正在加载图片...

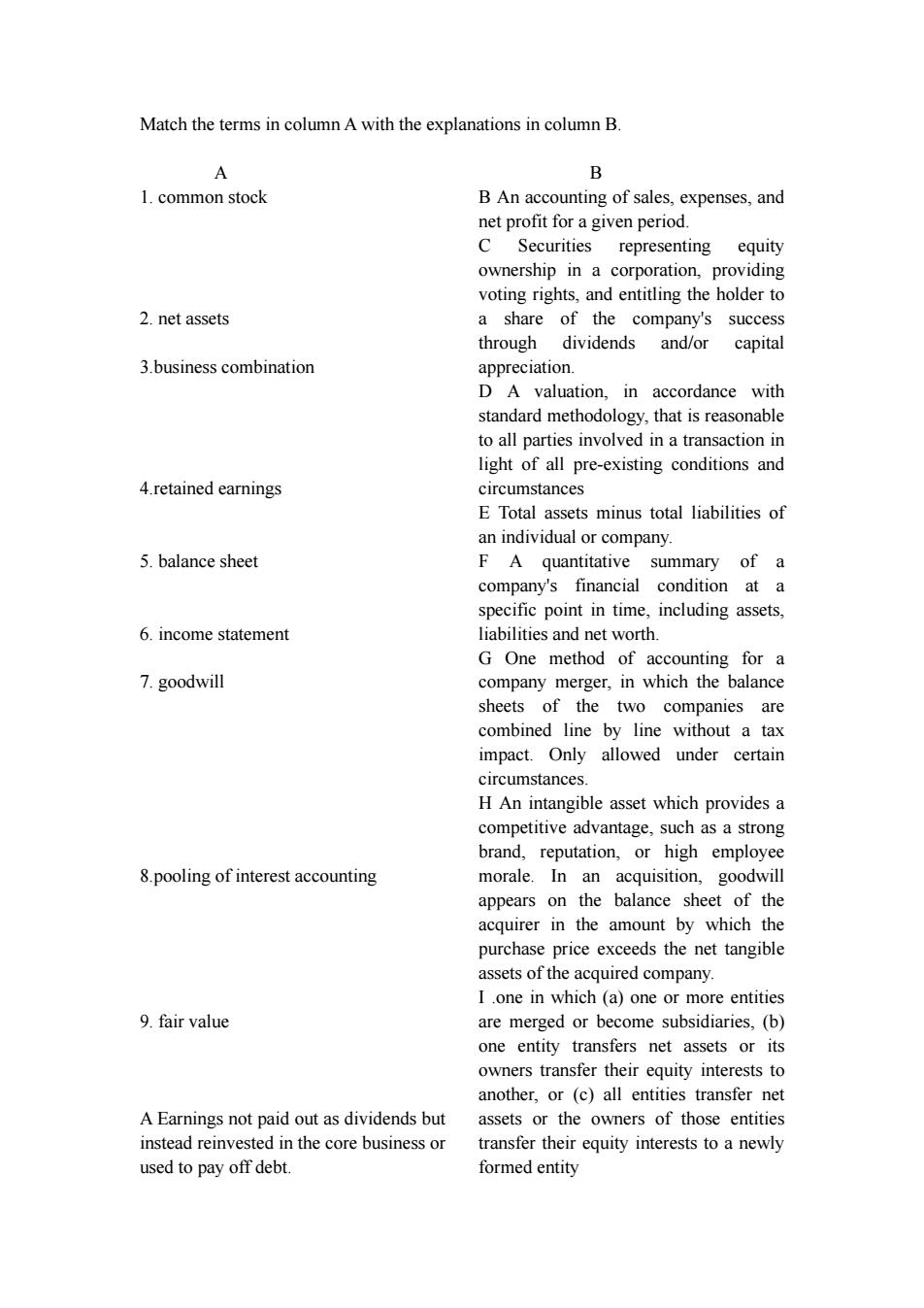

Match the terms in column A with the explanations in column B. y B 1.common stock B An accounting of sales,expenses,and net profit for a given period. C Securities representing equity ownership in a corporation,providing voting rights,and entitling the holder to 2.net assets a share of the company's success through dividends and/or capital 3.business combination appreciation. D A valuation,in accordance with standard methodology,that is reasonable to all parties involved in a transaction in light of all pre-existing conditions and 4.retained earnings circumstances E Total assets minus total liabilities of an individual or company. 5.balance sheet F A quantitative summary of a company's financial condition at a specific point in time,including assets, 6.income statement liabilities and net worth. G One method of accounting for a 7.goodwill company merger,in which the balance sheets of the two companies are combined line by line without a tax impact.Only allowed under certain circumstances. H An intangible asset which provides a competitive advantage,such as a strong brand,reputation,or high employee 8.pooling of interest accounting morale.In an acquisition,goodwill appears on the balance sheet of the acquirer in the amount by which the purchase price exceeds the net tangible assets of the acquired company. I.one in which (a)one or more entities 9.fair value are merged or become subsidiaries,(b) one entity transfers net assets or its owners transfer their equity interests to another,or (c)all entities transfer net A Earnings not paid out as dividends but assets or the owners of those entities instead reinvested in the core business or transfer their equity interests to a newly used to pay off debt. formed entityMatch the terms in column A with the explanations in column B. A B 1. common stock 2. net assets 3.business combination 4.retained earnings 5. balance sheet 6. income statement 7. goodwill 8.pooling of interest accounting 9. fair value A Earnings not paid out as dividends but instead reinvested in the core business or used to pay off debt. B An accounting of sales, expenses, and net profit for a given period. C Securities representing equity ownership in a corporation, providing voting rights, and entitling the holder to a share of the company's success through dividends and/or capital appreciation. D A valuation, in accordance with standard methodology, that is reasonable to all parties involved in a transaction in light of all pre-existing conditions and circumstances E Total assets minus total liabilities of an individual or company. F A quantitative summary of a company's financial condition at a specific point in time, including assets, liabilities and net worth. G One method of accounting for a company merger, in which the balance sheets of the two companies are combined line by line without a tax impact. Only allowed under certain circumstances. H An intangible asset which provides a competitive advantage, such as a strong brand, reputation, or high employee morale. In an acquisition, goodwill appears on the balance sheet of the acquirer in the amount by which the purchase price exceeds the net tangible assets of the acquired company. I .one in which (a) one or more entities are merged or become subsidiaries, (b) one entity transfers net assets or its owners transfer their equity interests to another, or (c) all entities transfer net assets or the owners of those entities transfer their equity interests to a newly formed entity