正在加载图片...

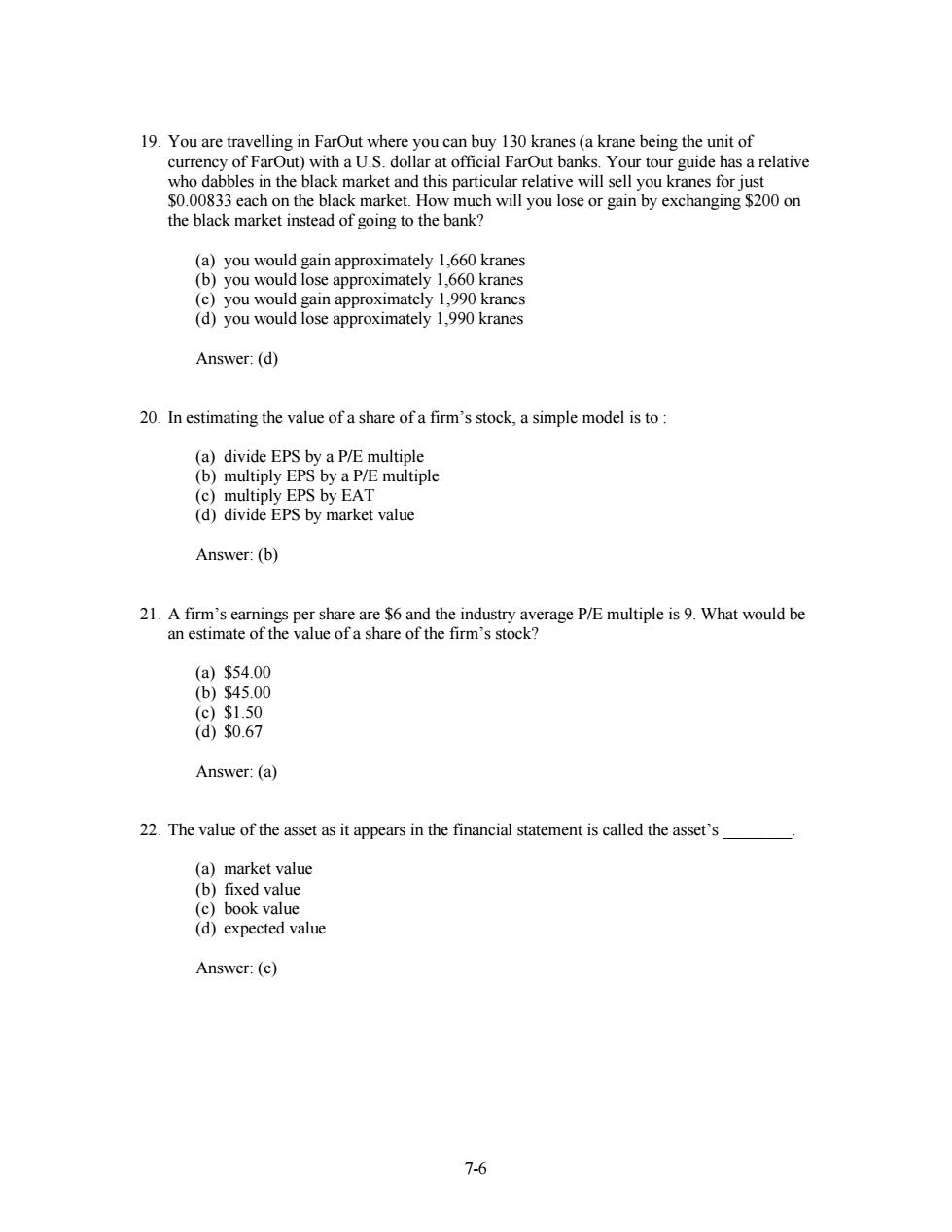

19.You are travelling in FarOut where you can buy 130 kranes(a krane being the unit of currency of FarOut)with a U.S.dollar at official FarOut banks.Your tour guide has a relative who dabbles in the black market and this particular relative will sell you kranes for just $0.00833 each on the black market.How much will you lose or gain by exchanging $200 on the black market instead of going to the bank? (a)you would gain approximately 1,660 kranes (b)you would lose approximately 1,660 kranes (c)you would gain approximately 1,990 kranes (d)you would lose approximately 1,990 kranes Answer:(d) 20.In estimating the value of a share of a firm's stock,a simple model is to: (a)divide EPS by a P/E multiple (b)multiply EPS by a P/E multiple (c)multiply EPS by EAT (d)divide EPS by market value Answer:(b) 21.A firm's earnings per share are $6 and the industry average P/E multiple is 9.What would be an estimate of the value of a share of the firm's stock? (a)$54.00 (b)$45.00 (c)$1.50 (d)$0.67 Answer:(a) 22.The value of the asset as it appears in the financial statement is called the asset's (a)market value (b)fixed value (c)book value (d)expected value Answer:(c) 7-67-6 19. You are travelling in FarOut where you can buy 130 kranes (a krane being the unit of currency of FarOut) with a U.S. dollar at official FarOut banks. Your tour guide has a relative who dabbles in the black market and this particular relative will sell you kranes for just $0.00833 each on the black market. How much will you lose or gain by exchanging $200 on the black market instead of going to the bank? (a) you would gain approximately 1,660 kranes (b) you would lose approximately 1,660 kranes (c) you would gain approximately 1,990 kranes (d) you would lose approximately 1,990 kranes Answer: (d) 20. In estimating the value of a share of a firm’s stock, a simple model is to : (a) divide EPS by a P/E multiple (b) multiply EPS by a P/E multiple (c) multiply EPS by EAT (d) divide EPS by market value Answer: (b) 21. A firm’s earnings per share are $6 and the industry average P/E multiple is 9. What would be an estimate of the value of a share of the firm’s stock? (a) $54.00 (b) $45.00 (c) $1.50 (d) $0.67 Answer: (a) 22. The value of the asset as it appears in the financial statement is called the asset’s ________. (a) market value (b) fixed value (c) book value (d) expected value Answer: (c)