正在加载图片...

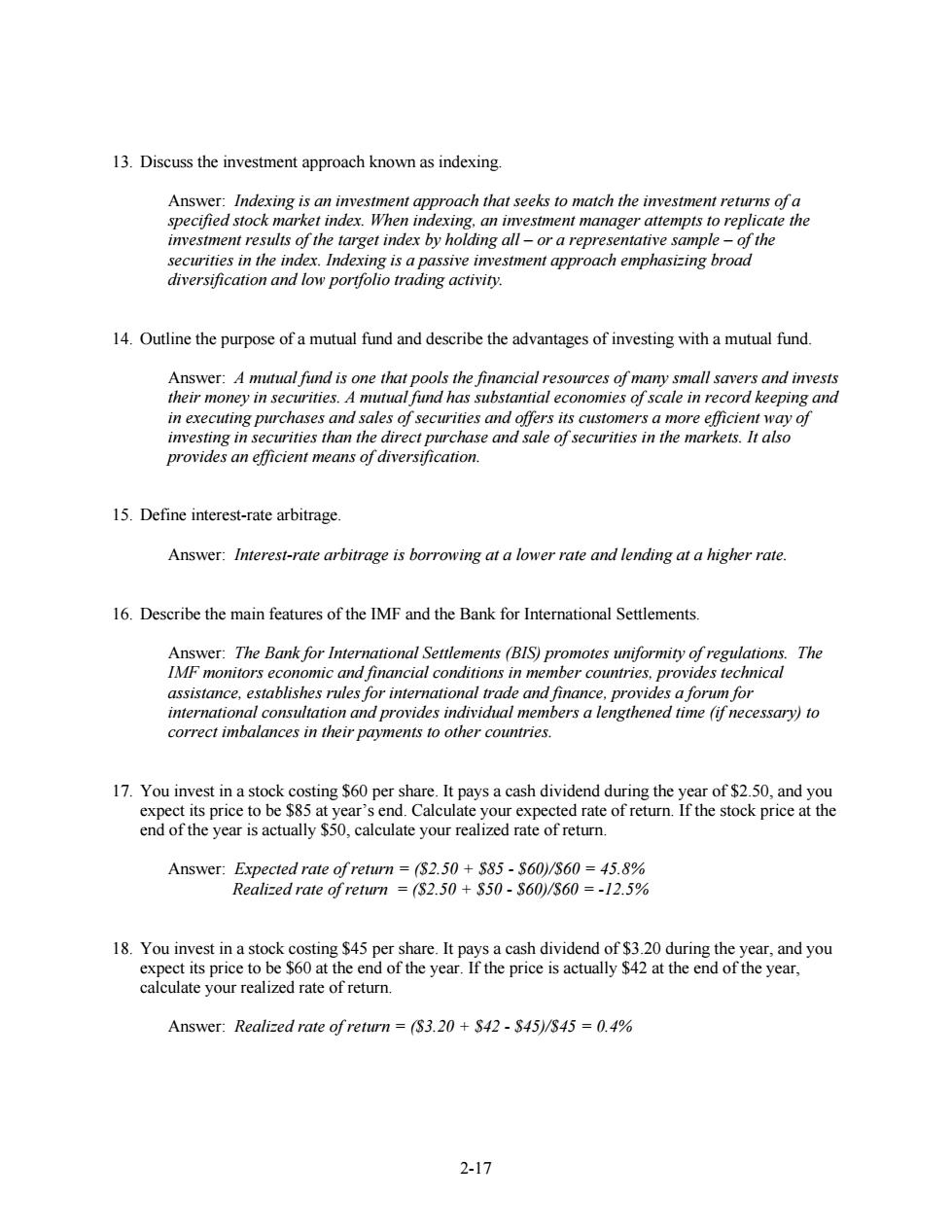

13.Discuss the investment approach known as indexing. Answer:Indexing is an investment approach that seeks to match the investment returns ofa specified stock market index.When indexing,an investment manager attempts to replicate the investment results of the target index by holding all-or a representative sample-of the securities in the index.Indexing is a passive investment approach emphasizing broad diversification and low portfolio trading activity. 14.Outline the purpose of a mutual fund and describe the advantages of investing with a mutual fund. Answer:A mutual fund is one that pools the financial resources of many small savers and invests their money in securities.A mutual fund has substantial economies of scale in record keeping and in executing purchases and sales of securities and offers its customers a more efficient way of investing in securities than the direct purchase and sale of securities in the markets.It also provides an efficient means of diversification. 15.Define interest-rate arbitrage. Answer:Interest-rate arbitrage is borrowing at a lower rate and lending at a higher rate. 16.Describe the main features of the IMF and the Bank for International Settlements. Answer:The Bank for International Settlements (BIS)promotes uniformity of regulations.The IMF monitors economic and financial conditions in member countries,provides technical assistance,establishes rules for international trade and finance,provides a forum for international consultation and provides individual members a lengthened time (if necessary)to correct imbalances in their payments to other countries. 17.You invest in a stock costing $60 per share.It pays a cash dividend during the year of $2.50,and you expect its price to be $85 at year's end.Calculate your expected rate of return.If the stock price at the end of the year is actually $50,calculate your realized rate of return. Answer:Expected rate of return ($2.50 $85-S60)/$60 =45.8% Realized rate of return =($2.50 +S50-S60)/S60 =-12.5% 18.You invest in a stock costing $45 per share.It pays a cash dividend of $3.20 during the year,and you expect its price to be $60 at the end of the year.If the price is actually $42 at the end of the year, calculate your realized rate of return. Answer:Realized rate of return =($3.20 +$42-S45)/$45=0.4% 2-172-17 13. Discuss the investment approach known as indexing. Answer: Indexing is an investment approach that seeks to match the investment returns of a specified stock market index. When indexing, an investment manager attempts to replicate the investment results of the target index by holding all – or a representative sample – of the securities in the index. Indexing is a passive investment approach emphasizing broad diversification and low portfolio trading activity. 14. Outline the purpose of a mutual fund and describe the advantages of investing with a mutual fund. Answer: A mutual fund is one that pools the financial resources of many small savers and invests their money in securities. A mutual fund has substantial economies of scale in record keeping and in executing purchases and sales of securities and offers its customers a more efficient way of investing in securities than the direct purchase and sale of securities in the markets. It also provides an efficient means of diversification. 15. Define interest-rate arbitrage. Answer: Interest-rate arbitrage is borrowing at a lower rate and lending at a higher rate. 16. Describe the main features of the IMF and the Bank for International Settlements. Answer: The Bank for International Settlements (BIS) promotes uniformity of regulations. The IMF monitors economic and financial conditions in member countries, provides technical assistance, establishes rules for international trade and finance, provides a forum for international consultation and provides individual members a lengthened time (if necessary) to correct imbalances in their payments to other countries. 17. You invest in a stock costing $60 per share. It pays a cash dividend during the year of $2.50, and you expect its price to be $85 at year’s end. Calculate your expected rate of return. If the stock price at the end of the year is actually $50, calculate your realized rate of return. Answer: Expected rate of return = ($2.50 + $85 - $60)/$60 = 45.8% Realized rate of return = ($2.50 + $50 - $60)/$60 = -12.5% 18. You invest in a stock costing $45 per share. It pays a cash dividend of $3.20 during the year, and you expect its price to be $60 at the end of the year. If the price is actually $42 at the end of the year, calculate your realized rate of return. Answer: Realized rate of return = ($3.20 + $42 - $45)/$45 = 0.4%