正在加载图片...

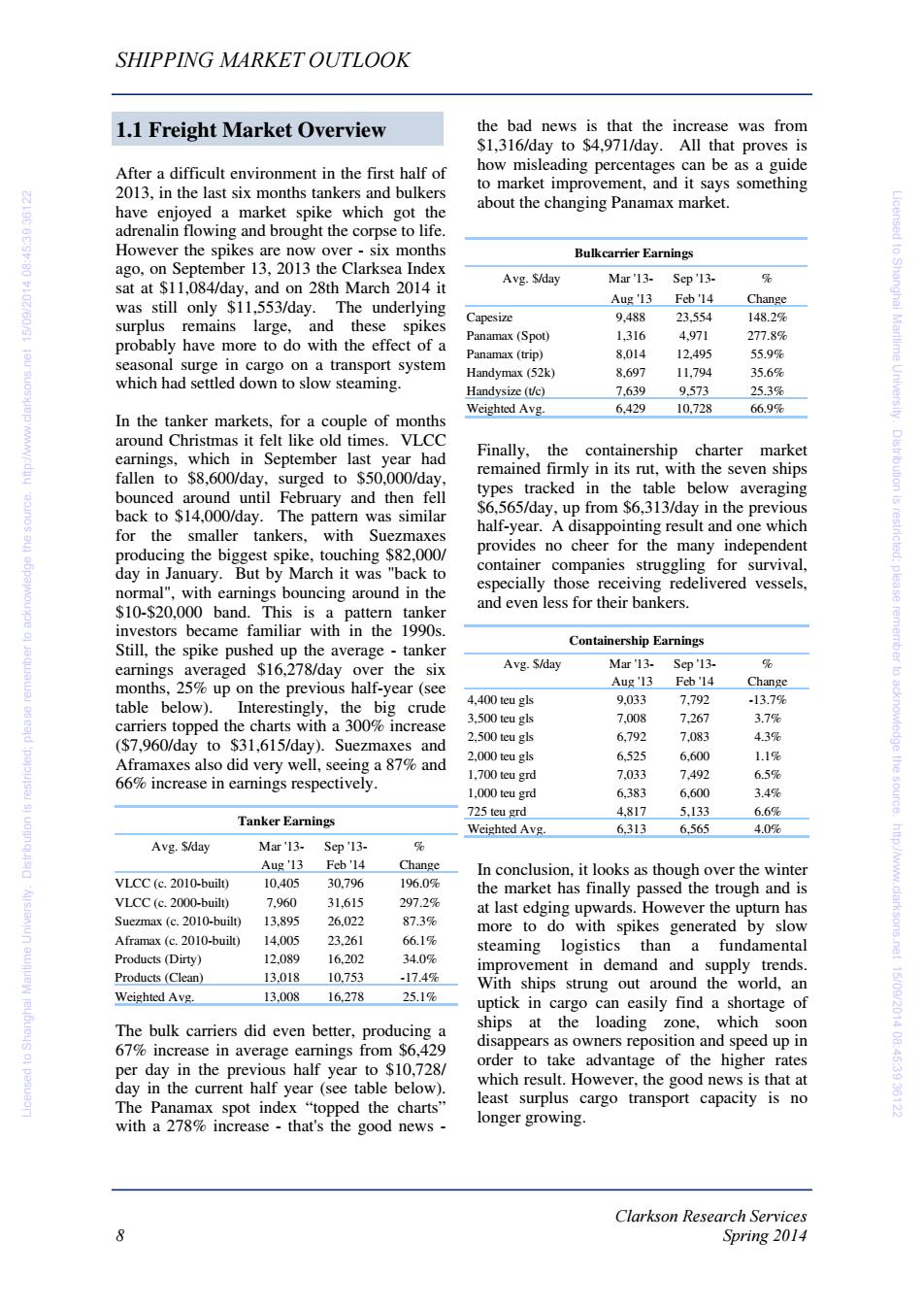

SHIPPING MARKET OUTLOOK 1.1 Freight Market Overview the bad news is that the increase was from $1,316/day to $4,971/day.All that proves is After a difficult environment in the first half of how misleading percentages can be as a guide 2013,in the last six months tankers and bulkers to market improvement,and it says something have enjoyed a market spike which got the about the changing Panamax market. adrenalin flowing and brought the corpse to life. However the spikes are now over-six months Bulkcarrier Earnings ago,on September 13,2013 the Clarksea Index % #10216031 sat at $11,084/day,and on 28th March 2014 it Avg.S/day Mar'13-Sep'13- was still only $11,553/day.The underlying Aug'13 Feb'14 Change Capesize 9,488 23.554 148.2% surplus remains large,and these spikes probably have more to do with the effect of a Panamax(Spot) 1,316 4.971 277.8% Panamax(trip) 8,014 12.495 55.9% seasonal surge in cargo on a transport system Handymax(52k) 8.697 11.794 35.6% icensed to Shanghai Maritime University which had settled down to slow steaming Handysize(t/c) 7,639 9.573 25.3% Weighted Avg 6,429 10,728 66.9% In the tanker markets,for a couple of months around Christmas it felt like old times.VLCC earnings,which in September last year had Finally, the containership charter market fallen to $8,600/day,surged to $50,000/day, remained firmly in its rut,with the seven ships bounced around until February and then fell types tracked in the table below averaging Dis tribution is back to $14,000/day.The pattern was similar S6,565/day,up from $6,313/day in the previous for the smaller tankers,with Suezmaxes half-year.A disappointing result and one which provides no cheer for the many independent producing the biggest spike,touching $82,000/ day in January.But by March it was "back to container companies struggling for survival, especially those receiving redelivered vessels, plea normal",with earnings bouncing around in the $10-$20,000 band.This is a pattern tanker and even less for their bankers. investors became familiar with in the 1990s. Still,the spike pushed up the average-tanker Containership Earnings earnings averaged $16,278/day over the six Avg.S/day Mar'13- Sep'13- % months,25%up on the previous half-year(see Aug'13 Feb'14 Change 4,400 teu gls 9.033 7.792 table below). Interestingly,the big crude -13.7% carriers topped the charts with a 300%increase 3.500 teu gls 7.008 7.267 3.7% remember to acknowledge 2.500 teu gls 6.792 7.083 ($7,960/day to $31,615/day).Suezmaxes and 4.3% Aframaxes also did very well,seeing a 87%and 2.000 teu gls 6,525 6,600 1.1% 1.700 teu grd 7.033 7.492 6.5% 66%increase in earnings respectively. 1,000 teu grd 6,383 6,600 3.4% the sourde. 725 teu grd 4,817 5.133 6.6% Tanker Earnings Weighted Avg. 6,313 6.565 4.0% Avg.$/day Mar'13- Sep'13- o Aug'13 Feb'14 Change In conclusion,it looks as though over the winter http://ww. VLCC (c.2010-built) 10.405 30.796 196.0% the market has finally passed the trough and is VLCC(c.2000-built) 7.960 31,615 297.2% at last edging upwards.However the upturn has Suezmax (c.2010-built) 13,895 26,022 87.3% more to do with spikes generated by slow Aframax (c.2010-built) 14.005 23,261 66.1% steaming logistics than a fundamental Products(Dirty) 12.089 16.202 34.0% improvement in demand and supply trends. Products(Clean) 13.018 10,753 -17.4% With ships strung out around the world,an Weighted Avg. 13.008 16.278 25.1% uptick in cargo can easily find a shortage of The bulk carriers did even better,producing a ships at the loading zone,which soon 67%increase in average earnings from $6,429 disappears as owners reposition and speed up in o]pas per day in the previous half year to $10,728/ order to take advantage of the higher rates .2218303:54:80410299051ci day in the current half year(see table below). which result.However,the good news is that at The Panamax spot index "topped the charts" least surplus cargo transport capacity is no with a 278%increase -that's the good news longer growing. Clarkson Research Services Spring 2014Clarkson Research Services 8 Spring 2014 SHIPPING MARKET OUTLOOK After a difficult environment in the first half of 2013, in the last six months tankers and bulkers have enjoyed a market spike which got the adrenalin flowing and brought the corpse to life. However the spikes are now over - six months ago, on September 13, 2013 the Clarksea Index sat at $11,084/day, and on 28th March 2014 it was still only $11,553/day. The underlying surplus remains large, and these spikes probably have more to do with the effect of a seasonal surge in cargo on a transport system which had settled down to slow steaming. In the tanker markets, for a couple of months around Christmas it felt like old times. VLCC earnings, which in September last year had fallen to $8,600/day, surged to $50,000/day, bounced around until February and then fell back to $14,000/day. The pattern was similar for the smaller tankers, with Suezmaxes producing the biggest spike, touching $82,000/ day in January. But by March it was "back to normal", with earnings bouncing around in the $10-$20,000 band. This is a pattern tanker investors became familiar with in the 1990s. Still, the spike pushed up the average - tanker earnings averaged $16,278/day over the six months, 25% up on the previous half-year (see table below). Interestingly, the big crude carriers topped the charts with a 300% increase ($7,960/day to $31,615/day). Suezmaxes and Aframaxes also did very well, seeing a 87% and 66% increase in earnings respectively. The bulk carriers did even better, producing a 67% increase in average earnings from $6,429 per day in the previous half year to $10,728/ day in the current half year (see table below). The Panamax spot index “topped the charts” with a 278% increase - that's the good news - the bad news is that the increase was from $1,316/day to $4,971/day. All that proves is how misleading percentages can be as a guide to market improvement, and it says something about the changing Panamax market. Finally, the containership charter market remained firmly in its rut, with the seven ships types tracked in the table below averaging $6,565/day, up from $6,313/day in the previous half-year. A disappointing result and one which provides no cheer for the many independent container companies struggling for survival, especially those receiving redelivered vessels, and even less for their bankers. In conclusion, it looks as though over the winter the market has finally passed the trough and is at last edging upwards. However the upturn has more to do with spikes generated by slow steaming logistics than a fundamental improvement in demand and supply trends. With ships strung out around the world, an uptick in cargo can easily find a shortage of ships at the loading zone, which soon disappears as owners reposition and speed up in order to take advantage of the higher rates which result. However, the good news is that at least surplus cargo transport capacity is no longer growing. 1.1 Freight Market Overview Tanker Earnings Avg. $/day Mar '13- Sep '13- % Aug '13 Feb '14 Change VLCC (c. 2010-built) 10,405 30,796 196.0% VLCC (c. 2000-built) 7,960 31,615 297.2% Suezmax (c. 2010-built) 13,895 26,022 87.3% Aframax (c. 2010-built) 14,005 23,261 66.1% Products (Dirty) 12,089 16,202 34.0% Products (Clean) 13,018 10,753 -17.4% Weighted Avg. 13,008 16,278 25.1% Bulkcarrier Earnings Avg. $/day Mar '13- Sep '13- % Aug '13 Feb '14 Change Capesize 9,488 23,554 148.2% Panamax (Spot) 1,316 4,971 277.8% Panamax (trip) 8,014 12,495 55.9% Handymax (52k) 8,697 11,794 35.6% Handysize (t/c) 7,639 9,573 25.3% Weighted Avg. 6,429 10,728 66.9% Containership Earnings Avg. $/day Mar '13- Sep '13- % Aug '13 Feb '14 Change 4,400 teu gls 9,033 7,792 -13.7% 3,500 teu gls 7,008 7,267 3.7% 2,500 teu gls 6,792 7,083 4.3% 2,000 teu gls 6,525 6,600 1.1% 1,700 teu grd 7,033 7,492 6.5% 1,000 teu grd 6,383 6,600 3.4% 725 teu grd 4,817 5,133 6.6% Weighted Avg. 6,313 6,565 4.0% Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122 Licensed to Shanghai Maritime University. Distribution is restricted; please remember to acknowledge the source. http://www.clarksons.net 15/09/2014 08:45:39 36122