正在加载图片...

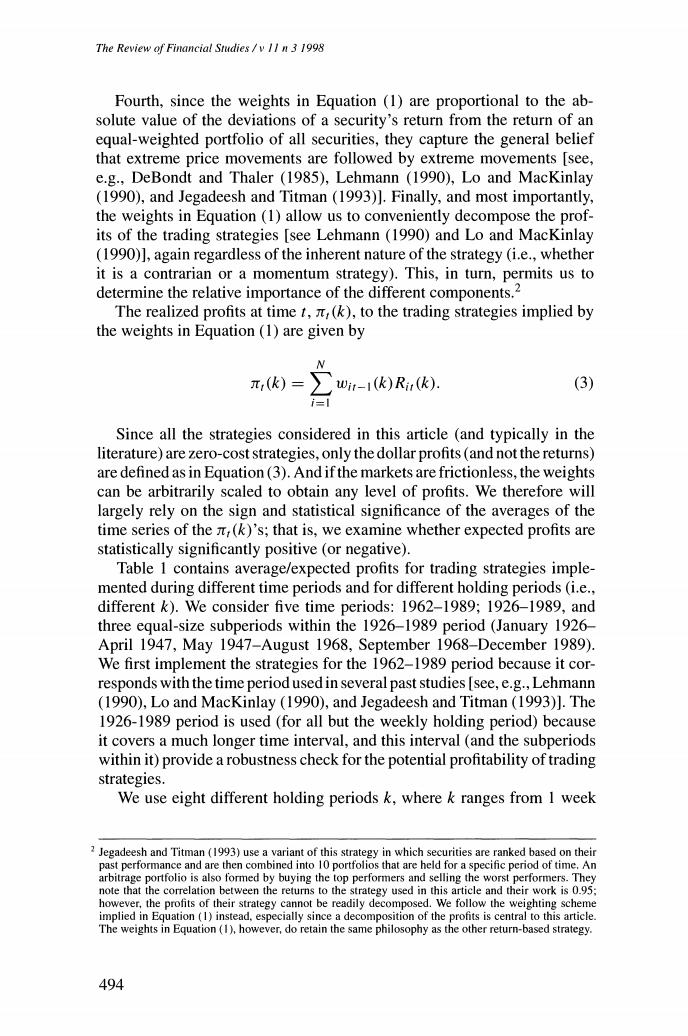

The Review of Financial Studies /v 1I n 3 1998 Fourth,since the weights in Equation (1)are proportional to the ab- solute value of the deviations of a security's return from the return of an equal-weighted portfolio of all securities,they capture the general belief that extreme price movements are followed by extreme movements [see, e.g.,DeBondt and Thaler (1985),Lehmann (1990),Lo and MacKinlay (1990),and Jegadeesh and Titman (1993)].Finally,and most importantly, the weights in Equation (1)allow us to conveniently decompose the prof- its of the trading strategies [see Lehmann(1990)and Lo and MacKinlay (1990)],again regardless of the inherent nature of the strategy (i.e.,whether it is a contrarian or a momentum strategy).This,in turn,permits us to determine the relative importance of the different components.2 The realized profits at time t,,(k),to the trading strategies implied by the weights in Equation(1)are given by N π,(k)=) wit-1(k)Rir(k) (3) i=l Since all the strategies considered in this article (and typically in the literature)are zero-cost strategies,only the dollar profits(and not the returns) are defined as in Equation(3).And if the markets are frictionless,the weights can be arbitrarily scaled to obtain any level of profits.We therefore will largely rely on the sign and statistical significance of the averages of the time series of the ,(k)'s;that is,we examine whether expected profits are statistically significantly positive (or negative). Table 1 contains average/expected profits for trading strategies imple- mented during different time periods and for different holding periods(i.e., different k).We consider five time periods:1962-1989;1926-1989,and three equal-size subperiods within the 1926-1989 period (January 1926- April 1947,May 1947-August 1968,September 1968-December 1989) We first implement the strategies for the 1962-1989 period because it cor- responds with the time period used in several past studies [see,e.g.,Lehmann (1990),Lo and MacKinlay (1990),and Jegadeesh and Titman(1993)].The 1926-1989 period is used (for all but the weekly holding period)because it covers a much longer time interval,and this interval (and the subperiods within it)provide a robustness check for the potential profitability of trading strategies. We use eight different holding periods k,where k ranges from I week 2 Jegadeesh and Titman(1993)use a variant of this strategy in which securities are ranked based on their past performance and are then combined into 10 portfolios that are held for a specific period of time.An arbitrage portfolio is also formed by buying the top performers and selling the worst performers.They note that the correlation between the returns to the strategy used in this article and their work is 0.95; however,the profits of their strategy cannot be readily decomposed.We follow the weighting scheme implied in Equation(1)instead,especially since a decomposition of the profits is central to this article. The weights in Equation(1),however,do retain the same philosophy as the other return-based strategy. 494