正在加载图片...

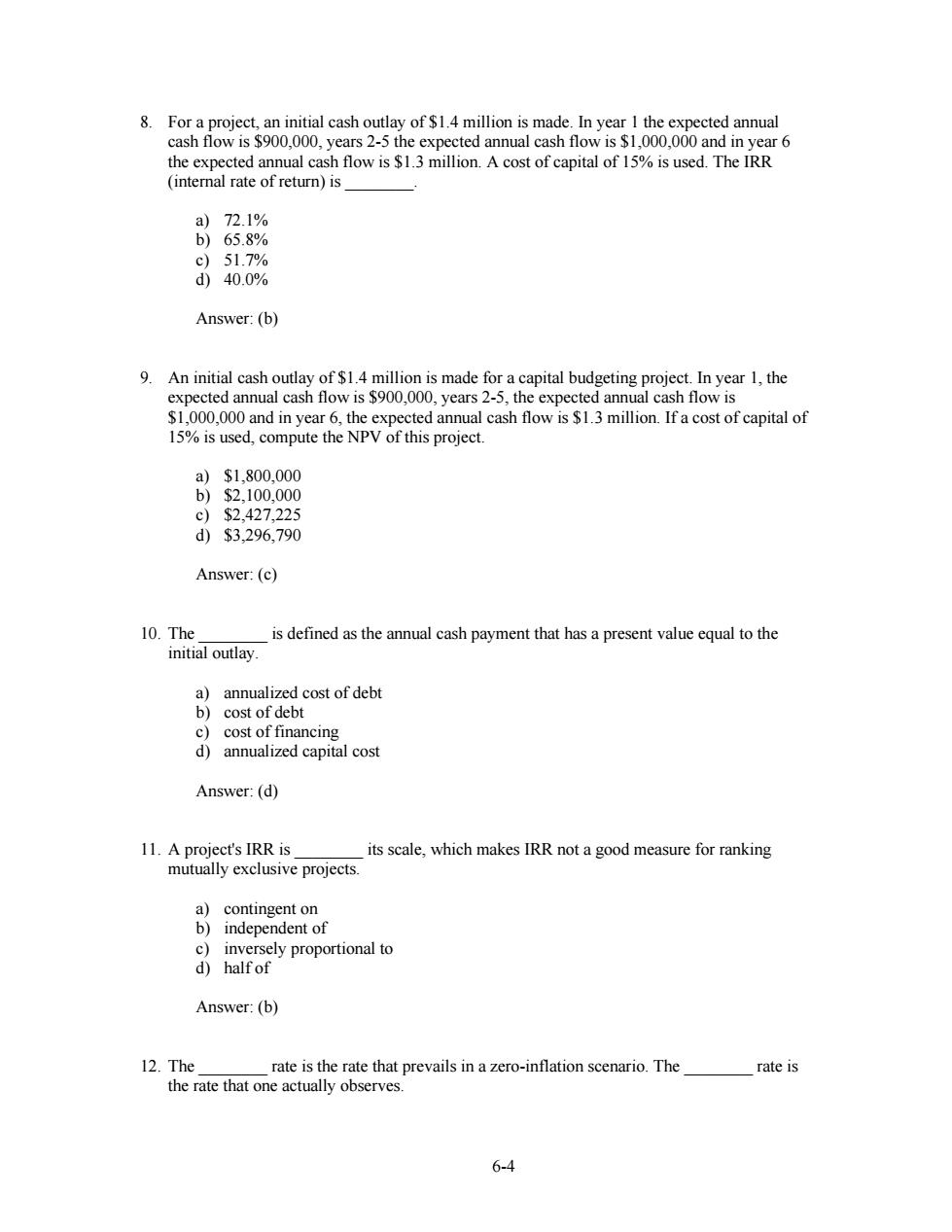

8.For a project,an initial cash outlay of $1.4 million is made.In year I the expected annual cash flow is $900,000,years 2-5 the expected annual cash flow is $1,000,000 and in year 6 the expected annual cash flow is $1.3 million.A cost of capital of 15%is used.The IRR (internal rate of return)is a)72.1% b)65.8% c)51.7% d)40.0% Answer:(b) 9.An initial cash outlay of $1.4 million is made for a capital budgeting project.In year 1,the expected annual cash flow is $900,000,years 2-5,the expected annual cash flow is $1,000,000 and in year 6,the expected annual cash flow is $1.3 million.If a cost of capital of 15%is used,compute the NPV of this project. a)$1,800,000 b)$2,100,000 c)$2,427,225 d$3,296,790 Answer:(c) 10.The is defined as the annual cash payment that has a present value equal to the initial outlay a)annualized cost of debt b)cost of debt c)cost of financing d)annualized capital cost Answer:(d) 11.A project's IRR is its scale,which makes IRR not a good measure for ranking mutually exclusive projects. a)contingent on b)independent of c)inversely proportional to d)half of Answer:(b) 12.The rate is the rate that prevails in a zero-inflation scenario.The rate is the rate that one actually observes. 6-46-4 8. For a project, an initial cash outlay of $1.4 million is made. In year 1 the expected annual cash flow is $900,000, years 2-5 the expected annual cash flow is $1,000,000 and in year 6 the expected annual cash flow is $1.3 million. A cost of capital of 15% is used. The IRR (internal rate of return) is ________. a) 72.1% b) 65.8% c) 51.7% d) 40.0% Answer: (b) 9. An initial cash outlay of $1.4 million is made for a capital budgeting project. In year 1, the expected annual cash flow is $900,000, years 2-5, the expected annual cash flow is $1,000,000 and in year 6, the expected annual cash flow is $1.3 million. If a cost of capital of 15% is used, compute the NPV of this project. a) $1,800,000 b) $2,100,000 c) $2,427,225 d) $3,296,790 Answer: (c) 10. The ________ is defined as the annual cash payment that has a present value equal to the initial outlay. a) annualized cost of debt b) cost of debt c) cost of financing d) annualized capital cost Answer: (d) 11. A project's IRR is ________ its scale, which makes IRR not a good measure for ranking mutually exclusive projects. a) contingent on b) independent of c) inversely proportional to d) half of Answer: (b) 12. The ________ rate is the rate that prevails in a zero-inflation scenario. The ________ rate is the rate that one actually observes