正在加载图片...

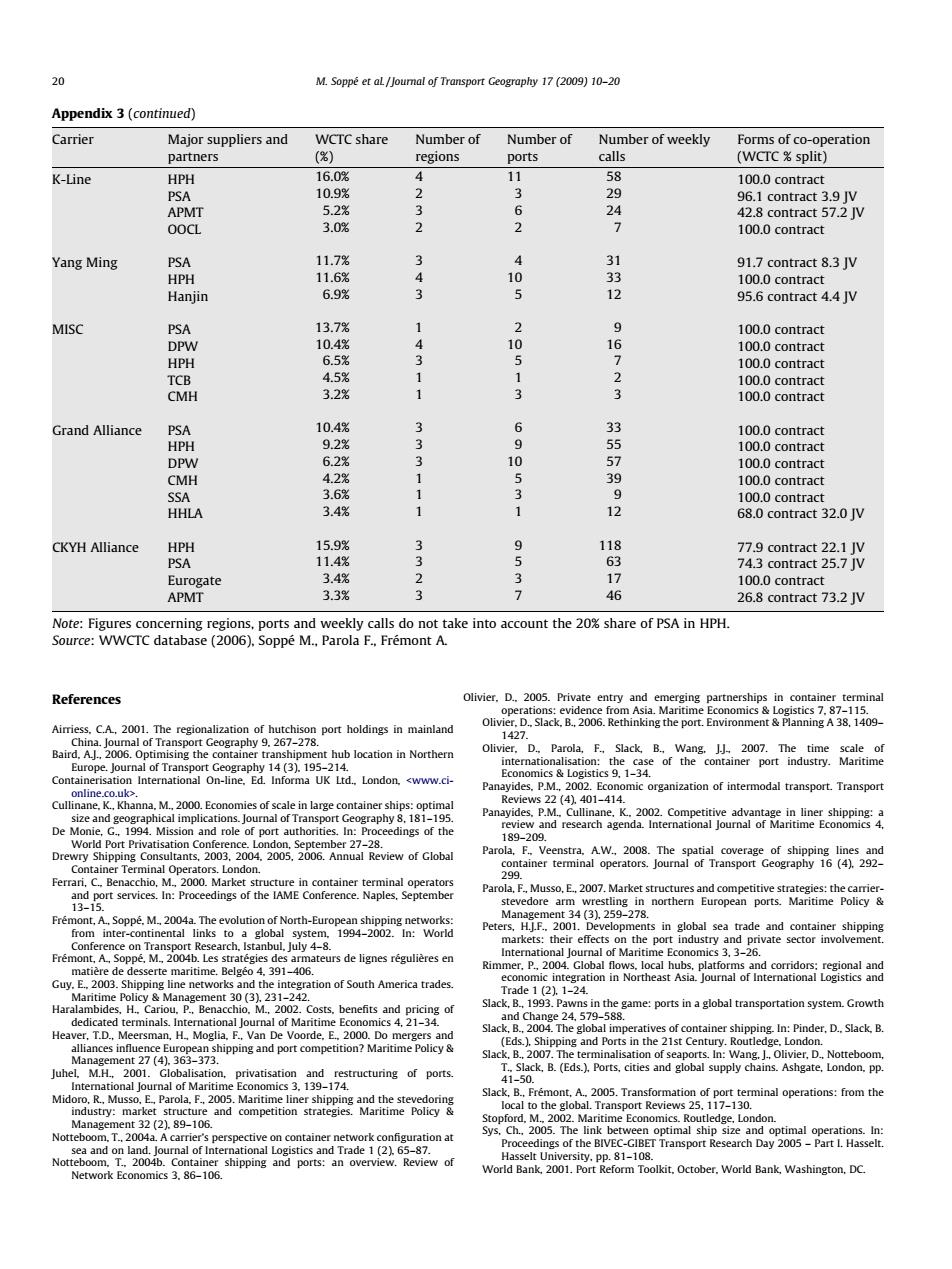

20 M.Soppe et aL/Joumal of Transport Geography 17(2009)10-20 Appendix 3(continued) Carrier Major suppliers and WCTC share Number of Number of Number of weekly Forms of co-operation partners (%) regions ports calls (WCTC%split) K-Line HPH 16.0% 7 1ì 58 100.0 contract PSA 10.9% 2 3 29 96.1 contract 3.9 JV APMT 5.2% 3 6 42.8 contract 57.2 V OOCL 3.0% 3 2 7 100.0 contract Yang Ming PSA 11.7% y 31 91.7 contract 8.3 JV HPH 11.6% 4 10 33 100.0 contract Hanjin 6.9% 3 5 12 95.6 contract 4.4 JV MISC PSA 13.7% 2 9 100.0 contract DPW 10.4% 7 10 16 100.0 contract HPH 6.5% 3 > 100.0 contract TCB 4.5% 2 p 100.0 contract CMH 3.2% 1 3 3 100.0 contract Grand Alliance PSA 10.4% 6 33 100.0 contract HPH 9.2% 9 5 100.0 contract DPW 6.2% 10 57 100.0 contract CMH 4.2% 5 39 100.0 contract SSA 3.6% 3 9 100.0 contract HHLA 3.4% 1 1 12 68.0 contract 32.0 JV CKYH Alliance HPH 15.9% 3 9 118 77.9 contract 22.1 IV PSA 11.4% 63 74.3 contract 25.7 IV Eurogate 3.4% 2 3 17 100.0 contract APMT 3.3% 3 7 46 26.8 contract 73.2 JV Note:Figures concerning regions,ports and weekly calls do not take into account the 20%share of PSA in HPH. Source:WWCTC database(2006).Soppe M.,Parola F..Fremont A. References Olivier.D..2005.Private entry and emerging partnerships in container terminal operations:evidence from Asia.Maritime Economics Logistics 7.87-115. Airriess.C.A,2001.The regionalization of hutchison port holdings in mainland Olivier.D..Slack.B..2006.Rethinking the port.Environment&Planning A 38.1409- 1427. China.Journal of Transport Geography 9.267-278. Baird.A.J..2006.Optimising the container transhipment hub location in Northern Olivier,D..Parola,F.Slack,B..Wang.JJ 2007.The time scale of Europe.Journal of Transport Geography 14(3).195-214. internationalisation:the case of the container port industry.Maritime Economics Logistics 9.1-34. Containerisation International On-line,Ed.Informa UK Ltd.London,<www.ci- Panayides.P.M..2002.Economic organization of intermodal transport.Transport online.co.uk>. Cullinane.K..Khanna.M.,2000.Economies of scale in large container ships:optimal Reviews22(4).401-414. size and geographical implications.Journal of Transport Geography 8.181-195. Panayides,P.M..Cullinane.K.2002.Competitive advantage in liner shipping:a De Monie,G..1994.Mission and role of port authorities.In:Proceedings of the review and research agenda.International Journal of Maritime Economics 4, 189-209 World Port Privatisation Conference.London.September 27-28. Drewry Shipping Consultants,2003.2004.2005.2006.Annual Review of Global Parola,F.Veenstra.A.W.,2008.The spatial coverage of shipping lines and Container Terminal Operators.London. container terminal operators.Journal of Transport Geography 16 (4).292- Ferrari,C..Benacchio,M.2000.Market structure in container terminal operators Parola,F..Musso,E..2007.Market structures and competitive strategies:the carrier- and port services.In:Proceedings of the IAME Conference.Naples.September 13-15. stevedore arm wrestling in northern European ports.Maritime Policy Fremont,A..Soppe.M.,2004a.The evolution of North-European shipping networks: Management 34 (3).259-278. from inter-continental links to a global syste 1994-2002.ln:World Peters.H.J.F..2001.Developments in global sea trade and container shipping Conference on Transport Research.Istanbul,July 4-8. markets:their effects on the port industry and private sector involvement Fremont,A.Soppe,M.2004b.Les strategies des armateurs de lignes regulieres en International Journal of Maritime Economics 3,3-26. matiere de desserte maritime.Belgeo 4.391-406. Rimmer.P.,2004.Global flows.local hubs,platforms and corridors regional and Guy.E..2003.Shipping line networks and the integration of South America trades. economic integration in Northeast Asia.Journal of International Logistics and Maritime Policy Management 30(3).231-242. Trade1211-24. Haralambides,H..Cariou.P..Benacchio.M..2002.Costs,benefits and pricing of Slack,B.,1993.Pawns in the game:ports in a global transportation system.Growth and Change 24.579-588. dedicated terminals.International Journal of Maritime Economics 4,21-34. Heaver.T.D.,Meersman,H.,Moglia,F..Van De Voorde,E..2000.Do mergers and Slack,B..2004.The global imperatives of container shipping.In:Pinder,D..Slack.B (Eds.)Shipping and Ports in the 21st Century.Routledge.London. alliances influence European shipping and port competition?Maritime Policy ment27(4).363-373. Slack.B.2007.The terminalisation of seaports.In:Wang.Olivier,D.Notteboom. Juhel.M.H..2001.Globalisation,privatisation and restructuring of ports. T..Slack,B.(Eds.).Ports,cities and global supply chains.Ashgate,London.pp 41-50. International Journal of Maritime Economics 3.139-174. Midoro,R.,Musso,E,Parola.F.,2005.Maritime liner shipping and the stevedoring Slack,B.,Fremont,A..2005.Transformation of port terminal operations:from the local to the global.Transport Reviews 25,117-130. industry:market structure and competition strategies.Maritime Policy Management 32(2).89-106. Stopford,M.. 2002.Maritime Economics.Routledge,London. Notteboom,T..2004a.A carrier's perspective on container network configuration at Sys.Ch..2005.The link between optimal ship size and optimal operations.In: sea and on land.Jour nal of International Logistics and Trade 1(2)65-87. Proceedings of the BIVEC-GIBET Transport Research Day 2005-Part I.Hasselt. Notteboom.T..2004b.Container shipping and ports:an overview.Review of Hasselt University.pp.81-108. Network Economics 3 86-106 World Bank,2001.Port Reform Toolkit.October.World Bank,Washington,DC.References Airriess, C.A., 2001. The regionalization of hutchison port holdings in mainland China. Journal of Transport Geography 9, 267–278. Baird, A.J., 2006. Optimising the container transhipment hub location in Northern Europe. Journal of Transport Geography 14 (3), 195–214. Containerisation International On-line, Ed. Informa UK Ltd., London, <www.cionline.co.uk>. Cullinane, K., Khanna, M., 2000. Economies of scale in large container ships: optimal size and geographical implications. Journal of Transport Geography 8, 181–195. De Monie, G., 1994. Mission and role of port authorities. In: Proceedings of the World Port Privatisation Conference. London, September 27–28. Drewry Shipping Consultants, 2003, 2004, 2005, 2006. Annual Review of Global Container Terminal Operators. London. Ferrari, C., Benacchio, M., 2000. Market structure in container terminal operators and port services. In: Proceedings of the IAME Conference. Naples, September 13–15. Frémont, A., Soppé, M., 2004a. The evolution of North-European shipping networks: from inter-continental links to a global system, 1994–2002. In: World Conference on Transport Research, Istanbul, July 4–8. Frémont, A., Soppé, M., 2004b. Les stratégies des armateurs de lignes régulières en matière de desserte maritime. Belgéo 4, 391–406. Guy, E., 2003. Shipping line networks and the integration of South America trades. Maritime Policy & Management 30 (3), 231–242. Haralambides, H., Cariou, P., Benacchio, M., 2002. Costs, benefits and pricing of dedicated terminals. International Journal of Maritime Economics 4, 21–34. Heaver, T.D., Meersman, H., Moglia, F., Van De Voorde, E., 2000. Do mergers and alliances influence European shipping and port competition? Maritime Policy & Management 27 (4), 363–373. Juhel, M.H., 2001. Globalisation, privatisation and restructuring of ports. International Journal of Maritime Economics 3, 139–174. Midoro, R., Musso, E., Parola, F., 2005. Maritime liner shipping and the stevedoring industry: market structure and competition strategies. Maritime Policy & Management 32 (2), 89–106. Notteboom, T., 2004a. A carrier’s perspective on container network configuration at sea and on land. Journal of International Logistics and Trade 1 (2), 65–87. Notteboom, T., 2004b. Container shipping and ports: an overview. Review of Network Economics 3, 86–106. Olivier, D., 2005. Private entry and emerging partnerships in container terminal operations: evidence from Asia. Maritime Economics & Logistics 7, 87–115. Olivier, D., Slack, B., 2006. Rethinking the port. Environment & Planning A 38, 1409– 1427. Olivier, D., Parola, F., Slack, B., Wang, J.J., 2007. The time scale of internationalisation: the case of the container port industry. Maritime Economics & Logistics 9, 1–34. Panayides, P.M., 2002. Economic organization of intermodal transport. Transport Reviews 22 (4), 401–414. Panayides, P.M., Cullinane, K., 2002. Competitive advantage in liner shipping: a review and research agenda. International Journal of Maritime Economics 4, 189–209. Parola, F., Veenstra, A.W., 2008. The spatial coverage of shipping lines and container terminal operators. Journal of Transport Geography 16 (4), 292– 299. Parola, F., Musso, E., 2007. Market structures and competitive strategies: the carrierstevedore arm wrestling in northern European ports. Maritime Policy & Management 34 (3), 259–278. Peters, H.J.F., 2001. Developments in global sea trade and container shipping markets: their effects on the port industry and private sector involvement. International Journal of Maritime Economics 3, 3–26. Rimmer, P., 2004. Global flows, local hubs, platforms and corridors; regional and economic integration in Northeast Asia. Journal of International Logistics and Trade 1 (2), 1–24. Slack, B., 1993. Pawns in the game: ports in a global transportation system. Growth and Change 24, 579–588. Slack, B., 2004. The global imperatives of container shipping. In: Pinder, D., Slack, B. (Eds.), Shipping and Ports in the 21st Century. Routledge, London. Slack, B., 2007. The terminalisation of seaports. In: Wang, J., Olivier, D., Notteboom, T., Slack, B. (Eds.), Ports, cities and global supply chains. Ashgate, London, pp. 41–50. Slack, B., Frémont, A., 2005. Transformation of port terminal operations: from the local to the global. Transport Reviews 25, 117–130. Stopford, M., 2002. Maritime Economics. Routledge, London. Sys, Ch., 2005. The link between optimal ship size and optimal operations. In: Proceedings of the BIVEC-GIBET Transport Research Day 2005 – Part I. Hasselt. Hasselt University, pp. 81–108. World Bank, 2001. Port Reform Toolkit, October, World Bank, Washington, DC. Appendix 3 (continued) Carrier Major suppliers and partners WCTC share (%) Number of regions Number of ports Number of weekly calls Forms of co-operation (WCTC % split) K-Line HPH 16.0% 4 11 58 100.0 contract PSA 10.9% 2 3 29 96.1 contract 3.9 JV APMT 5.2% 3 6 24 42.8 contract 57.2 JV OOCL 3.0% 2 2 7 100.0 contract Yang Ming PSA 11.7% 3 4 31 91.7 contract 8.3 JV HPH 11.6% 4 10 33 100.0 contract Hanjin 6.9% 3 5 12 95.6 contract 4.4 JV MISC PSA 13.7% 1 2 9 100.0 contract DPW 10.4% 4 10 16 100.0 contract HPH 6.5% 3 5 7 100.0 contract TCB 4.5% 1 1 2 100.0 contract CMH 3.2% 1 3 3 100.0 contract Grand Alliance PSA 10.4% 3 6 33 100.0 contract HPH 9.2% 3 9 55 100.0 contract DPW 6.2% 3 10 57 100.0 contract CMH 4.2% 1 5 39 100.0 contract SSA 3.6% 1 3 9 100.0 contract HHLA 3.4% 1 1 12 68.0 contract 32.0 JV CKYH Alliance HPH 15.9% 3 9 118 77.9 contract 22.1 JV PSA 11.4% 3 5 63 74.3 contract 25.7 JV Eurogate 3.4% 2 3 17 100.0 contract APMT 3.3% 3 7 46 26.8 contract 73.2 JV Note: Figures concerning regions, ports and weekly calls do not take into account the 20% share of PSA in HPH. Source: WWCTC database (2006), Soppé M., Parola F., Frémont A. 20 M. Soppé et al. / Journal of Transport Geography 17 (2009) 10–20