正在加载图片...

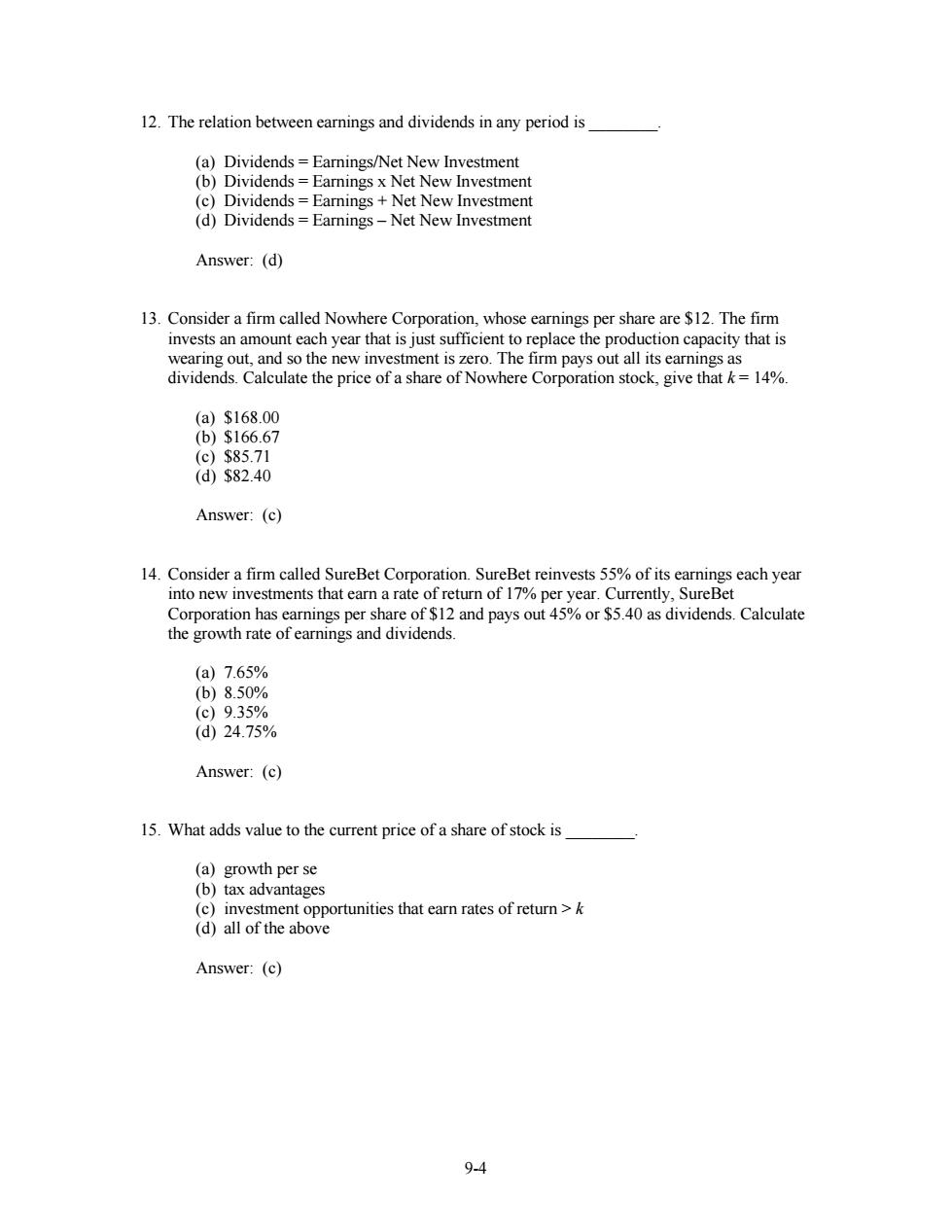

12.The relation between earnings and dividends in any period is (a)Dividends =Earnings/Net New Investment (b)Dividends=Earnings x Net New Investment (c)Dividends=Earnings Net New Investment (d)Dividends Earnings-Net New Investment Answer:(d) 13.Consider a firm called Nowhere Corporation,whose earnings per share are $12.The firm invests an amount each year that is just sufficient to replace the production capacity that is wearing out,and so the new investment is zero.The firm pays out all its earnings as dividends.Calculate the price of a share of Nowhere Corporation stock,give that k=14%. (a)$168.00 (b)$166.67 (c)$85.71 (d)$82.40 Answer:(c) 14.Consider a firm called SureBet Corporation.SureBet reinvests 55%of its earnings each year into new investments that earn a rate of return of 17%per year.Currently,SureBet Corporation has earnings per share of $12 and pays out 45%or $5.40 as dividends.Calculate the growth rate of earnings and dividends. (a)7.65% (b)8.50% (c)9.35% (d)24.75% Answer:(c) 15.What adds value to the current price of a share of stock is (a)growth per se (b)tax advantages (c)investment opportunities that earn rates of return >k (d)all of the above Answer:(c) 9-49-4 12. The relation between earnings and dividends in any period is ________. (a) Dividends = Earnings/Net New Investment (b) Dividends = Earnings x Net New Investment (c) Dividends = Earnings + Net New Investment (d) Dividends = Earnings – Net New Investment Answer: (d) 13. Consider a firm called Nowhere Corporation, whose earnings per share are $12. The firm invests an amount each year that is just sufficient to replace the production capacity that is wearing out, and so the new investment is zero. The firm pays out all its earnings as dividends. Calculate the price of a share of Nowhere Corporation stock, give that k = 14%. (a) $168.00 (b) $166.67 (c) $85.71 (d) $82.40 Answer: (c) 14. Consider a firm called SureBet Corporation. SureBet reinvests 55% of its earnings each year into new investments that earn a rate of return of 17% per year. Currently, SureBet Corporation has earnings per share of $12 and pays out 45% or $5.40 as dividends. Calculate the growth rate of earnings and dividends. (a) 7.65% (b) 8.50% (c) 9.35% (d) 24.75% Answer: (c) 15. What adds value to the current price of a share of stock is ________. (a) growth per se (b) tax advantages (c) investment opportunities that earn rates of return > k (d) all of the above Answer: (c)