正在加载图片...

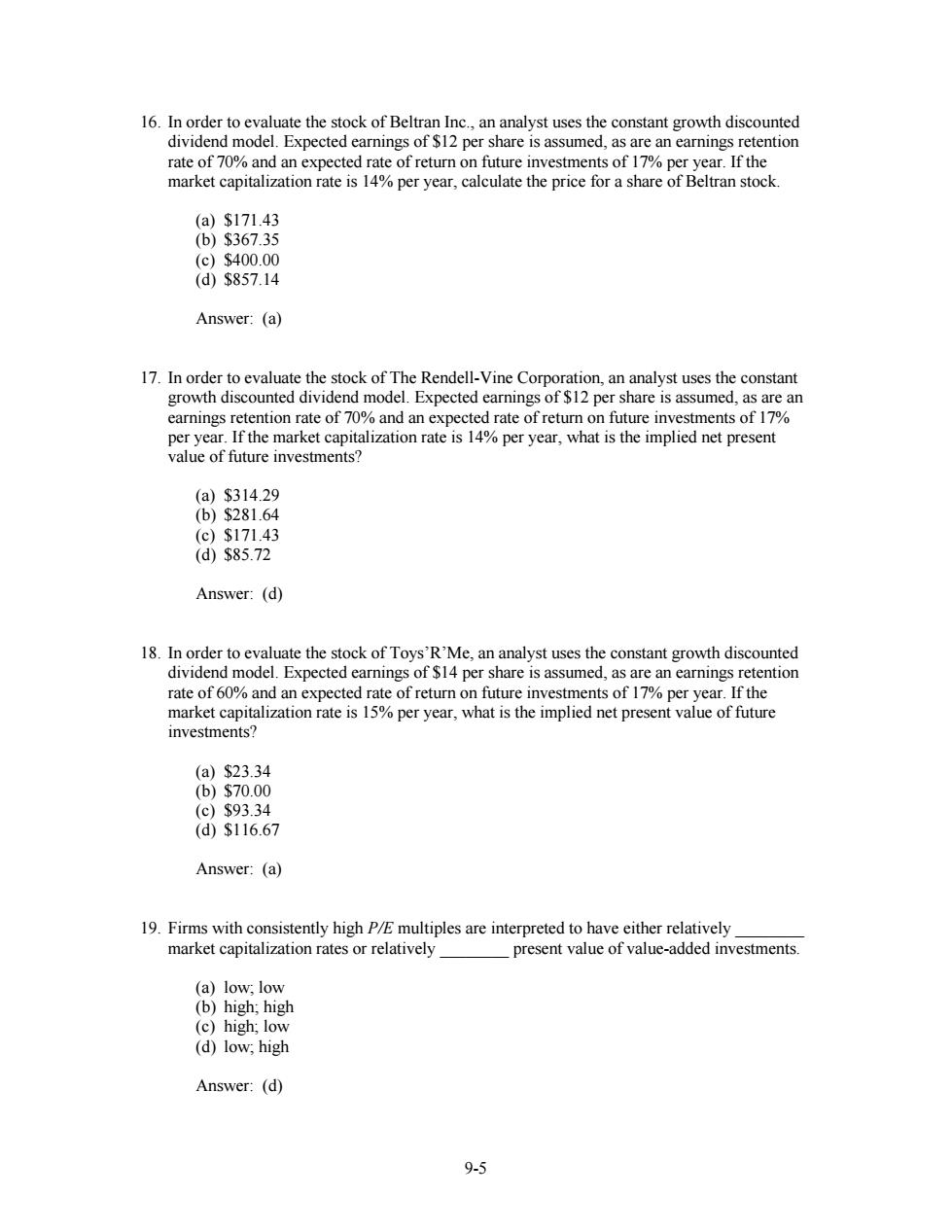

16.In order to evaluate the stock of Beltran Inc.,an analyst uses the constant growth discounted dividend model.Expected earnings of $12 per share is assumed,as are an earnings retention rate of 70%and an expected rate of return on future investments of 17%per year.If the market capitalization rate is 14%per year,calculate the price for a share of Beltran stock. (a)$171.43 (b)$367.35 (c)$400.00 (d)$857.14 Answer:(a) 17.In order to evaluate the stock of The Rendell-Vine Corporation,an analyst uses the constant growth discounted dividend model.Expected earnings of $12 per share is assumed,as are an earnings retention rate of 70%and an expected rate of return on future investments of 17% per year.If the market capitalization rate is 14%per year,what is the implied net present value of future investments? (a)$314.29 (b)$281.64 (c)$171.43 (d)$85.72 Answer:(d) 18.In order to evaluate the stock of Toys'R'Me,an analyst uses the constant growth discounted dividend model.Expected earnings of $14 per share is assumed,as are an earnings retention rate of 60%and an expected rate of return on future investments of 17%per year.If the market capitalization rate is 15%per year,what is the implied net present value of future investments? (a)$23.34 (b)$70.00 (c)$93.34 (d)$116.67 Answer:(a) 19.Firms with consistently high P/E multiples are interpreted to have either relatively market capitalization rates or relatively present value of value-added investments. (a)low;low (b)high;high (c)high;low (d)low;high Answer:(d) 9-59-5 16. In order to evaluate the stock of Beltran Inc., an analyst uses the constant growth discounted dividend model. Expected earnings of $12 per share is assumed, as are an earnings retention rate of 70% and an expected rate of return on future investments of 17% per year. If the market capitalization rate is 14% per year, calculate the price for a share of Beltran stock. (a) $171.43 (b) $367.35 (c) $400.00 (d) $857.14 Answer: (a) 17. In order to evaluate the stock of The Rendell-Vine Corporation, an analyst uses the constant growth discounted dividend model. Expected earnings of $12 per share is assumed, as are an earnings retention rate of 70% and an expected rate of return on future investments of 17% per year. If the market capitalization rate is 14% per year, what is the implied net present value of future investments? (a) $314.29 (b) $281.64 (c) $171.43 (d) $85.72 Answer: (d) 18. In order to evaluate the stock of Toys’R’Me, an analyst uses the constant growth discounted dividend model. Expected earnings of $14 per share is assumed, as are an earnings retention rate of 60% and an expected rate of return on future investments of 17% per year. If the market capitalization rate is 15% per year, what is the implied net present value of future investments? (a) $23.34 (b) $70.00 (c) $93.34 (d) $116.67 Answer: (a) 19. Firms with consistently high P/E multiples are interpreted to have either relatively ________ market capitalization rates or relatively ________ present value of value-added investments. (a) low; low (b) high; high (c) high; low (d) low; high Answer: (d)