正在加载图片...

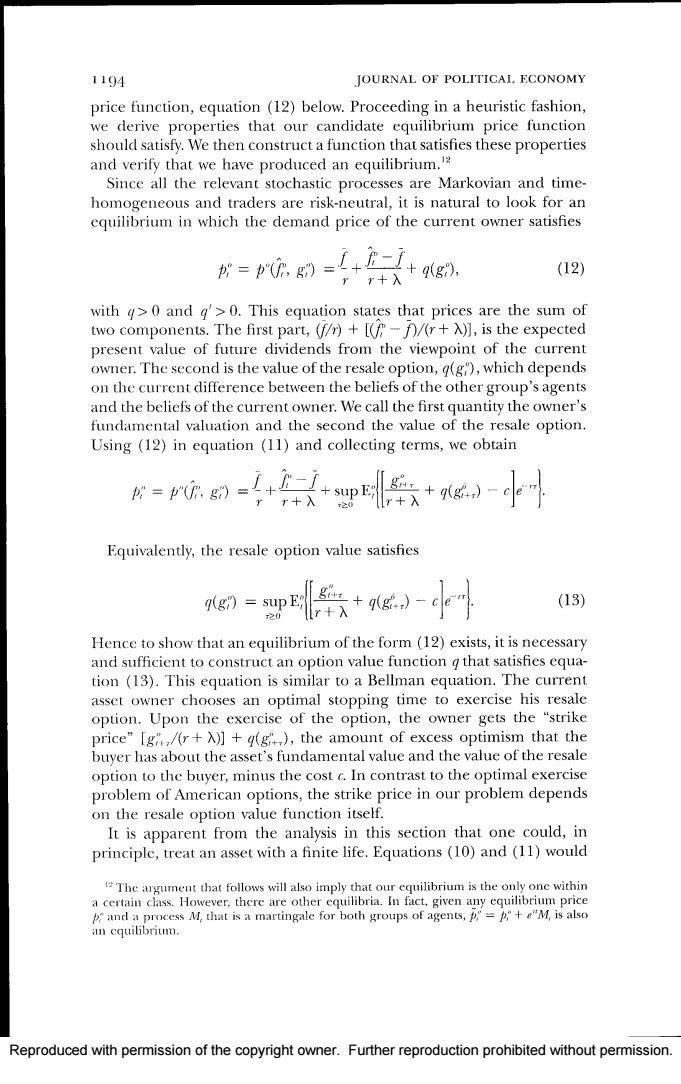

1194 JOURNAL OF POLITICAL.ECONOMY price function,equation (12)below.Proceeding in a heuristic fashion, we derive properties that our candidate equilibrium price function should satisfy.We then construct a function that satisfies these properties and verify that we have produced an equilibrium.2 Since all the relevant stochastic processes are Markovian and time- homogeneous and traders are risk-neutral,it is natural to look for an equilibrium in which the demand price of the current owner satisfies p g)g). (12) rr+入 with 4>0 and g'>0.This equation states that prices are the sum of two components.The first part,(fr)+[(-A)/(r+A)],is the expected present value of future dividends from the viewpoint of the current owner.The second is the value of the resale option,q(g"),which depends on the current difference between the beliefs of the other group's agents and the beliefs of the current owner.We call the first quantity the owner's fundamental valuation and the second the value of the resale option. Using (12)in equation (11)and collecting terms,we obtain Equivalently,the resale option value satisfies q(g= sup (13) Hence to show that an equilibrium of the form (12)exists,it is necessary and sufficient to construct an option value function g that satisfies equa- tion (13).This equation is similar to a Bellman equation.The current asset owner chooses an optimal stopping time to exercise his resale option.Upon the exercise of the option,the owner gets the "strike price”"[g,/r+入】+gg+,),the amount of excess optimism that the buyer has about the asset's fundamental value and the value of the resale option to the buyer,minus the cost c.In contrast to the optimal exercise problem of American options,the strike price in our problem depends on the resale option value function itself. It is apparent from the analysis in this section that one could,in principlc,treat an asset with a finite life.Equations(10)and (11)would The argument that follows will also imply that our cquilibrium is the only one within a certain class.However,there are other equilibria.In fact,given any equilibrium price p and a process M,that is a martingale for both groups of agents,p"=p+e"M,is also an cquilibrium. Reproduced with permission of the copyright owner.Further reproduction prohibited without permission.Reproduced with permission of the copyright owner. Further reproduction prohibited without permission