正在加载图片...

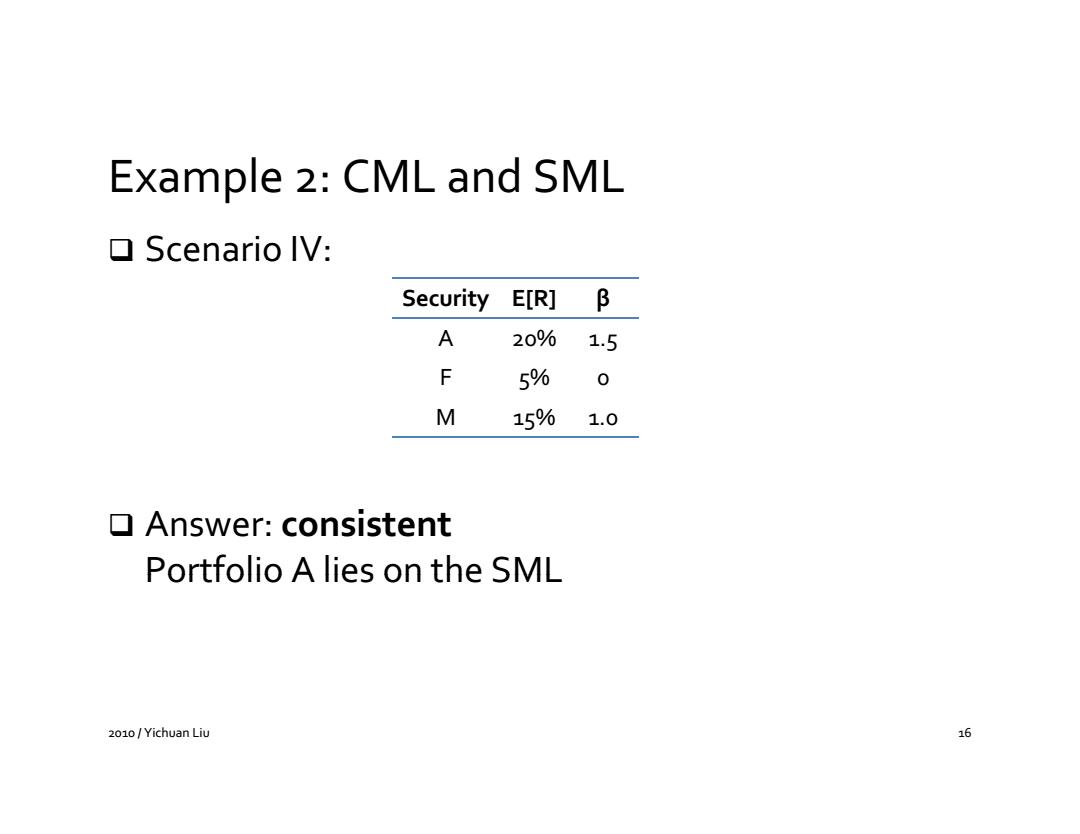

Example 2:CML and SML ▣Scenario IV: Security E[R] B A 20% 1.5 F 5% 0 M 15% 1.0 ▣Answer:consistent Portfolio a lies on the sML 2010/Yichuan Liu 16Example 2: CML and SML Scenario Scenario IV: Security E[R] β A 20% 1.5 F 5% 0 M 15% 1.0 Answer: consistent Portfolio Portfolio A lies on the SML 2010 / Yichuan Liu 16