正在加载图片...

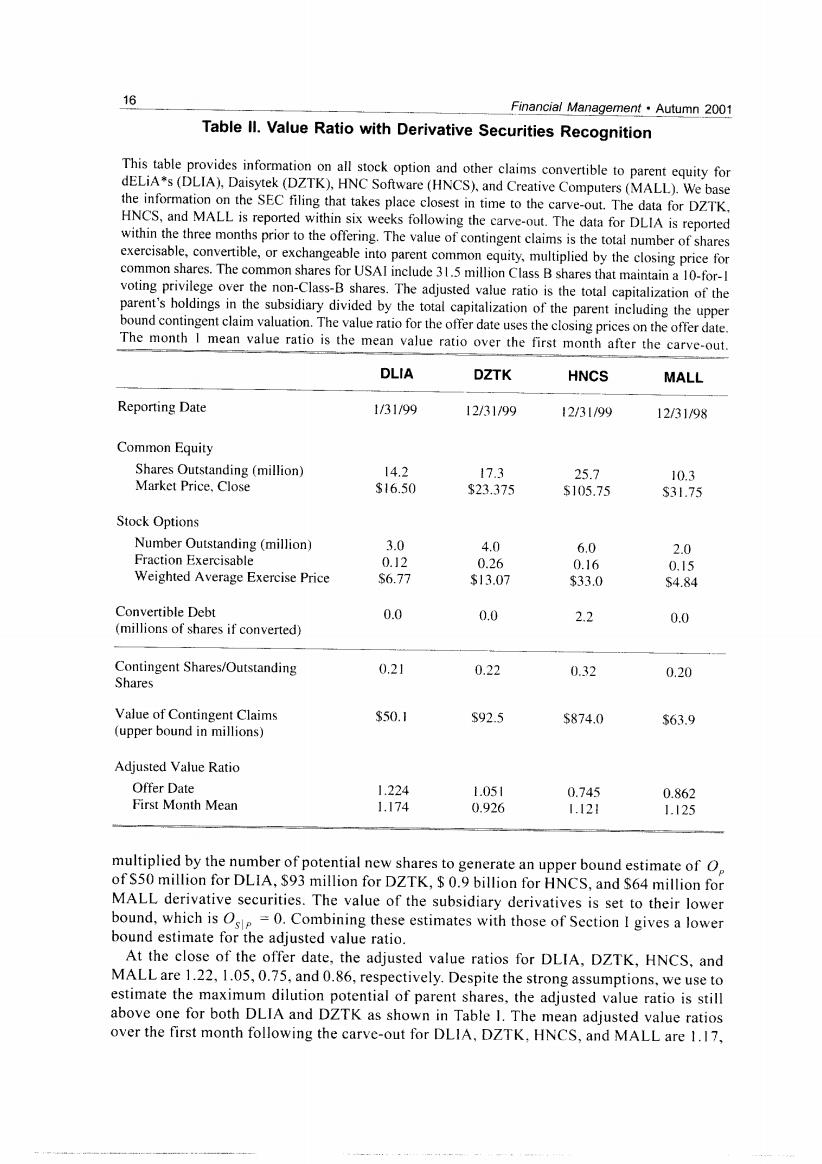

16 Financial Management.Autumn 2001 Table ll.Value Ratio with Derivative Securities Recognition This table provides information on all stock option and other claims convertible to parent equity for dELiA*s (DLIA),Daisytek (DZTK),HNC Software (HNCS),and Creative Computers(MALL).We base the information on the SEC filing that takes place closest in time to the carve-out.The data for DZTK. HNCS,and MALL is reported within six weeks following the carve-out.The data for DLIA is reported within the three months prior to the offering.The value of contingent claims is the total number of shares exercisable,convertible,or exchangeable into parent common equity,multiplied by the closing price for common shares.The common shares for USAI include 31.5 million Class B shares that maintain a 10-for-I voting privilege over the non-Class-B shares.The adjusted value ratio is the total capitalization of the parent's holdings in the subsidiary divided by the total capitalization of the parent including the upper bound contingent claim valuation.The value ratio for the offer date uses the closing prices on the offer date. The month I mean value ratio is the mean value ratio over the first month after the carve-out. DLIA DZTK HNCS MALL Reporting Date 1/3199 12/31/99 12/31/99 12/31/98 Common Equity Shares Outstanding (million) 14.2 17.3 25.7 10.3 Market Price,Close $16.50 $23.375 $105.75 $31.75 Stock Options Number Outstanding (million) 3.0 4.0 6.0 2.0 Fraction Exercisable 0.12 0.26 0.16 0.15 Weighted Average Exercise Price $6.77 $13.07 $33.0 S4.84 Convertible Debt 0.0 0.0 2.2 0.0 (millions of shares if converted) Contingent Shares/Outstanding 0.21 0.22 0.32 0.20 Shares Value of Contingent Claims $50.1 $92.5 $874.0 $63.9 (upper bound in millions) Adjusted Value Ratio Offer Date 1.224 1.051 0.745 0.862 First Month Mean 1.174 0.926 1.121 1.125 multiplied by the number of potential new shares to generate an upper bound estimate of O of S50 million for DLIA,$93 million for DZTK,0.9 billion for HNCS,and $64 million for MALL derivative securities.The value of the subsidiary derivatives is set to their lower bound,which is Os=0.Combining these estimates with those of Section I gives a lower bound estimate for the adjusted value ratio. At the close of the offer date,the adjusted value ratios for DLIA,DZTK,HNCS,and MALL are 1.22,1.05,0.75,and 0.86,respectively.Despite the strong assumptions,we use to estimate the maximum dilution potential of parent shares,the adjusted value ratio is still above one for both DLIA and DZTK as shown in Table I.The mean adjusted value ratios over the first month following the carve-out for DLIA,DZTK,HNCS,and MALL are 1.17