正在加载图片...

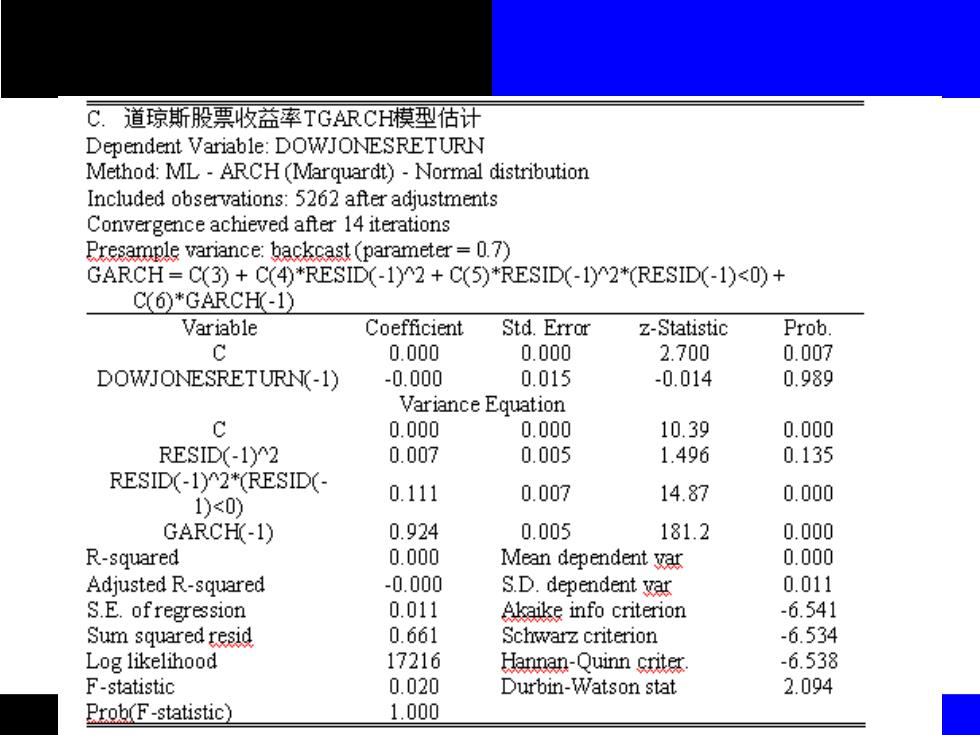

C.道琼斯股票收益率TGARCH模型估计 Dependent Variable:DOWJONESRETURN Method:ML-ARCH(Marquardt)-Normal distribution Included observations:5262 after adjustments Convergence achieved after 14 iterations Presample variance:backcast (parameter=0.7) GARCH=C(3)+C(4)*RESID(-1)2+C(5)*RESID(-1)2*(RESID(-1)<0)+ C(6)*GARCH(-1) Variable Coefficient Std.Error z-Statistic Prob. C 0.000 0.000 2.700 0.007 DOWJONESRETURN(-1) -0.000 0.015 -0.014 0.989 Variance Equation c 0.000 0.000 10.39 0.000 RESID(-1)2 0.007 0.005 1.496 0.135 RESID(-1)2*(RESID(- 0.111 0.007 1)<0) 14.87 0.000 GARCH(-1) 0.924 0.005 181.2 0.000 R-squared 0.000 Mean dependent var 0.000 Adjusted R-squared -0.000 S.D.dependent var 0.011 S.E.ofregression 0.011 Akaike info criterion -6.541 Sum squared resid 0.661 Schwarz criterion -6.534 Log likelihood 17216 Hannan-Quinn criter -6.538 F-statistic 0.020 Durbin-Watson stat 2.094 Broh(F-statistic】 1.000