正在加载图片...

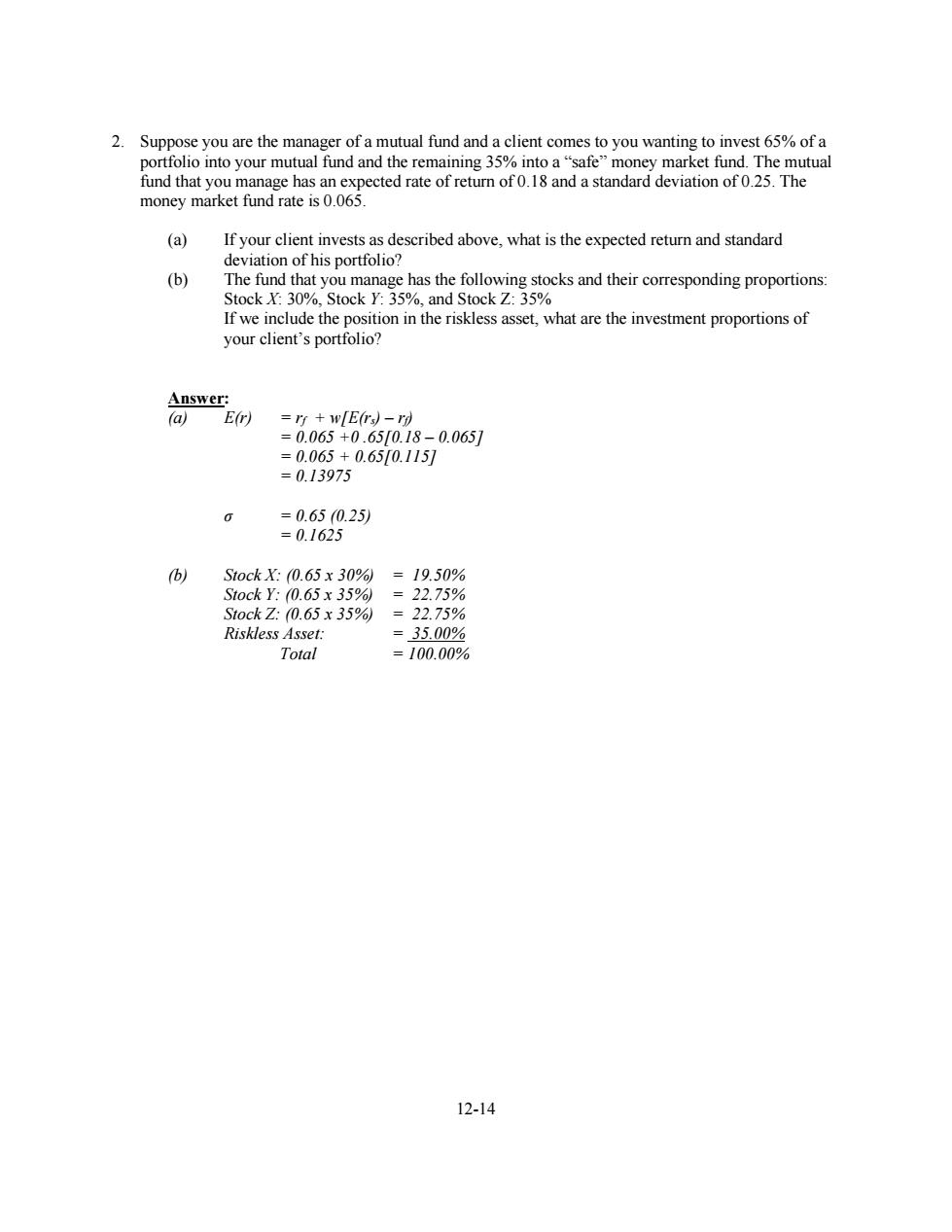

2.Suppose you are the manager of a mutual fund and a client comes to you wanting to invest 65%of a portfolio into your mutual fund and the remaining 35%into a"safe"money market fund.The mutual fund that you manage has an expected rate of return of 0.18 and a standard deviation of 0.25.The money market fund rate is 0.065. (a) If your client invests as described above,what is the expected return and standard deviation of his portfolio? (b) The fund that you manage has the following stocks and their corresponding proportions: Stock X:30%,Stock Y:35%,and Stock Z:35% If we include the position in the riskless asset,what are the investment proportions of your client's portfolio? Answer: (a)Er) =rf w[E(rs)-rp) =0.065+0.65f0.18-0.0651 =0.065+0.65[0.115] =0.13975 =0.650.25 =0.1625 b Stock X:0.65x30%=19.50% Stock Y:(0.65 x 35%) =22.75% Stock Z:0.65x35%=22.75% Riskless Asset: =35.00% Total =100.00% 12-1412-14 2. Suppose you are the manager of a mutual fund and a client comes to you wanting to invest 65% of a portfolio into your mutual fund and the remaining 35% into a “safe” money market fund. The mutual fund that you manage has an expected rate of return of 0.18 and a standard deviation of 0.25. The money market fund rate is 0.065. (a) If your client invests as described above, what is the expected return and standard deviation of his portfolio? (b) The fund that you manage has the following stocks and their corresponding proportions: Stock X: 30%, Stock Y: 35%, and Stock Z: 35% If we include the position in the riskless asset, what are the investment proportions of your client’s portfolio? Answer: (a) E(r) = rf + w[E(rs) – rf) = 0.065 +0 .65[0.18 – 0.065] = 0.065 + 0.65[0.115] = 0.13975 σ = 0.65 (0.25) = 0.1625 (b) Stock X: (0.65 x 30%) = 19.50% Stock Y: (0.65 x 35%) = 22.75% Stock Z: (0.65 x 35%) = 22.75% Riskless Asset: = 35.00% Total = 100.00%