正在加载图片...

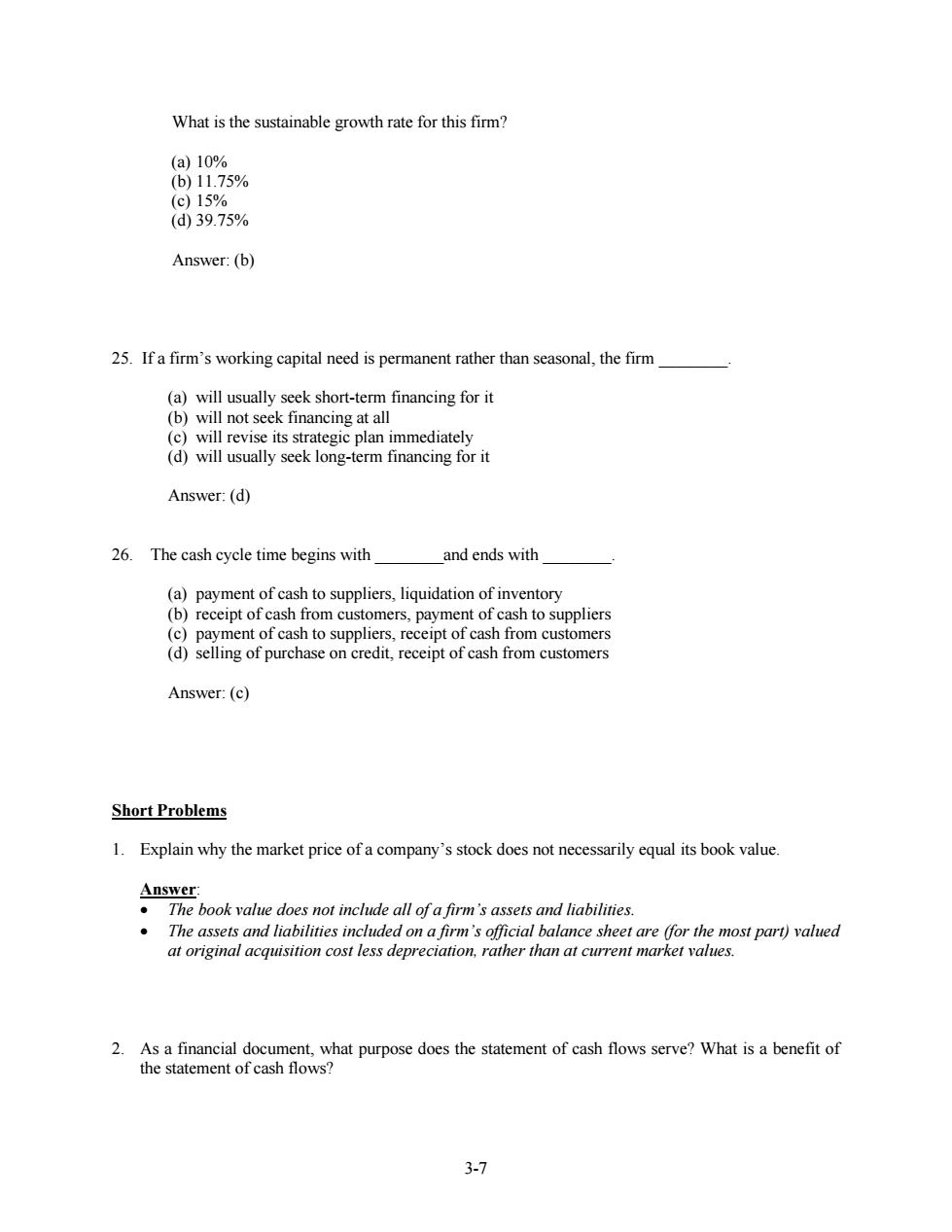

What is the sustainable growth rate for this firm? (a)10% (b)11.75% (c)15% (d)39.75% Answer:(b) 25.If a firm's working capital need is permanent rather than seasonal,the firm (a)will usually seek short-term financing for it (b)will not seek financing at all (c)will revise its strategic plan immediately (d)will usually seek long-term financing for it Answer:(d) 26.The cash cycle time begins with and ends with (a)payment of cash to suppliers,liquidation of inventory (b)receipt of cash from customers,payment of cash to suppliers (c)payment of cash to suppliers,receipt of cash from customers (d)selling of purchase on credit,receipt of cash from customers Answer:(c) Short Problems 1.Explain why the market price of a company's stock does not necessarily equal its book value. Answer: The book value does not include all of a firm's assets and liabilities. The assets and liabilities included on a firm's official balance sheet are (for the most part)valued at original acquisition cost less depreciation,rather than at current market values. 2.As a financial document,what purpose does the statement of cash flows serve?What is a benefit of the statement of cash flows? 3-73-7 What is the sustainable growth rate for this firm? (a) 10% (b) 11.75% (c) 15% (d) 39.75% Answer: (b) 25. If a firm’s working capital need is permanent rather than seasonal, the firm ________. (a) will usually seek short-term financing for it (b) will not seek financing at all (c) will revise its strategic plan immediately (d) will usually seek long-term financing for it Answer: (d) 26. The cash cycle time begins with ________and ends with ________. (a) payment of cash to suppliers, liquidation of inventory (b) receipt of cash from customers, payment of cash to suppliers (c) payment of cash to suppliers, receipt of cash from customers (d) selling of purchase on credit, receipt of cash from customers Answer: (c) Short Problems 1. Explain why the market price of a company’s stock does not necessarily equal its book value. Answer: The book value does not include all of a firm’s assets and liabilities. The assets and liabilities included on a firm’s official balance sheet are (for the most part) valued at original acquisition cost less depreciation, rather than at current market values. 2. As a financial document, what purpose does the statement of cash flows serve? What is a benefit of the statement of cash flows?