正在加载图片...

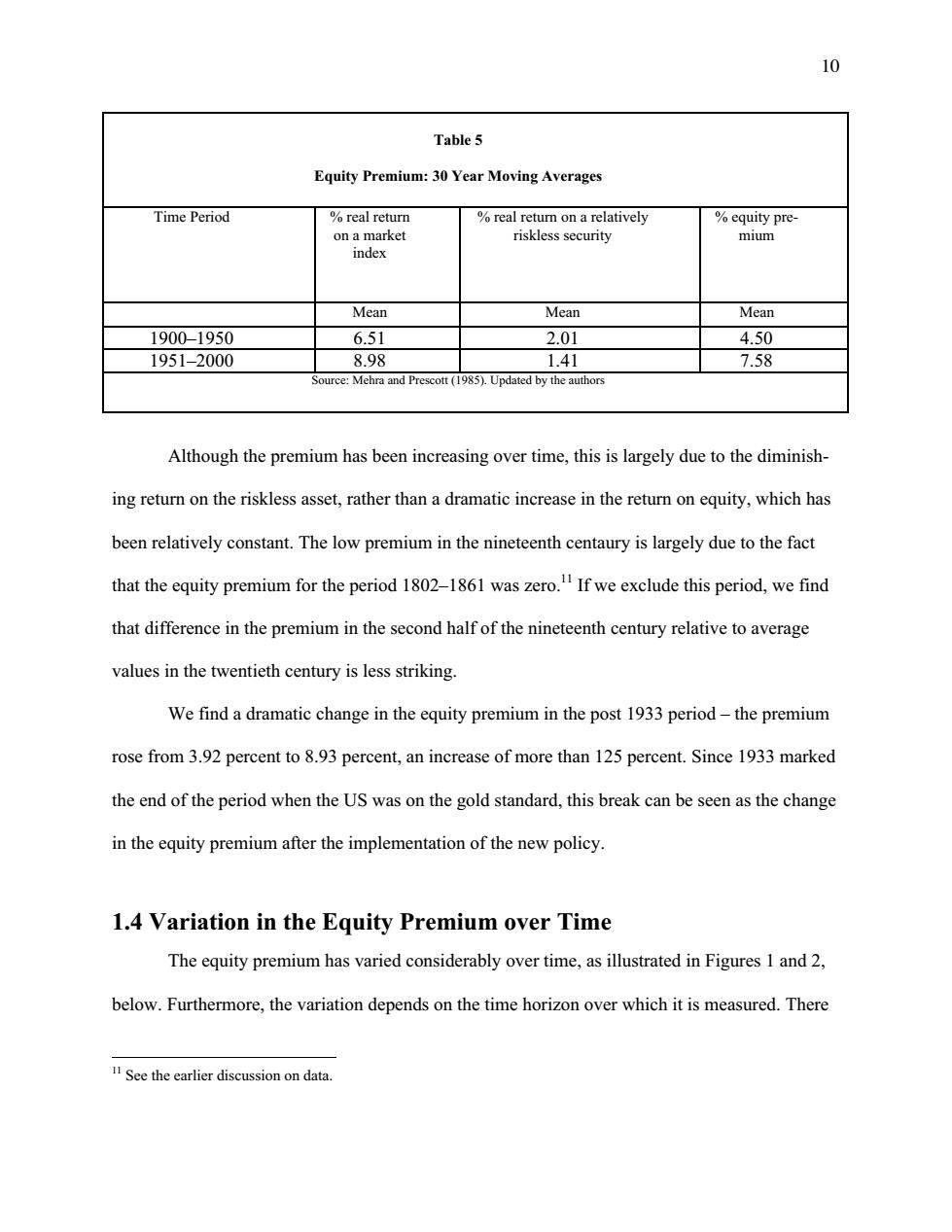

10 Table 5 Equity Premium:30 Year Moving Averages Time Period real return real return on a relatively %equity pre- on a market riskless security mium index Mean Mean Mean 1900-1950 6.51 2.01 4.50 1951-2000 8.98 1.41 7.58 Source:Mehra and Prescott (1985).Updated by the authors Although the premium has been increasing over time,this is largely due to the diminish- ing return on the riskless asset,rather than a dramatic increase in the return on equity,which has been relatively constant.The low premium in the nineteenth centaury is largely due to the fact that the equity premium for the period 1802-1861 was zero.If we exclude this period,we find that difference in the premium in the second half of the nineteenth century relative to average values in the twentieth century is less striking. We find a dramatic change in the equity premium in the post 1933 period-the premium rose from 3.92 percent to 8.93 percent,an increase of more than 125 percent.Since 1933 marked the end of the period when the US was on the gold standard,this break can be seen as the change in the equity premium after the implementation of the new policy. 1.4 Variation in the Equity Premium over Time The equity premium has varied considerably over time,as illustrated in Figures 1 and 2, below.Furthermore,the variation depends on the time horizon over which it is measured.There See the earlier discussion on data.10 Table 5 Equity Premium: 30 Year Moving Averages Time Period % real return on a market index % real return on a relatively riskless security % equity premium Mean Mean Mean 1900–1950 6.51 2.01 4.50 1951–2000 8.98 1.41 7.58 Source: Mehra and Prescott (1985). Updated by the authors Although the premium has been increasing over time, this is largely due to the diminishing return on the riskless asset, rather than a dramatic increase in the return on equity, which has been relatively constant. The low premium in the nineteenth centaury is largely due to the fact that the equity premium for the period 1802–1861 was zero.11 If we exclude this period, we find that difference in the premium in the second half of the nineteenth century relative to average values in the twentieth century is less striking. We find a dramatic change in the equity premium in the post 1933 period – the premium rose from 3.92 percent to 8.93 percent, an increase of more than 125 percent. Since 1933 marked the end of the period when the US was on the gold standard, this break can be seen as the change in the equity premium after the implementation of the new policy. 1.4 Variation in the Equity Premium over Time The equity premium has varied considerably over time, as illustrated in Figures 1 and 2, below. Furthermore, the variation depends on the time horizon over which it is measured. There 11 See the earlier discussion on data