正在加载图片...

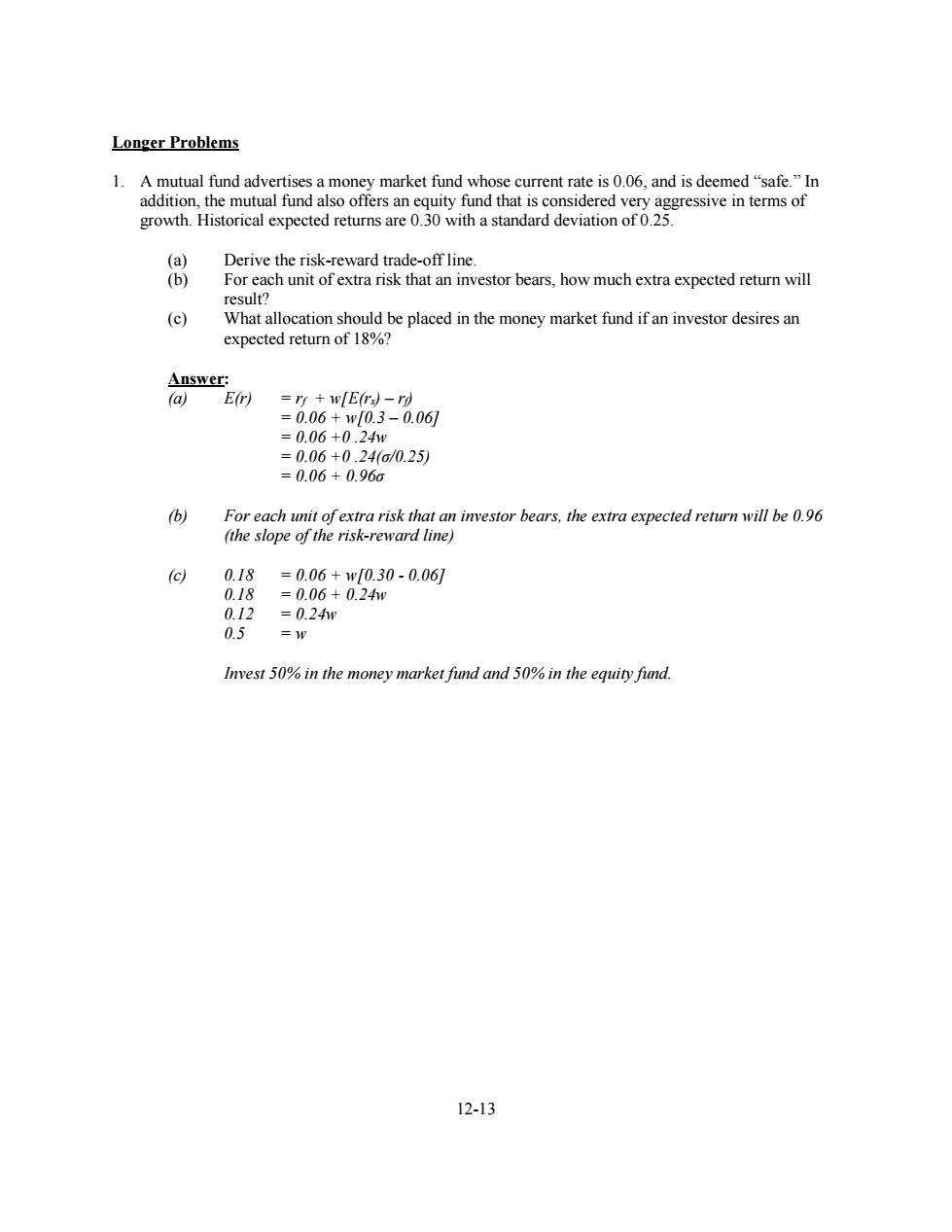

Longer Problems 1.A mutual fund advertises a money market fund whose current rate is 0.06,and is deemed"safe."In addition,the mutual fund also offers an equity fund that is considered very aggressive in terms of growth.Historical expected returns are 0.30 with a standard deviation of 0.25. (a) Derive the risk-reward trade-off line. (b) For each unit of extra risk that an investor bears,how much extra expected return will result? (c) What allocation should be placed in the money market fund if an investor desires an expected return of 18%? Answer: (a)E(r) =rf +w[E(rs)-rp) =0.06+w[0.3-0.061 =0.06+0.24w =0.06+0.24o/0.25) =0.06+0.96o (b) For each unit of extra risk that an investor bears,the extra expected return will be 0.96 (the slope of the risk-reward line) c 0.18 =0.06+w0.30-0.06] 0.18 =0.06+0.24m 0.12 =0.24w 0.5 = Invest 50%in the money market fund and 50%in the equity fund. 12-1312-13 Longer Problems 1. A mutual fund advertises a money market fund whose current rate is 0.06, and is deemed “safe.” In addition, the mutual fund also offers an equity fund that is considered very aggressive in terms of growth. Historical expected returns are 0.30 with a standard deviation of 0.25. (a) Derive the risk-reward trade-off line. (b) For each unit of extra risk that an investor bears, how much extra expected return will result? (c) What allocation should be placed in the money market fund if an investor desires an expected return of 18%? Answer: (a) E(r) = rf + w[E(rs) – rf) = 0.06 + w[0.3 – 0.06] = 0.06 +0 .24w = 0.06 +0 .24(σ/0.25) = 0.06 + 0.96σ (b) For each unit of extra risk that an investor bears, the extra expected return will be 0.96 (the slope of the risk-reward line) (c) 0.18 = 0.06 + w[0.30 - 0.06] 0.18 = 0.06 + 0.24w 0.12 = 0.24w 0.5 = w Invest 50% in the money market fund and 50% in the equity fund