正在加载图片...

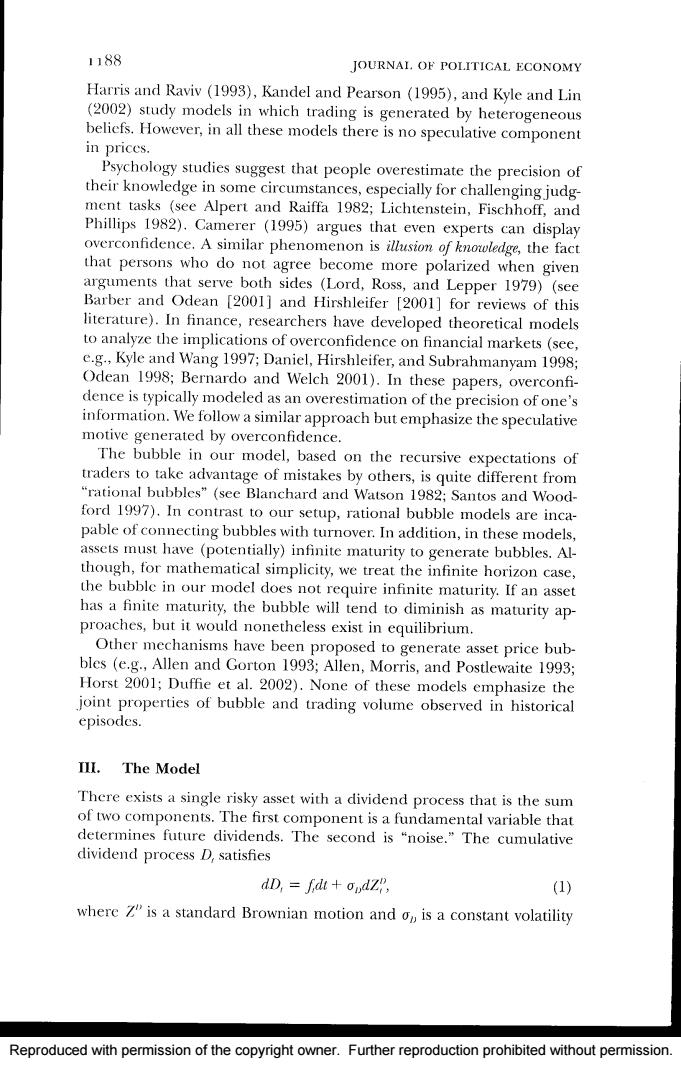

1188 JOURNAI.OF POLITICAL ECONOMY Harris and Raviv (1993),Kandel and Pearson (1995),and Kyle and Lin (2002)study models in which trading is generated by heterogeneous beliefs.However,in all these models there is no speculative component in prices. Psychology studies suggest that people overestimate the precision of their knowledge in some circumstances,especially for challenging judg- ment tasks (see Alpert and Raiffa 1982;Lichtenstein,Fischhoff,and Phillips 1982).Camerer (1995)argues that even experts can display overconfidence.A similar phenomenon is illusion of knowledge,the fact that persons who do not agree become more polarized when given arguments that serve both sides (Lord,Ross,and Lepper 1979)(see Barber and Odean [2001]and Hirshleifer [2001]for reviews of this literature).In finance,researchers have developed theoretical models to analyze the implications of overconfidence on financial markets (see, e.g.,Kyle and Wang 1997;Daniel,Hirshleifer,and Subrahmanyam 1998; Odean 1998;Bernardo and Welch 2001).In these papers,overconfi- dence is typically modeled as an overestimation of the precision of one's information.We follow a similar approach but emphasize the speculative motive generated by overconfidence. The bubble in our model,based on the recursive expectations of traders to take advantage of mistakes by others,is quite different from "rational bubbles"(see Blanchard and Watson 1982;Santos and Wood- ford 1997).In contrast to our setup,rational bubble models are inca- pable of connecting bubbles with turnover.In addition,in these models, assets must have (potentially)infinite maturity to generate bubbles.Al- though,for mathematical simplicity,we treat the infinite horizon case, the bubble in our model does not require infinite maturity.If an asset has a finite maturity,the bubble will tend to diminish as maturity ap- proaches,but it would nonetheless exist in equilibrium. Other mechanisms have been proposed to generate asset price bub- bles (e.g.,Allen and Gorton 1993;Allen,Morris,and Postlewaite 1993; Horst 2001;Duffie et al.2002).None of these models emphasize the joint properties of bubble and trading volume observed in historical episodes. III.The Model There exists a single risky asset with a dividend process that is the sum of two components.The first component is a fundamental variable that determines future dividends.The second is "noise."The cumulative dividend process D,satisfies dD,fdt+opdz, (1) where Z"is a standard Brownian motion and op is a constant volatility Reproduced with permission of the copyright owner.Further reproduction prohibited without permission.Reproduced with permission of the copyright owner. Further reproduction prohibited without permission