正在加载图片...

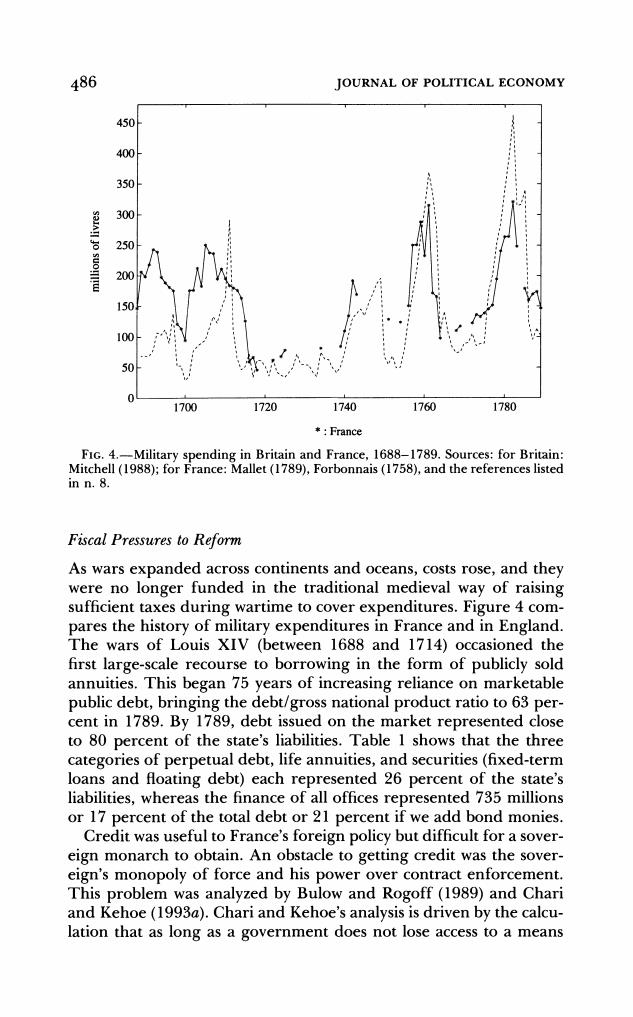

486 JOURNAL OF POLITICAL ECONOMY 450 400 350 300 250 200 150 100 50 1700 1720 1740 1760 1780 *France FIG.4.-Military spending in Britain and France,1688-1789.Sources:for Britain: Mitchell(1988);for France:Mallet(1789),Forbonnais(1758),and the references listed in n.8. Fiscal Pressures to Reform As wars expanded across continents and oceans,costs rose,and they were no longer funded in the traditional medieval way of raising sufficient taxes during wartime to cover expenditures.Figure 4 com- pares the history of military expenditures in France and in England. The wars of Louis XIV (between 1688 and 1714)occasioned the first large-scale recourse to borrowing in the form of publicly sold annuities.This began 75 years of increasing reliance on marketable public debt,bringing the debt/gross national product ratio to 63 per- cent in 1789.By 1789,debt issued on the market represented close to 80 percent of the state's liabilities.Table I shows that the three categories of perpetual debt,life annuities,and securities(fixed-term loans and floating debt)each represented 26 percent of the state's liabilities,whereas the finance of all offices represented 735 millions or 17 percent of the total debt or 21 percent if we add bond monies. Credit was useful to France's foreign policy but difficult for a sover- eign monarch to obtain.An obstacle to getting credit was the sover- eign's monopoly of force and his power over contract enforcement. This problem was analyzed by Bulow and Rogoff(1989)and Chari and Kehoe (1993a).Chari and Kehoe's analysis is driven by the calcu- lation that as long as a government does not lose access to a means486 JOURNAL OF POLITICAL ECONOMY 450 - 400 350- 0 250- .0 1501 100 / 50 1700 1720 1740 1760 1780 *: France FIG. 4.-Military spending in Britain and France, 1688-1789. Sources: for Britain: Mitchell (1988); for France: Mallet (1789), Forbonnais (1758), and the references listed in n. 8. Fiscal Pressures to Reform As wars expanded across continents and oceans, costs rose, and they were no longer funded in the traditional medieval way of raising sufficient taxes during wartime to cover expenditures. Figure 4 compares the history of military expenditures in France and in England. The wars of Louis XIV (between 1688 and 1714) occasioned the first large-scale recourse to borrowing in the form of publicly sold annuities. This began 75 years of increasing reliance on marketable public debt, bringing the debt/gross national product ratio to 63 percent in 1789. By 1789, debt issued on the market represented close to 80 percent of the state's liabilities. Table 1 shows that the three categories of perpetual debt, life annuities, and securities (fixed-term loans and floating debt) each represented 26 percent of the state's liabilities, whereas the finance of all offices represented 735 millions or 17 percent of the total debt or 21 percent if we add bond monies. Credit was useful to France's foreign policy but difficult for a sovereign monarch to obtain. An obstacle to getting credit was the sovereign's monopoly of force and his power over contract enforcement. This problem was analyzed by Bulow and Rogoff (1989) and Chari and Kehoe (1993a). Chari and Kehoe's analysis is driven by the calculation that as long as a government does not lose access to a means