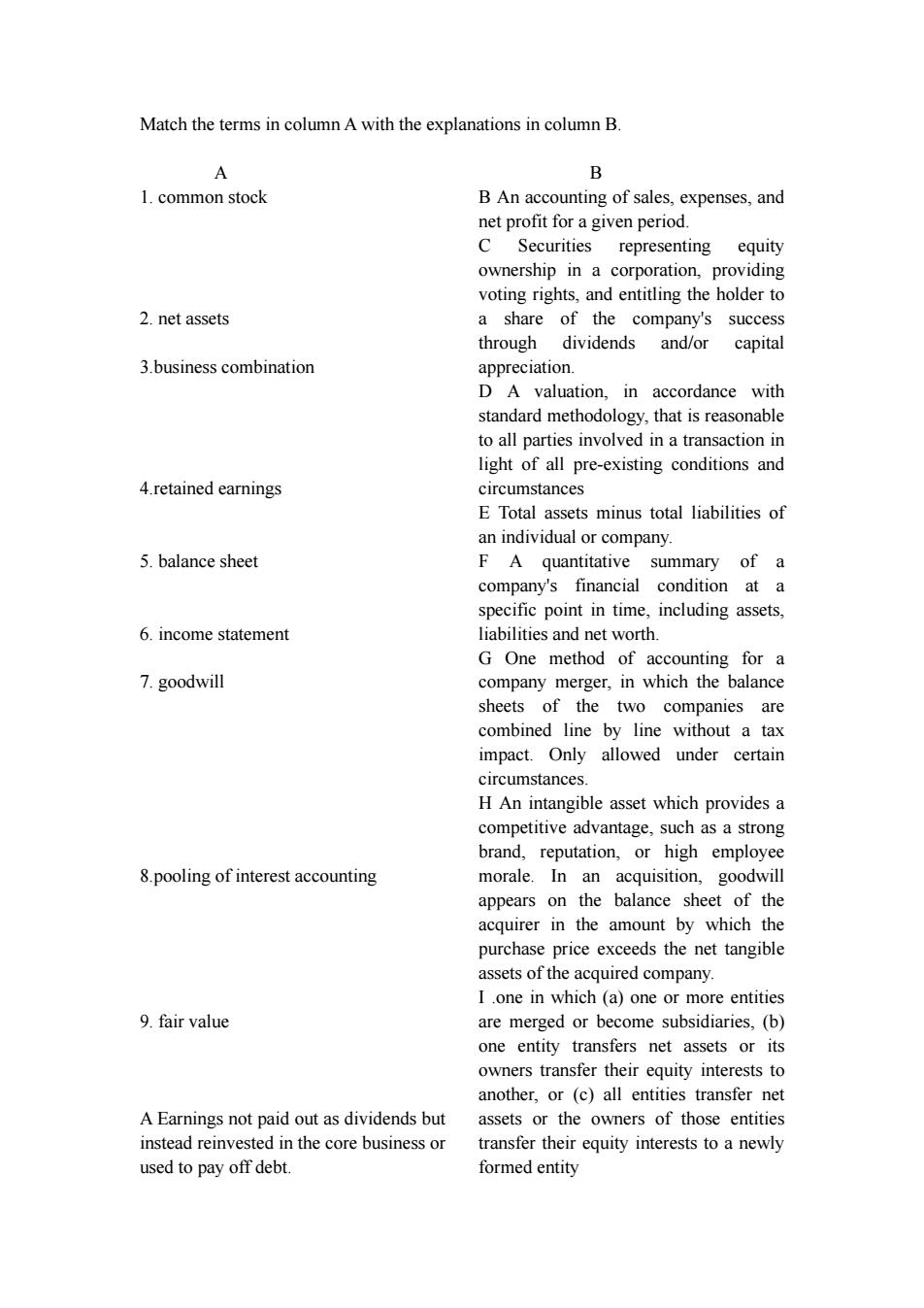

Match the terms in column A with the explanations in column B. y B 1.common stock B An accounting of sales,expenses,and net profit for a given period. C Securities representing equity ownership in a corporation,providing voting rights,and entitling the holder to 2.net assets a share of the company's success through dividends and/or capital 3.business combination appreciation. D A valuation,in accordance with standard methodology,that is reasonable to all parties involved in a transaction in light of all pre-existing conditions and 4.retained earnings circumstances E Total assets minus total liabilities of an individual or company. 5.balance sheet F A quantitative summary of a company's financial condition at a specific point in time,including assets, 6.income statement liabilities and net worth. G One method of accounting for a 7.goodwill company merger,in which the balance sheets of the two companies are combined line by line without a tax impact.Only allowed under certain circumstances. H An intangible asset which provides a competitive advantage,such as a strong brand,reputation,or high employee 8.pooling of interest accounting morale.In an acquisition,goodwill appears on the balance sheet of the acquirer in the amount by which the purchase price exceeds the net tangible assets of the acquired company. I.one in which (a)one or more entities 9.fair value are merged or become subsidiaries,(b) one entity transfers net assets or its owners transfer their equity interests to another,or (c)all entities transfer net A Earnings not paid out as dividends but assets or the owners of those entities instead reinvested in the core business or transfer their equity interests to a newly used to pay off debt. formed entity

Match the terms in column A with the explanations in column B. A B 1. common stock 2. net assets 3.business combination 4.retained earnings 5. balance sheet 6. income statement 7. goodwill 8.pooling of interest accounting 9. fair value A Earnings not paid out as dividends but instead reinvested in the core business or used to pay off debt. B An accounting of sales, expenses, and net profit for a given period. C Securities representing equity ownership in a corporation, providing voting rights, and entitling the holder to a share of the company's success through dividends and/or capital appreciation. D A valuation, in accordance with standard methodology, that is reasonable to all parties involved in a transaction in light of all pre-existing conditions and circumstances E Total assets minus total liabilities of an individual or company. F A quantitative summary of a company's financial condition at a specific point in time, including assets, liabilities and net worth. G One method of accounting for a company merger, in which the balance sheets of the two companies are combined line by line without a tax impact. Only allowed under certain circumstances. H An intangible asset which provides a competitive advantage, such as a strong brand, reputation, or high employee morale. In an acquisition, goodwill appears on the balance sheet of the acquirer in the amount by which the purchase price exceeds the net tangible assets of the acquired company. I .one in which (a) one or more entities are merged or become subsidiaries, (b) one entity transfers net assets or its owners transfer their equity interests to another, or (c) all entities transfer net assets or the owners of those entities transfer their equity interests to a newly formed entity

制研价货易上孝 金融英语阅读 Cloze Huge computer merger drags on Wen Dao 2004-12-0706:05(China Daily12/07/2004page10) The largest merger deal in China's computer industry drags on,as the country's biggest computer maker Lenovo Group halted the trading of its stocks on the Hong Kong Stock Exchange.1 Hong Kong-listed Lenovo asked the Hong Kong Stock Exchange yesterday morning to halt transactions of its stocks,because it would make an announcement containing price-sensitive deals.2 A Lenovo spokeswoman declined to specify when the statement will be made, only saying the company would follow the rules of the securities regulatory authorities.She also refused to say what the statement will contain. 3 The production base,named International Information Product(Shenzhen)Co Ltd (IIPC),is a joint venture between IBM and its long-time partner China Great Wall Group Corp,with IBM holding 80 per cent of the stakes.IIPC is IBM's most important notebook computer production base worldwide and houses its biggest Intel-architecture computer server production facility in the Asia-Pacific region. Sources close to Great Wall Group said yesterday the Chinese company agreed to sell IIPC's 20 per cent of the stakes in its hand to Lenovo,mainly under the request from IBM.Great Wall's chairman Chen Zhaoxiong said recently 4 ne previous pillar of Great Wall Group's business was the original equipment manufacturing(OEM)business to IBM.The Chinese company opened a US$280-million chip assembly and testing plant in Shenzhen,which was believed to be the beginning of its industrial restructuring. For Lenovo,the acquisition of IIPC will greatly elevate Lenovo's manufacturing and design capability,according to Huang Yong,a senior industry analyst with the domestic research firm.5 With IBM's reputation and tech-nological design capability in IIPC,Lenovo has a much larger chance to expand overseas,said Huang.The expertise of IIPC in OEM can also help Lenovo open another business line. Lenovo,the largest PC maker in China,has some difficulties in further expanding or even maintaining its market share due to fierce competition.As its expansion in mobile phone manufacturing and IT services are far from the company's expectations,OEM business can diversify Lenovo's business line. 第2页共4页

金融英语阅读 第 2 页 共 4 页 Cloze Huge computer merger drags on Wen Dao 2004-12-07 06:05(China Daily 12/07/2004 page10) The largest merger deal in China's computer industry drags on, as the country's biggest computer maker Lenovo Group halted the trading of its stocks on the Hong Kong Stock Exchange. 1_______________ Hong Kong-listed Lenovo asked the Hong Kong Stock Exchange yesterday morning to halt transactions of its stocks, because it would make an announcement containing price-sensitive deals. 2_______________ A Lenovo spokeswoman declined to specify when the statement will be made, only saying the company would follow the rules of the securities regulatory authorities. She also refused to say what the statement will contain. 3_______________ The production base, named International Information Product (Shenzhen) Co Ltd (IIPC), is a joint venture between IBM and its long-time partner China Great Wall Group Corp, with IBM holding 80 per cent of the stakes. IIPC is IBM's most important notebook computer production base worldwide and houses its biggest Intel-architecture computer server production facility in the Asia-Pacific region. Sources close to Great Wall Group said yesterday the Chinese company agreed to sell IIPC's 20 per cent of the stakes in its hand to Lenovo, mainly under the request from IBM. Great Wall's chairman Chen Zhaoxiong said recently 4_______________ ne previous pillar of Great Wall Group's business was the original equipment manufacturing (OEM) business to IBM. The Chinese company opened a US$280-million chip assembly and testing plant in Shenzhen, which was believed to be the beginning of its industrial restructuring. For Lenovo, the acquisition of IIPC will greatly elevate Lenovo's manufacturing and design capability, according to Huang Yong, a senior industry analyst with the domestic research firm. 5_______________ With IBM's reputation and tech-nological design capability in IIPC, Lenovo has a much larger chance to expand overseas, said Huang. The expertise of IIPC in OEM can also help Lenovo open another business line. Lenovo, the largest PC maker in China, has some difficulties in further expanding or even maintaining its market share due to fierce competition. As its expansion in mobile phone manufacturing and IT services are far from the company's expectations, OEM business can diversify Lenovo's business line

制卧价贸易+考 金融英语阅读 Since the deal was valued at US$1-2 billion by some investment banks and Lenovo may not be able to afford it,industry experts estimate Lenovo is likely to pay IBM with some of its stocks,which still allows IBM to have some control over the production facility A. The objective of this merger is to combine with Lenovo to strengthen its market position B However,the company did not issue any statement yesterday until the market closed. C. The focuses of his company were to strengthen self-owned brands and foster new profit growth engines. D. Although Lenovo has a strong presence in the Chinese market,its brand influence in the international market is quite small. E However,Lenovo continued to remain silent on a speculated deal to acquire US giant IBM's plant in Shenzhen. F Lenovo has made a huge amount of investments overseas to expand its business and stimulate profit growth. 61 However,it is widely believed the statement will be related to the acquisition of the world's biggest information technology company IBM's major production base in Shenzhen of South China's Guangdong Province. Translation Translate the English into Chinese. The notion of continuity of ownership is central to the pooling of interests concept.Therefore,an exchange of voting common stock is essential for a combination to be viewed as a pooling of interests.Through the exchange of stock, the shareholder groups of two previously separate companies are joined together,in effect,pooling their interests to share jointly the rewards and risks of ownership from that point forward.Pooling is viewed as different from purchase accounting in that no new assets are invested,nor do any of the original owners withdraw assets or give up their ownership rights by participating in the exchange.A pooling is simply a coming together of previously separate owners.Following this line of thought,there is no purchase of sale of ownership,and there are no grounds for establishing a new basis of accountablility. Translate the Chinese into English. 实质上,并得公司的资产和负债与被并公司的所有普通股股票没有区别,净 影响是一样的,尽管合并的形式不一样。当普通股在一个合并形式的并购中互换, 并得公司收到的股票以它们的账面价值计入投资。并得公司的股东股本账户受到 的影像就如其他被并入公司的净资产受影响的方式一致。 第3页共4页

金融英语阅读 第 3 页 共 4 页 Since the deal was valued at US$1-2 billion by some investment banks and Lenovo may not be able to afford it, industry experts estimate Lenovo is likely to pay IBM with some of its stocks, which still allows IBM to have some control over the production facility. A. The objective of this merger is to combine with Lenovo to strengthen its market position. B. However, the company did not issue any statement yesterday until the market closed. C. The focuses of his company were to strengthen self-owned brands and foster new profit growth engines. D. Although Lenovo has a strong presence in the Chinese market, its brand influence in the international market is quite small. E. However, Lenovo continued to remain silent on a speculated deal to acquire US giant IBM's plant in Shenzhen. F. Lenovo has made a huge amount of investments overseas to expand its business and stimulate profit growth. G. However, it is widely believed the statement will be related to the acquisition of the world's biggest information technology company IBM's major production base in Shenzhen of South China's Guangdong Province. Translation Translate the English into Chinese. The notion of continuity of ownership is central to the pooling of interests concept. Therefore, an exchange of voting common stock is essential for a combination to be viewed as a pooling of interests. Through the exchange of stock, the shareholder groups of two previously separate companies are joined together, in effect, pooling their interests to share jointly the rewards and risks of ownership from that point forward. Pooling is viewed as different from purchase accounting in that no new assets are invested, nor do any of the original owners withdraw assets or give up their ownership rights by participating in the exchange. A pooling is simply a coming together of previously separate owners. Following this line of thought, there is no purchase of sale of ownership, and there are no grounds for establishing a new basis of accountablility. Translate the Chinese into English. 实质上,并得公司的资产和负债与被并公司的所有普通股股票没有区别,净 影响是一样的,尽管合并的形式不一样。当普通股在一个合并形式的并购中互换, 并得公司收到的股票以它们的账面价值计入投资。并得公司的股东股本账户受到 的影像就如其他被并入公司的净资产受影响的方式一致

制卧陵贸蜀土孝 金融英语阅读 随着股本的交换,并得公司也许会选择保持被并公司的分离状态并继续以分 离公司的形式经营该公司。另一方面,母公司也许决定清算子公司并且合并子公 司所有资产负债到母公司账内。在第二种情况中,最终影响就和原来的合并即兼 并一样。 Key Match:C EI AFBH GD Cloze:E BGC D Translation: 1.合并法概念的核心是所有权的继续。所以,发生了具有投票权的普通股的 相互转换是企业联合能否看作权益合并的重要标准。在股权交换中,两个原来分 立的持股群合并在一起,因而,从那时起,合并业主收益共享盈利,共担风险。 会计中的“合并法”与“并购法”的区别在于合并中没有新资产的投资,也没有任何 一家原来的企业以参与交换的形式撤出资产,或放弃他们的企业所有权。一次合 并仅是原来分立的企业主的简单加总,依照这种思路,从中不发生所有权的买卖, 也没有新会计记账基础的产生。 2.In substance,there may be no difference between acquiring all of a company's assets and liabilities and acquiring all its common stock.The net effect is the same, although the form of the combination is not.When common shares are exchanged in a pooling-type business combination,the stock received by the acquiring company's recorded as an investment at the book value of those shares.The stockholders'equity accounts of the acquiring company are affected in the same way as if the net assets of the other company had been acquired. Following an exchange of stock,the acquiring company may choose to maintain the separate existence of the acquired company and continue to operate it as a separate company.On the other hand,the parent may decide to liquidate the subsidiary and merge all the assets and liabilities into the parent.In this latter case,the ultimate effect is the same as if the original combination had been a merger. 第4页共4页

金融英语阅读 第 4 页 共 4 页 随着股本的交换,并得公司也许会选择保持被并公司的分离状态并继续以分 离公司的形式经营该公司。另一方面,母公司也许决定清算子公司并且合并子公 司所有资产负债到母公司账内。在第二种情况中,最终影响就和原来的合并即兼 并一样。 Key Match: C EI AFBH GD Cloze: E B G C D Translation: 1. 合并法概念的核心是所有权的继续。所以,发生了具有投票权的普通股的 相互转换是企业联合能否看作权益合并的重要标准。在股权交换中,两个原来分 立的持股群合并在一起,因而,从那时起,合并业主收益共享盈利,共担风险。 会计中的“合并法”与“并购法”的区别在于合并中没有新资产的投资,也没有任何 一家原来的企业以参与交换的形式撤出资产,或放弃他们的企业所有权。一次合 并仅是原来分立的企业主的简单加总,依照这种思路,从中不发生所有权的买卖, 也没有新会计记账基础的产生。 2. In substance, there may be no difference between acquiring all of a company’s assets and liabilities and acquiring all its common stock. The net effect is the same, although the form of the combination is not. When common shares are exchanged in a pooling-type business combination, the stock received by the acquiring company’s recorded as an investment at the book value of those shares. The stockholders’ equity accounts of the acquiring company are affected in the same way as if the net assets of the other company had been acquired. Following an exchange of stock, the acquiring company may choose to maintain the separate existence of the acquired company and continue to operate it as a separate company. On the other hand, the parent may decide to liquidate the subsidiary and merge all the assets and liabilities into the parent. In this latter case, the ultimate effect is the same as if the original combination had been a merger