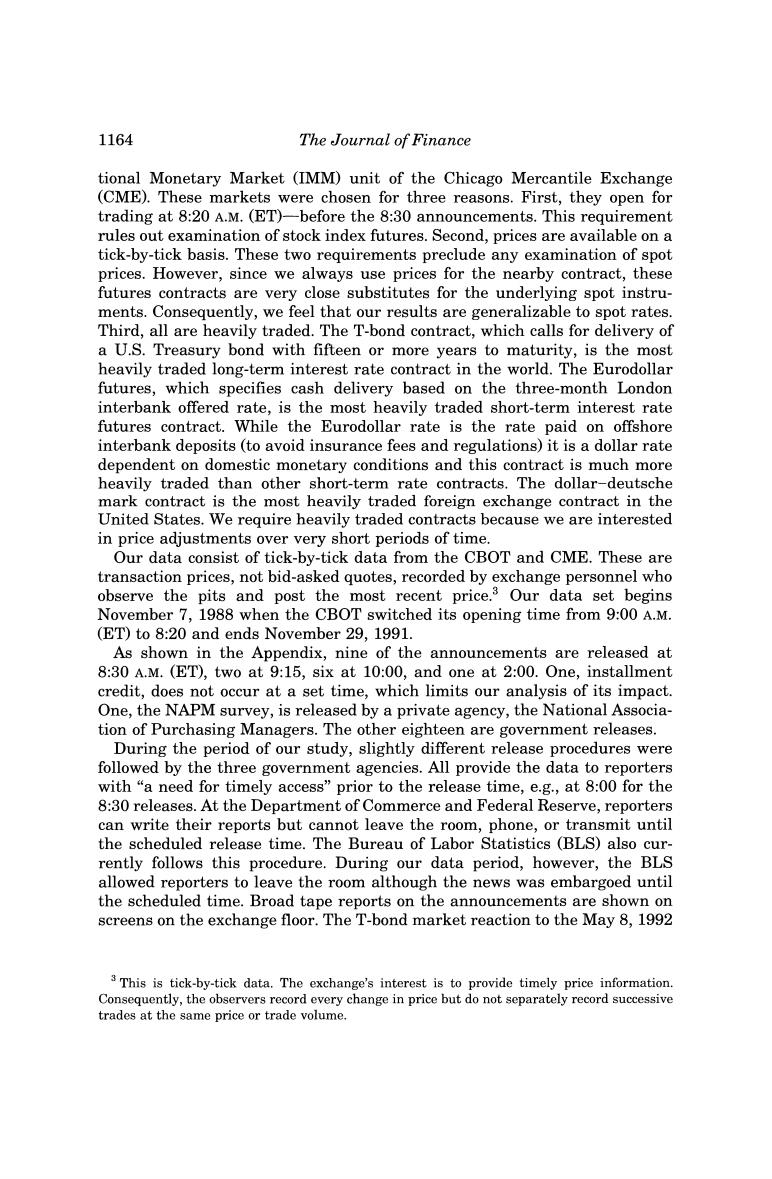

THE JOURNAL OF FINANCE VOL.XLVIII,NO.4.SEPTEMBER 1993 How Markets Process Information: News Releases and Volatility LOUIS H.EDERINGTON and JAE HA LEE* ABSTRACT We examine the impact of scheduled macroeconomic news announcements on interest rate and foreign exchange futures markets.We find these announcements are responsible for most of the observed time-of-day and day-of-the-week volatility patterns in these markets.While the bulk of the price adjustment to a major announcement occurs within the first minute,volatility remains substantially higher than normal for roughly fifteen minutes and slightly elevated for several hours.Nonetheless,these subsequent price adjustments are basically independent of the first minute's return.We identify those announcements with the greatest impact on these markets WE EXAMINE THE IMPACT on interest rate and foreign exchange markets of scheduled macroeconomic news releases such as the employment report,the consumer price index(CPD),and the producer price index(PPI).Many market participants believe that such announcements have a major impact on finan- cial markets.Indeed,a small industry devoted to predicting the figures to be released in upcoming releases has evolved in recent years.With the exception of the weekly money supply figures,however,the impact of such announce- ments on financial markets has received scant attention.This is doubly surprising given the considerable research interest in market volatility since these news releases are a potential source of much of this volatility.Consider, for instance,Figure 1.As shown there,prices in interest rate and foreign exchange futures markets are much more volatile between 8:30 and 8:35 A.M. eastern time(ET)than during any other five-minute trading period including "Ederington and Lee are from the University of Oklahoma.The authors acknowledge the helpful comments of Steve Andrews,Tim Dunne,R.W.Hafer,Scott Linn,participants in the finance workshop at the University of Oklahoma,an anonymous referee,and the editor, Rene Stulz.The Center for Financial Studies at the University of Oklahoma provided financial support for data acquisition.Lee was partially supported by a Noble Research Grant from the University of Oklahoma Exceptions are Dwyer and Hafer(1989),Hakkio and Pearce(1985),Cook and Korn(1991) and recent independent studies by Harvey and Huang(1992)and Savanayana,Schneeweis,and Yau(1992).The first two studies find little evidence that several announcements impact interest or exchange rates respectively but Cook and Korn(1991)find a strong interest rate reaction to the employment report.Harvey and Huang (1992)and Savanayana et al.(1992)observe that returns on interest futures markets are more volatile following some macroeconomic news announcements.In addition French,Leftwich,and Uhrig(1989)find that the volume of trading in agricultural futures markets declines prior to releases of U.S.Department of Agriculture crop forecasts and increases sharply following the release. 1161

1162 The Journal of Finance the open (8:20 A.M.)and close.In the two interest rate futures markets,the standard deviation of 8:30 to 8:35 returns is approximately two and a half times the next highest five-minute return standard deviation.In the deutsche mark market,the ratio is 1.9.Since several major macroeconomic statistical releases,including the employment report,the CPI and PPI,Gross National Product (GNP),the index of leading indicators,and the merchandise trade deficit,are released at 8:30 A.M.(ET),these releases are obvious candidates for explaining this phenomenon. We examine the impact of the nineteen monthly announcements,listed in the Appendix,on the Treasury bond(T-bond),Eurodollar,and deutsche mark futures markets.We focus on these markets because they open before 8:30, are heavily traded,and provide tick-by-tick prices.Because the futures and spot instruments are close substitutes,we believe our results are generaliz- able to spot interest and exchange rate markets as well.Indeed,we feel many of our results are relevant to any scheduled announcement,i.e., one whose timing is known beforehand,such as earnings and dividend announcements. Harvey and Huang (1991,1992)observe that interest rate and foreign exchange futures prices are much more volatile during the first sixty to seventy minutes of trading on Thursdays and Fridays than during any other hour over the trading week.They hypothesize that this pattern is due to the fact that many macroeconomic announcements occur during the first hour of trading on these two days-it is not due to the opening itself.Our results support their hypothesis.We find that,within the first seventy minutes, volatility is not usually high at the opening(8:20)but at 8:30 when the announcements are made.More important,we find that,when we control for these announcements,volatility is basically flat both across the trading day and across the trading week. In examining the importance of individual announcements,we find that the following seven announcements (listed in order of decreasing impact) have a significant(0.005 level)effect on T-bond futures prices:employment, the PPI,the CPI,durable goods orders,industrial production-capacity uti- lization,construction spending-National Association of Purchasing Managers (NAPM)survey,and the federal budget.Employment,the PPI,the CPI, durable goods orders,construction spending-NAPM survey and industrial production-capacity utilization have a significant impact on Eurodollar futures,while employment,the U.S.merchandise trade deficit,the PPI, durable goods orders,GNP,and retail sales significantly impact the dollar- deutsche mark rate. We explore the speed at which the market adjusts to these news releases focusing on both market efficiency and volatility.We find that the major price adjustment occurs within one minute of the release and the direction of subsequent price adjustments is basically independent of the first minute's price change.Nonetheless,prices continue to be considerably more volatile than normal for roughly fifteen minutes and slightly more volatile for several hours.This is a considerably more rapid adjustment than that observed by

How Markets Process Information:News Releases and Volatility 1163 Patell and Wolfson (1984)in equity markets.They find that following divi- dend and earnings announcements,it takes five to ten minutes for trading profits in individual equities to disappear and that volatility may remain high even into the next day.Given our results,it appears that traders with immediate access to the market quickly form a basically unbiased estimate of the release's implications for market prices and that the price adjusts to this level almost immediately.Prices continue to adjust as details become avail- able and as these and other traders reassess the news and its implications for prices.However,these subsequent adjustments are generally independent of the initial price change. In the next section we explain our choices of news releases and markets;we also describe the news release procedures.In Section II,we examine the implications of these releases for intraday and day-of-the-week volatility.In Section III we turn to the question of the relative importance of these announcements.The efficiency of the markets in adjusting to this information is explored in Section IV and our results are summarized in Section V. I.News Releases and Market Structure We explore the impact on interest rate and foreign exchange futures prices of the nineteen macroeconomic news releases listed in the Appendix.These are the nineteen monthly announcements whose upcoming release is regularly covered in "The Week Ahead"section of Business Week.2 Their release could affect interest and exchange rates either because they are viewed as sig- nalling a likely change in the demand for credit or foreign exchange or because market participants believe these are important variables which the Federal Reserve considers in setting monetary policy.We examine only monthly announcements.Weekly news releases such as the money supply figures and Treasury bill auction results are excluded because(since they are always announced on the same day)their impact would be difficult to distinguish from day-of-the-week effects.Also,most (e.g.,the money supply) are announced after the markets close.Because the number of data points is inadequate for individual analysis,purely quarterly announcements are excluded.While the GNP is a quarterly statistic,advance,preliminary,and final estimates are announced in successive months,so we include it in our set. We examine the impact of these announcements on the T-bond,Eurodollar, and deutsche mark futures markets.The T-bond contract is traded on the Chicago Board of Trade (CBOT).The other two are traded on the Interna- 2A few other upcoming monthly announcements are occasionally reported in this column but not on a consistent basis.Consensus forecasts for most of our releases are tabulated by MMS International and these are reported in Business Week.The federal government's "Schedule of Release Dates"lists twenty-four monthly nonagricultural news releases.We include eighteen of these.We also include one release from a private agency,the National Association of Purchasing Managers

1164 The Journal of Finance tional Monetary Market (IMM)unit of the Chicago Mercantile Exchange (CME).These markets were chosen for three reasons.First,they open for trading at 8:20 A.M.(ET)-before the 8:30 announcements.This requirement rules out examination of stock index futures.Second,prices are available on a tick-by-tick basis.These two requirements preclude any examination of spot prices.However,since we always use prices for the nearby contract,these futures contracts are very close substitutes for the underlying spot instru- ments.Consequently,we feel that our results are generalizable to spot rates. Third,all are heavily traded.The T-bond contract,which calls for delivery of a U.S.Treasury bond with fifteen or more years to maturity,is the most heavily traded long-term interest rate contract in the world.The Eurodollar futures,which specifies cash delivery based on the three-month London interbank offered rate,is the most heavily traded short-term interest rate futures contract.While the Eurodollar rate is the rate paid on offshore interbank deposits(to avoid insurance fees and regulations)it is a dollar rate dependent on domestic monetary conditions and this contract is much more heavily traded than other short-term rate contracts.The dollar-deutsche mark contract is the most heavily traded foreign exchange contract in the United States.We require heavily traded contracts because we are interested in price adjustments over very short periods of time. Our data consist of tick-by-tick data from the CBOT and CME.These are transaction prices,not bid-asked quotes,recorded by exchange personnel who observe the pits and post the most recent price.3 Our data set begins November 7,1988 when the CBOT switched its opening time from 9:00 A.M. (ET)to 8:20 and ends November 29,1991. As shown in the Appendix,nine of the announcements are released at 8:30 A.M.(ET),two at 9:15,six at 10:00,and one at 2:00.One,installment credit,does not occur at a set time,which limits our analysis of its impact. One,the NAPM survey,is released by a private agency,the National Associa- tion of Purchasing Managers.The other eighteen are government releases. During the period of our study,slightly different release procedures were followed by the three government agencies.All provide the data to reporters with "a need for timely access"prior to the release time,e.g.,at 8:00 for the 8:30 releases.At the Department of Commerce and Federal Reserve,reporters can write their reports but cannot leave the room,phone,or transmit until the scheduled release time.The Bureau of Labor Statistics (BLS)also cur- rently follows this procedure.During our data period,however,the BLS allowed reporters to leave the room although the news was embargoed until the scheduled time.Broad tape reports on the announcements are shown on screens on the exchange floor.The T-bond market reaction to the May 8,1992 3 This is tick-by-tick data.The exchange's interest is to provide timely price information. Consequently,the observers record every change in price but do not separately record successive trades at the same price or trade volume

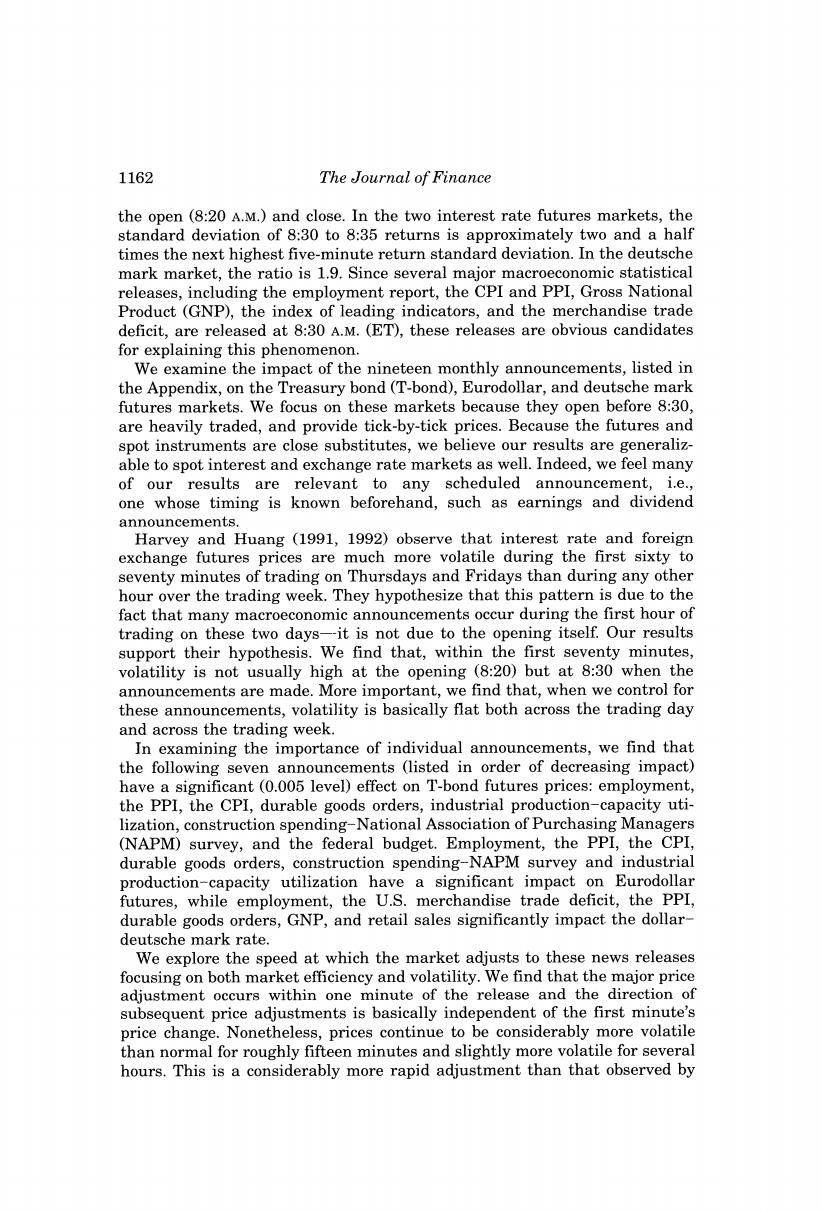

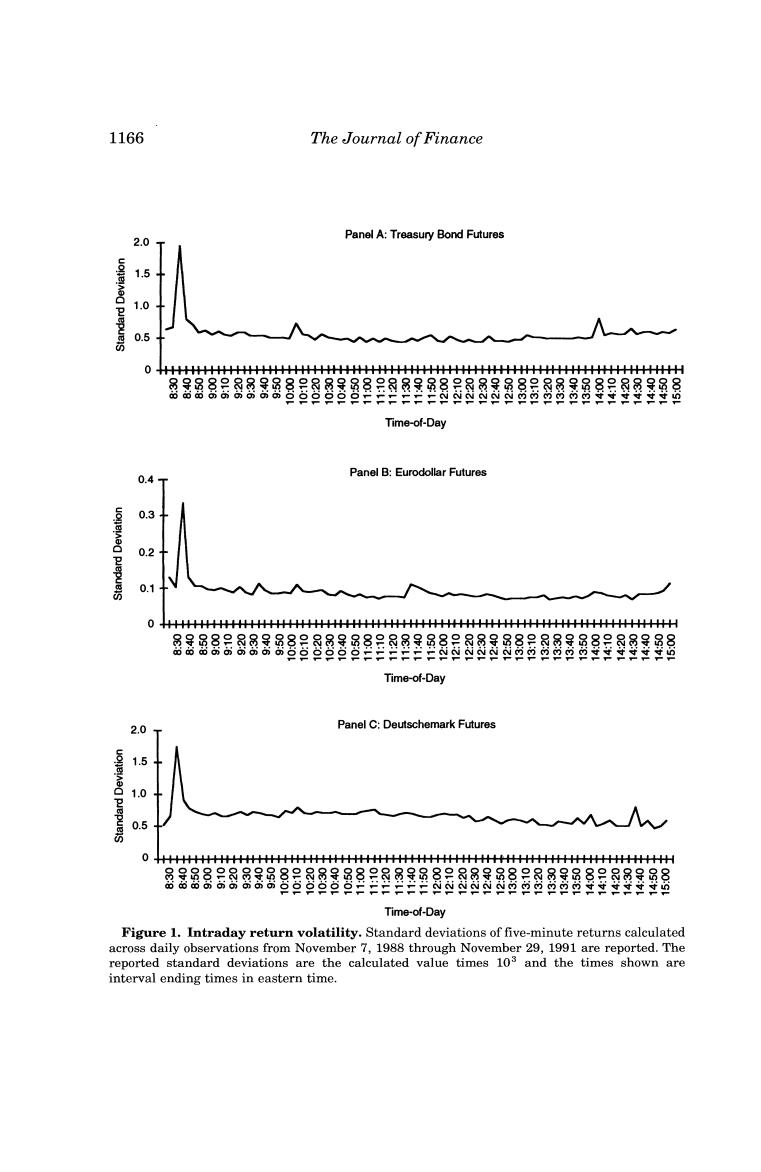

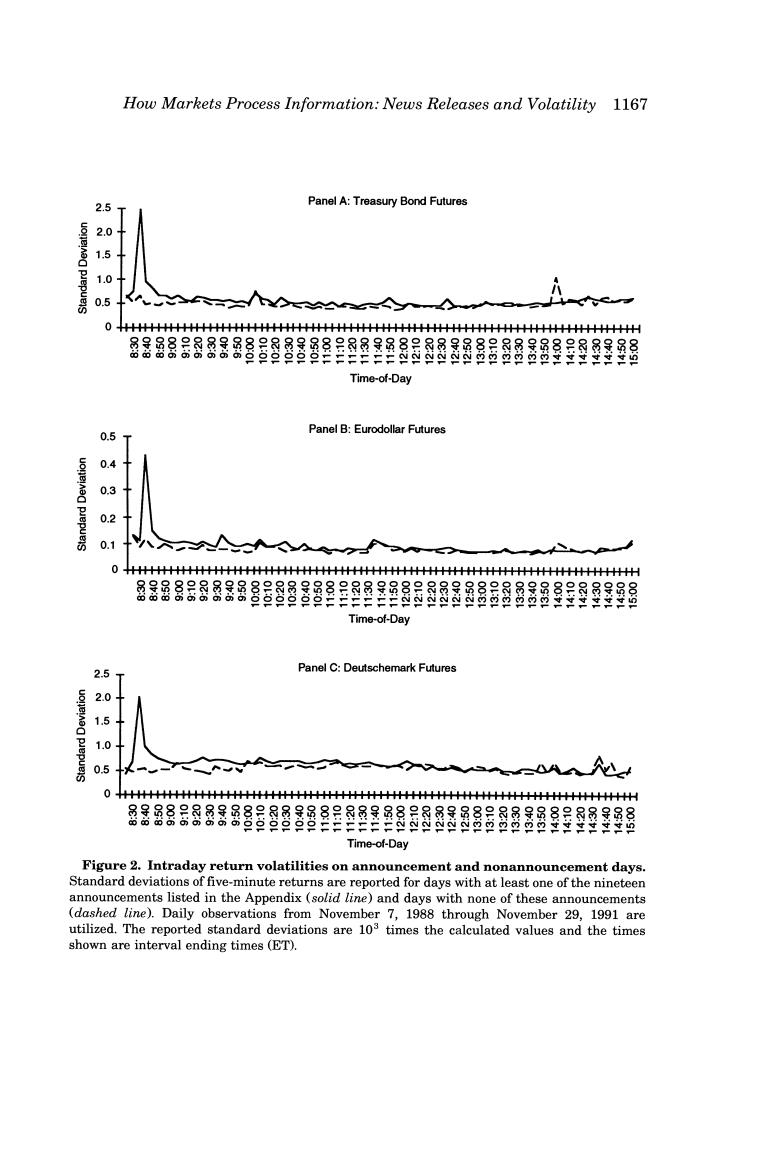

How Markets Process Information:News Releases and Volatility 1165 employment report was directly observed from the CBOT trading pit.Key figures appeared promptly at 8:30 and a paragraph of text was displayed on the screens within ten seconds or so.However,several traders said they don't normally watch the screen but simply react to the order flow.Also,the screens are not visible to all traders unless they turn their back on the trading pit.There appeared to be a flurry of phone orders within a few seconds of 8:30. Ⅱ.Volatility A.Intraday Volatility To examine intraday volatility,log returns,In(P/P-1),are calculated from prices on the nearby contract for each five-minute period over the trading day.Of course these "returns"measure price changes only.They are not returns in an investment sense since no money is actually invested up front.Standard deviations of these log returns calculated across all 775 trading days (November 7,1988 to November 29,1991)are shown in Figure 1.In this and other figures,the time on the horizontal axis indicates the end of the interval in eastern time,e.g.,8:35 for 8:30 to 8:35 returns.It is readily apparent that returns are much more variable over the 8:30 to 8:35 period than during any other five-minute period.In the T-bond market,the ratio of the 8:30 to 8:35 standard deviation to the next highest five-minute standard deviation is 2.4.In the Eurodollar and deutsche mark futures markets,this ratio is 2.6 and 1.9 respectively. Of particular interest is volatility at the open.Note that if one examines periods of fifteen minutes or longer for our futures contracts(e.g.,Harvey and Huang(1991,1992)or Ekman(1992)),prices appear to be more volatile at the open.However,prices over the first ten minutes,8:20 to 8:30,are not particularly volatile.It is between 8:30 and 8:35 that volatility is unusually high.Nine of our news releases occur at 8:30 including all three which several futures traders have told us are particularly important:the employ- ment report,the CPI,and the PPI.To determine if the intraday volatility patterns observed in Figure 1 are indeed due to these new releases,we divide the sample into those days with at least one of our nineteen new releases,457 days,and those with none,318 days.As shown in Figure 2,in the nonan- nouncement day set,the 8:30 to 8:35 spike disappears.5 4 The authors are grateful to Jerome Lacey and others at Prudential Securities for sharing their experiences on the market's reaction to these announcements and for arranging for one of the authors to visit the trading floor to observe the reaction to the May 8,1992 employment report. 5The days and times of the announcements were primarily determined from Business Week's "The Week Ahead"column.On the few occasions when an announcement was not reported in Business Week we use the government's "Schedule of Release Dates."Although the only major spike in Figure 1 is at 8:30,we include in our data set announcements at other times in order to determine if there is any impact on volatility at those times

1166 The Journal of Finance Panel A:Treasury Bond Futures 2.0 15 1 0.5 0 ++++++++++++++++++++++++++H++++H+++++H 密8器g8经888888昌目的图程3的图器器器8器88群图强程昌 Time-of-Day Panel B:Eurodollar Futures 0.4 03 02 0.1 0H+H++H+++++++H+H+H+H+H Time-of-Day 2.0 Panel C:Deutschemark Futures 1.5 1.0 0.5 Time-of-Day Figure 1.Intraday return volatility.Standard deviations of five-minute returns calculated across daily observations from November 7,1988 through November 29,1991 are reported.The reported standard deviations are the calculated value times 103 and the times shown are interval ending times in eastern time

How Markets Process Information:News Releases and Volatility 1167 2.5 Panel A:Treasury Bond Futures 2 1.0 0 HHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHH 居器88888昌8图器8程目图图强8弱图图是器8器8路品品程程强经经程 Time-of-Day Panel B:Eurodollar Futures 05 4 0.3 0.1 0 HHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHH 居器器88888器8器8强目留甜图图器器品强屋器器星强经强强餐 Time-of-Day 2.5 Panel C:Deutschemark Futures 2.0 1. 0.5 +H+++H++++++H++H+++H+HH++H+++++H++HH 8器888品器器图8昌强图程8图备器品品器888品星程经强程 Time-of-Day Figure 2.Intraday return volatilities on announcement and nonannouncement days. Standard deviations of five-minute returns are reported for days with at least one of the nineteen announcements listed in the Appendix(solid line)and days with none of these announcements (dashed line).Daily observations from November 7,1988 through November 29,1991 are utilized.The reported standard deviations are 103 times the calculated values and the times shown are interval ending times(ET)

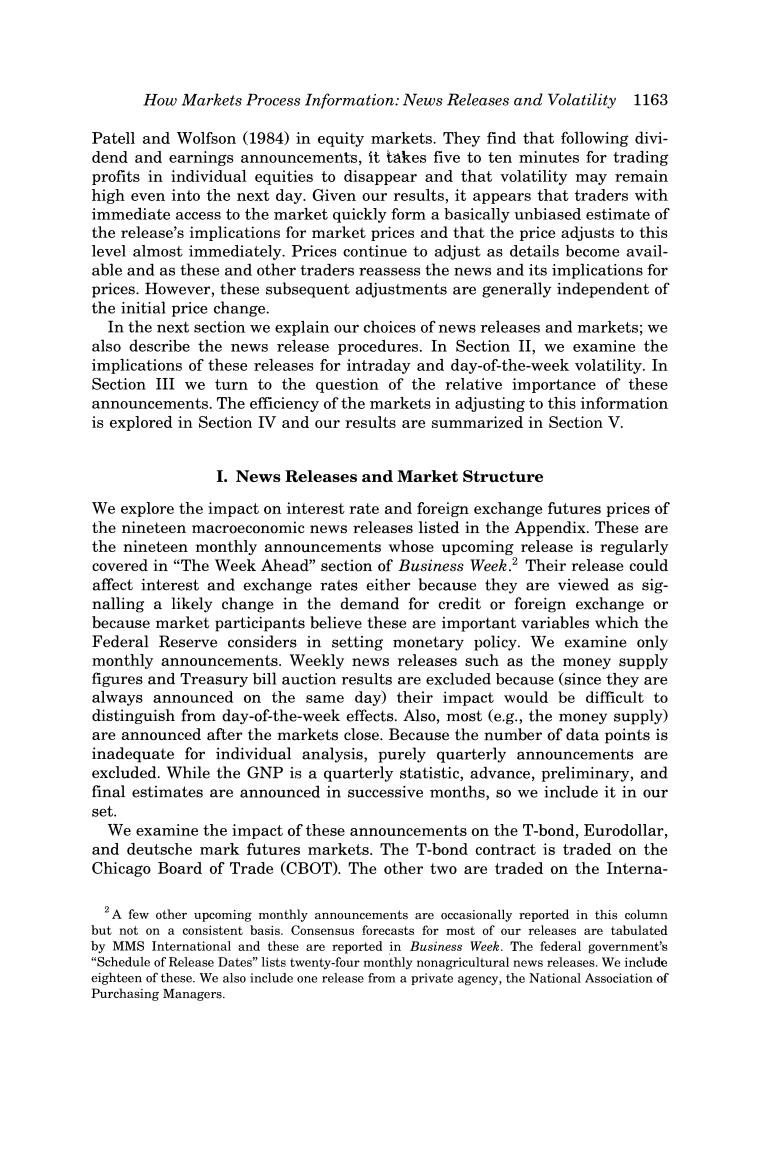

1168 The Journal of Finance Table I Tests of Homoskedasticity of the Return Variates Brown-Forsythe-modified Levene test statistics are reported;F is the test statistic for equality of the variances across the 80 intraday five-minute intervals.F2 is the test statistic for equal- ity of the variances for the 8:30 to 8:35 period across days of the week,and Fa is the test statistic for equality of the variances for the open to 9:30 period across days of the week.The Brown- Forsythe-modified Levene test statistic is F.(D,-D.2(w-) y4(Dw-D)2(J-1)’ where D=Iry-Ml;rt;is the return for day t,interval j;M,is the sample median return for interval j computed over the n;days included in the test;D.;=EL(Di/n,)is the mean absolute deviation (from the median)for interval j;and D..DN)is the grand mean,and N-E-1n,.The statistic is distributed F-1 w-,under the null hypothesis.An asterisk indicates that the null hypothesis of homoskedasticity is rejected at the 0.01 percent level. Announcement Days Nonannouncement Days All Days Panel A:Treasury Bond Futures F 39.57+ 5.77* 35.86* 20.35* 2.79 31.73* 17.59 0.21 24.54 Panel B:Eurodollar Futures 34.11* 6.11* 33.11* F2 17.59* 0.54 27.85* 13.37* 1.31 21.90* Panel C:Deutsche Mark Futures F 22.25* 3.89 18.62 F2 22.79* 2.43 36.69* 10.80* 1.61 13.91* In Table I,we present the Brown-Forsythe-modified Levene test statistic (F)for the null hypothesis that the variance of returns is constant through- out the trading day.This null is overwhelmingly rejected for days on which announcements occur and for the total data set.For the nonannouncement set,the homoskedasticity null is still rejected at the 0.0001 level.However, the F statistic is sharply reduced and there is no discernable intraday pattern on these days.In particular there is no evidence that volatility is particularly high at the open and close as observed in equity markets by 6 Conover,Johnson,and Johnson(1981)compare over fifty methods of testing for homogeneity of variance and find that this test is among the most powerful and is robust to nonnormality.It is used by Lockwood and Linn(1990)to test for homogeneity of intraday return variances

How Markets Process Information:News Releases and Volatility 1169 Wood,McInish,and Ord (1985),Lockwood and Linn (1990),and others. Indeed,one wonders if the high variance observed at the open in equity markets is partly due to the 8:30 news releases which occur shortly before the stock market opens.In the nonannouncement set,the highest variance in the T-bond market occurs at 1:55 to 2:00(10:00 to 10:05 if a single outlier is removed).?For Eurodollars and deutsche marks,the high points are at 8:20 to 8:25 (the open)and 2:30 to 2:35,respectively.Harvey and Huang (1992) hypothesize and present evidence that interest rate volatility tends to be high between 11:35 and 12:15 (ET)when a uniquely informed trader,the Federal Reserve,is actively trading.While we do not explicitly test their hypothesis, no such increase in volatility is apparent in Figures 1 and 2.In summary, although the null of homoskedasticity is rejected for nonannouncement days, there is no clear pattern,i.e.,volatility is basically flat across the trading day. B.Day-of-the-Week Effects Harvey and Huang(1991)observe that in the interest rate and foreign exchange futures markets,returns over the first sixty to seventy minutes of trading on Thursdays and Fridays are more volatile than during any other one-hour period during the week.8 They hypothesize that this is due to the fact that many news releases take place during this time on these days and present evidence in a later paper (1992)that this is the case.Our results further support their hypothesis.The distribution of our announcements by day of the week is reported in the Appendix.Among our 8:30 announcements, the employment report is always released on Friday and the PPI is usually released on Thursday or Friday.In Figures 3 and 4 we show 8:30 to 8:35 and 8:20 to 9:30 standard deviations for each day of the week for announcement days,nonannouncement days,and our complete sample.Volatility is particu- larly high on Fridays on which announcements occur.On nonannouncement Fridays,there is no such pattern.In Table I,we present Brown-Forsythe- modified Levene tests of the null that the variance is the same for all days of the week.F2 is the test statistic for the null that the 8:30 to 8:35 variance is the same on all five days and Fa is the equivalent test statistic for the 8:20 to 9:30 variance.Both are clearly rejected for the announcement and total samples but cannot be rejected for the nonannouncement sample.In sum- mary,intraday and interday volatility patterns in these markets appear to be due primarily to the timing of macroeconomic news releases. 7As shown in Figure 2,there is a"mini-spike"at 1:55 to 2:00 in the nonannouncement data set.This is due to a single outlier on January 9,1991 when Secretary of State Baker emerged from a meeting with Iraqi Foreign Minister Aziz and reported there was no indication Iraq would leave Kuwait peacefully.To avoid distortion,this outlier is eliminated in our subsequent analysis. 8 In a recent paper,Harvey and Huang(1992)calculate the variances of returns over the period from the open to 8:45 A.M.(ET)for days when at least one of six macroeconomic announcements occur and separately for days without any of the six.They observe a much higher variance on announcement days