正在加载图片...

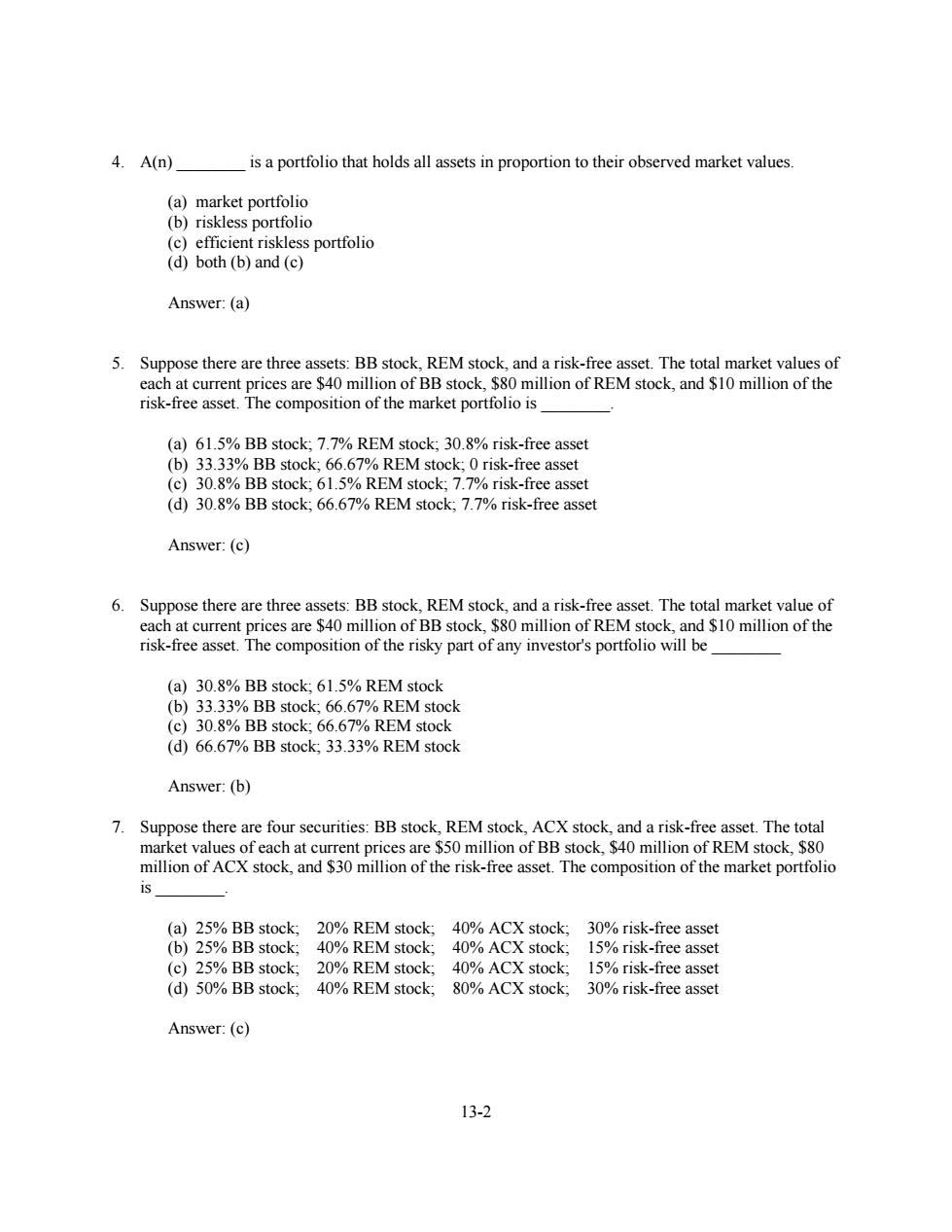

4.A(n)_ is a portfolio that holds all assets in proportion to their observed market values. (a)market portfolio (b)riskless portfolio (c)efficient riskless portfolio (d)both (b)and (c) Answer:(a) 5. Suppose there are three assets:BB stock,REM stock,and a risk-free asset.The total market values of each at current prices are $40 million of BB stock,$80 million of REM stock,and $10 million of the risk-free asset.The composition of the market portfolio is (a)61.5%BB stock;7.7%REM stock;30.8%risk-free asset (b)33.33%BB stock;66.67%REM stock;0 risk-free asset (c)30.8%BB stock;61.5%REM stock;7.7%risk-free asset (d)30.8%BB stock;66.67%REM stock;7.7%risk-free asset Answer:(c) 6.Suppose there are three assets:BB stock,REM stock,and a risk-free asset.The total market value of each at current prices are $40 million of BB stock,$80 million of REM stock,and $10 million of the risk-free asset.The composition of the risky part of any investor's portfolio will be (a)30.8%BB stock;61.5%REM stock (b)33.33%BB stock;66.67%REM stock (c)30.8%BB stock;66.67%REM stock (d)66.67%BB stock;33.33%REM stock Answer:(b) 7.Suppose there are four securities:BB stock,REM stock,ACX stock,and a risk-free asset.The total market values of each at current prices are $50 million of BB stock,$40 million of REM stock,$80 million of ACX stock,and $30 million of the risk-free asset.The composition of the market portfolio (a)25%BB stock:20%REM stock:40%ACX stock:30%risk-free asset (b)25%BB stock:40%REM stock: 40%ACX stock:15%risk-free asset (c)25%BB stock;20%REM stock:40%ACX stock: 15%risk-free asset (d)50%BB stock;40%REM stock;80%ACX stock;30%risk-free asset Answer:(c) 13-213-2 4. A(n) ________ is a portfolio that holds all assets in proportion to their observed market values. (a) market portfolio (b) riskless portfolio (c) efficient riskless portfolio (d) both (b) and (c) Answer: (a) 5. Suppose there are three assets: BB stock, REM stock, and a risk-free asset. The total market values of each at current prices are $40 million of BB stock, $80 million of REM stock, and $10 million of the risk-free asset. The composition of the market portfolio is ________. (a) 61.5% BB stock; 7.7% REM stock; 30.8% risk-free asset (b) 33.33% BB stock; 66.67% REM stock; 0 risk-free asset (c) 30.8% BB stock; 61.5% REM stock; 7.7% risk-free asset (d) 30.8% BB stock; 66.67% REM stock; 7.7% risk-free asset Answer: (c) 6. Suppose there are three assets: BB stock, REM stock, and a risk-free asset. The total market value of each at current prices are $40 million of BB stock, $80 million of REM stock, and $10 million of the risk-free asset. The composition of the risky part of any investor's portfolio will be ________ (a) 30.8% BB stock; 61.5% REM stock (b) 33.33% BB stock; 66.67% REM stock (c) 30.8% BB stock; 66.67% REM stock (d) 66.67% BB stock; 33.33% REM stock Answer: (b) 7. Suppose there are four securities: BB stock, REM stock, ACX stock, and a risk-free asset. The total market values of each at current prices are $50 million of BB stock, $40 million of REM stock, $80 million of ACX stock, and $30 million of the risk-free asset. The composition of the market portfolio is ________. (a) 25% BB stock; 20% REM stock; 40% ACX stock; 30% risk-free asset (b) 25% BB stock; 40% REM stock; 40% ACX stock; 15% risk-free asset (c) 25% BB stock; 20% REM stock; 40% ACX stock; 15% risk-free asset (d) 50% BB stock; 40% REM stock; 80% ACX stock; 30% risk-free asset Answer: (c)