正在加载图片...

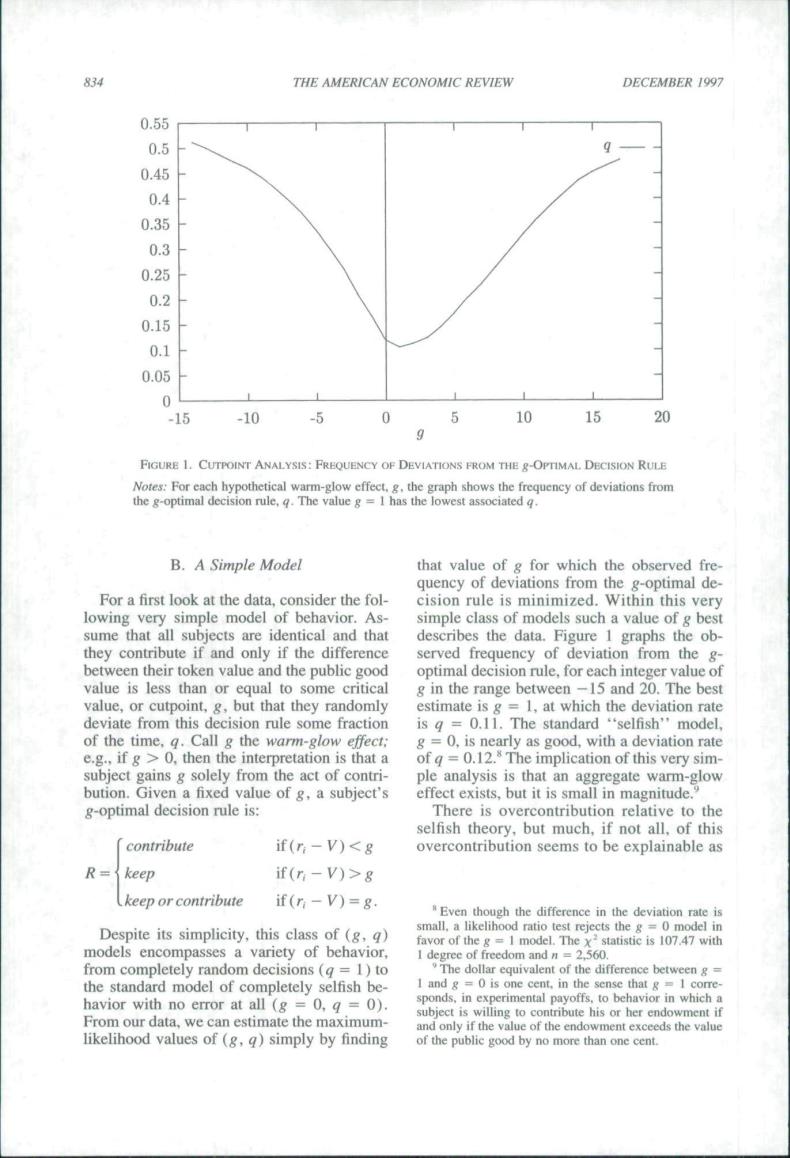

834 THE AMERICAN ECONOMIC REVIEW DECEMBER 1997 0.55 0.5 0.45 0.4 0.35 0.3 0.25 0.2 0.15 0.1 0.05 0 5 -10 5 10 15 20 B.A Simple Model that valu for which the ob For a first look at the data,consider the fol- lowing very simple model of behavior.As. simple class of models such a value of g bes sume that all subjects are s the data.Figure I graphs the ob he ond th e f value is less than or equal to some critical in the range between15 and 20.The bes value,or cutpoint.gbut that they randomly estimate is g=1.at which the deviation rate from thi 'selfish mode selfish h contribute if (n-V)<g overcontribution seems to bee R keep if (n-V)>8 keep or contribute if (n-V)=8. m decis ons to r at andg is one cent.in the 0 =0 in ex in which From our data.we can estimate the maximum likelihood values of(g,q)simply by finding of the public good by no more than one cent.834 THE AMERICAN ECONOMIC REVIEW DECEMBER 1997 u.oo 0.5 0.45 0.4 0.35 0.3 0.25 0.2 0.15 0.1 0.05 n 1 1 \ \ \ \ \ - 1 1 1 q / / / / / -15 -10 -5 0 5 10 15 20 9 FtGURB 1. CUTPOINT ANALYSIS : FRBQUENCY OF DEVIATIONS FROM THE ^-OPTIMAL DECISION RULE Notes: For each hypothetical warm-glow effect, g, the graph shows the frequency of deviations from the g-optimal decision rule, q. The value g = 1 has the lowest associated q. B. A Simple Model For a first look at the data, consider the following very simple model of behavior. Assume that all subjects are identical and that they contribute if and only if the difference between their token value and the public good value is less than or equal to some critical value, or cutpoint, g, but that they randomly deviate from this decision rule some fraction of the time, q. Call g the warm-glow effect: e.g., if g > 0, then the interpretation is that a subject gains g solely from the act of contribution. Given a fixed value of g, a subject's ^-optimal decision rule is: ( contribute keep keep or contribute iHn-V)<g \f{n-V)>g Despite its simplicity, this class of (g, q) models encompasses a variety of behavior, from completely random decisions {q = 1) to the standard model of completely selfish behavior with no error at all {g = 0, ^ = 0). From our data, we can estimate the maximumlikelihood values of {g, q) simply by finding that value of g for which the observed frequency of deviations from the ^-optimal decision rule is minimized. Within this very simple class of models such a value of g best describes the data. Figure 1 graphs the observed frequency of deviation from the goptimal decision rule, for each integer value of g in the range between —15 and 20. The best estimate is g = I, at which the deviation rate is ^ = 0.11. The standard "selfish" model, g = 0, is nearly as good, with a deviation rate of g = 0.12." The implication of this very simple analysis is that an aggregate warm-glow effect exists, but it is small in magnitude.'' There is overcontribution relative to the selfish theory, but much, if not ail, of this overcontribution seems to be explainable as " Even though the difference in the deviation rate is small, a likelihood ratio test rejects the g = 0 model in favor of the g = I model. The x' statistic is 107.47 with 1 degree of freedom and n = 2,560. " The dollar equivalent of the difference hetween g = 1 and g = 0 is one cent, in the sense thai g = 1 corresponds, in experimental payoffs, to behavior in which a subject is willing to contribute his or her endowment if and only if the value of the endowment exceeds the value of the public good by no more than one cent