正在加载图片...

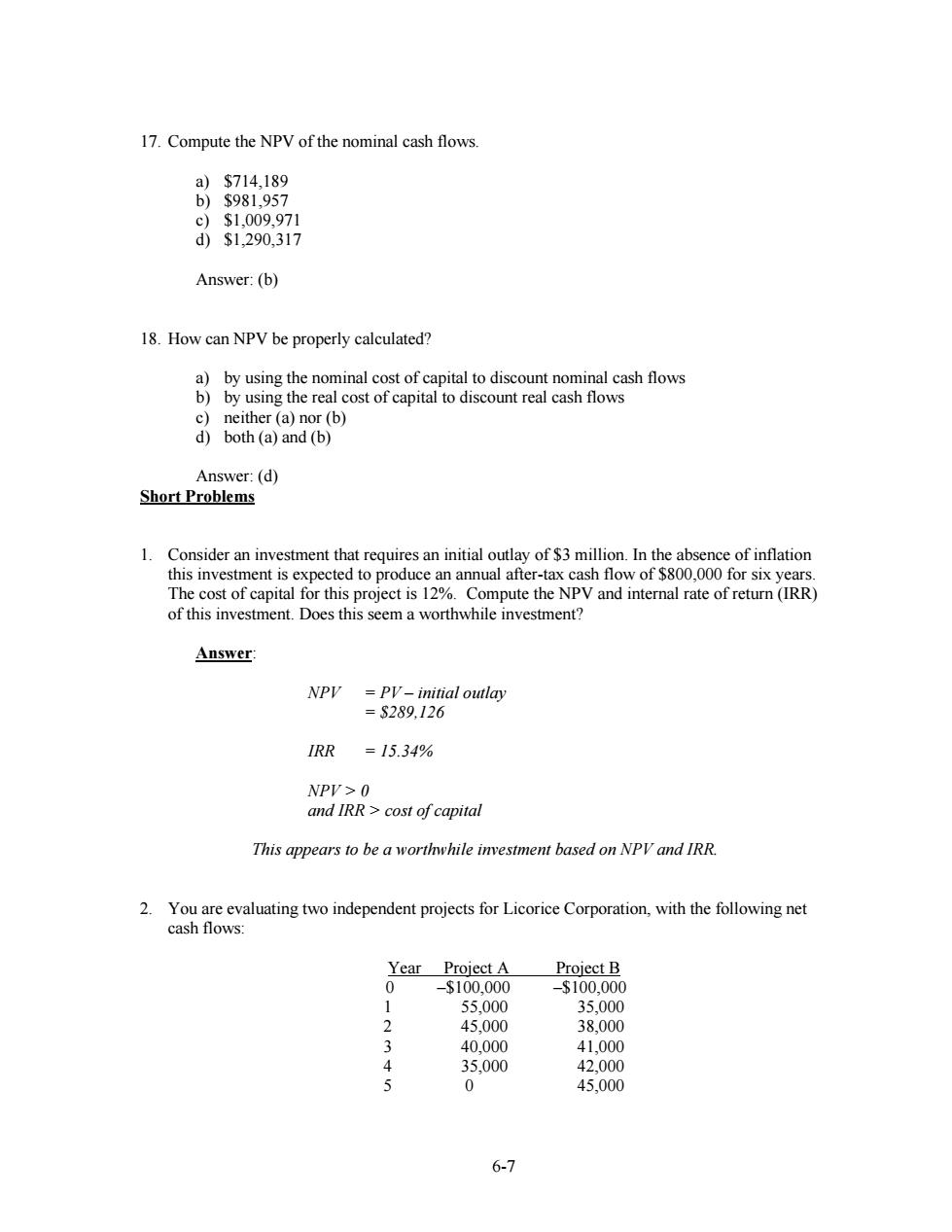

17.Compute the NPV of the nominal cash flows. a)$714,189 b)$981,957 c)$1,009.971 d)$1,290,317 Answer:(b) 18.How can NPV be properly calculated? a)by using the nominal cost of capital to discount nominal cash flows b)by using the real cost of capital to discount real cash flows c)neither (a)nor(b) d)both (a)and(b) Answer:(d) Short Problems 1.Consider an investment that requires an initial outlay of $3 million.In the absence of inflation this investment is expected to produce an annual after-tax cash flow of $800,000 for six years. The cost of capital for this project is 12%.Compute the NPV and internal rate of return (IRR) of this investment.Does this seem a worthwhile investment? Answer NPy PV-initial outlay =S289.126 IRR =15.34% NPV>0 and IRR cost of capital This appears to be a worthwhile investment based on NPV and IRR. 2.You are evaluating two independent projects for Licorice Corporation,with the following net cash flows: Year Project A Project B 0 -$100,000 -$100,000 55.000 35,000 2 45,000 38,000 3 40,000 41,000 X 35,000 42,000 5 0 45,000 6-76-7 17. Compute the NPV of the nominal cash flows. a) $714,189 b) $981,957 c) $1,009,971 d) $1,290,317 Answer: (b) 18. How can NPV be properly calculated? a) by using the nominal cost of capital to discount nominal cash flows b) by using the real cost of capital to discount real cash flows c) neither (a) nor (b) d) both (a) and (b) Answer: (d) Short Problems 1. Consider an investment that requires an initial outlay of $3 million. In the absence of inflation this investment is expected to produce an annual after-tax cash flow of $800,000 for six years. The cost of capital for this project is 12%. Compute the NPV and internal rate of return (IRR) of this investment. Does this seem a worthwhile investment? Answer: NPV = PV – initial outlay = $289,126 IRR = 15.34% NPV > 0 and IRR > cost of capital This appears to be a worthwhile investment based on NPV and IRR. 2. You are evaluating two independent projects for Licorice Corporation, with the following net cash flows: Year Project A Project B 0 –$100,000 –$100,000 1 55,000 35,000 2 45,000 38,000 3 40,000 41,000 4 35,000 42,000 5 0 45,000