正在加载图片...

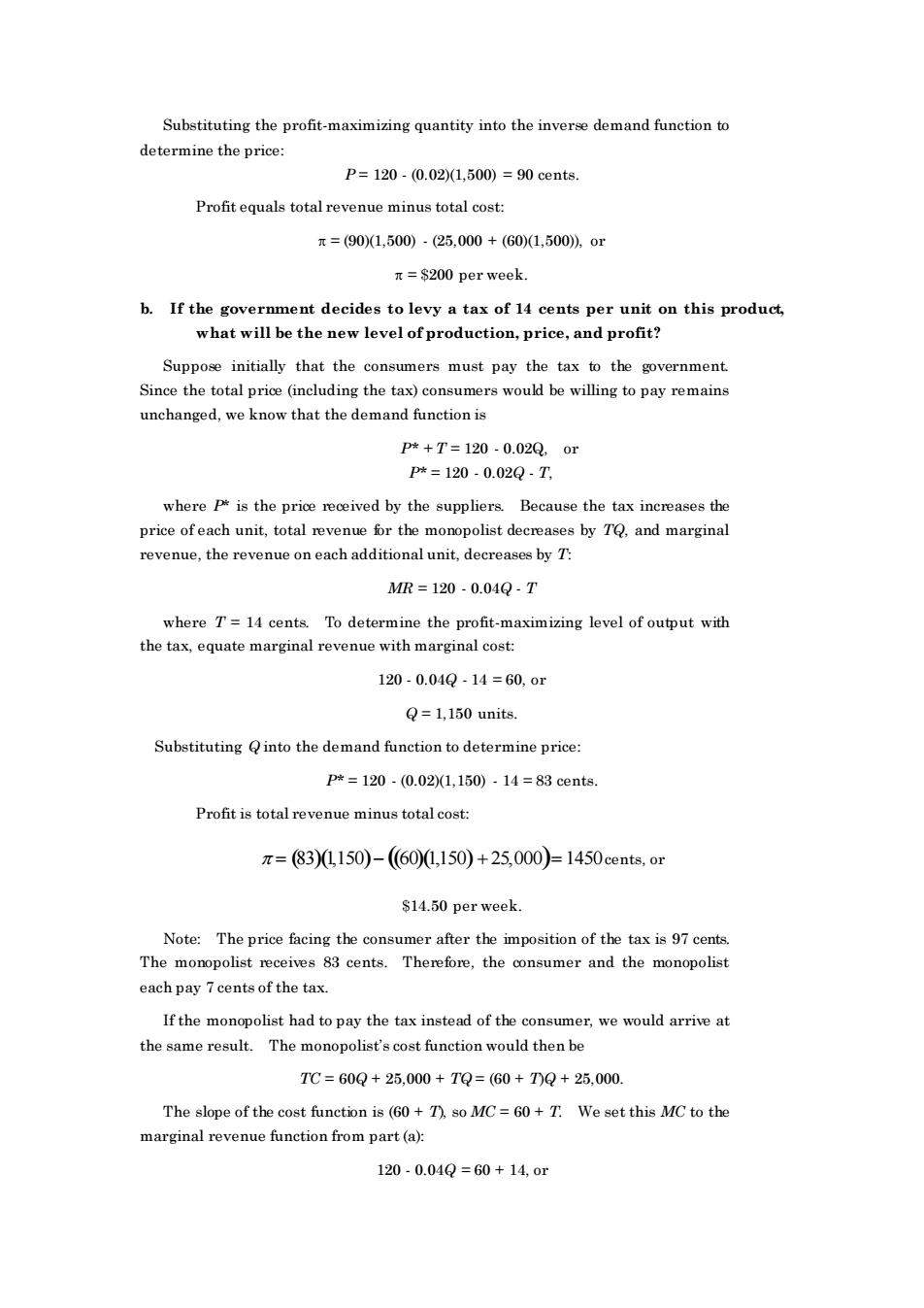

Substituting the profit-maximizing quantity into the inverse demand function to determine the price: P=120.(0.021,500)=90 cents Profitequals total revenue minus total cost: 元=(901,500)-(25,000+(601,500).or 元=$200 per week. b.If the government decides to levy a tax of 14 cents per unit on this product what will be the new level of production,price,and profit? Suppose initially that the consumers must pay the tax to the government. Since the total price (including the tax)consumers woul be willing to pay remains unchanged,we know that the demand function is p*+T=120.0.02Q or p*=120.0.02Q.T where is the price recived by the suppliers Because the tax increases the price of each unit,total revenue for the moropolist decreases by T and marginal revenue,the revenue on each additional unit,decreases by 7. MR=120-0.04Q-T where T=14 cents.To determine the profit-maximizing level of output with the tax,equate marginal revenue with marginal cost: 120.0.04Q-14=60,or Q=1,150 units Substituting into the demand function to determine price p*=120-(0.021,150)-14=83 cents Profit is total revenue minus total cos π=830150)-(600,150)+25,000)-1450 cents,o $14.50 per week. Note:The price facing theco after the imposition of the tax is 97cent The monopolist receives 83 cents.Therefore,the consumer and the monopolist each pay 7 cents of the tax If the monopolist had to pay the tax instead of the consumer,we would arrive at the same result.The monopolist's cost function would then be TC=60Q+25,000+TQ=(60+T)Q+25,000. The slope of the cost function is(60+T so MC=60+T.We set this MC to the marginal revenue function from part (a) 120.0.04Q=60+14,oSubstituting the profit-maximizing quantity into the inverse demand function to determine the price: P = 120 - (0.02)(1,500) = 90 cents. Profit equals total revenue minus total cost: = (90)(1,500) - (25,000 + (60)(1,500)), or = $200 per week. b. If the government decides to levy a tax of 14 cents per unit on this product, what will be the new level of production, price, and profit? Suppose initially that the consumers must pay the tax to the government. Since the total price (including the tax) consumers would be willing to pay remains unchanged, we know that the demand function is P* + T = 120 - 0.02Q, or P* = 120 - 0.02Q - T, where P* is the price received by the suppliers. Because the tax increases the price of each unit, total revenue for the monopolist decreases by TQ, and marginal revenue, the revenue on each additional unit, decreases by T: MR = 120 - 0.04Q - T where T = 14 cents. To determine the profit-maximizing level of output with the tax, equate marginal revenue with marginal cost: 120 - 0.04Q - 14 = 60, or Q = 1,150 units. Substituting Q into the demand function to determine price: P* = 120 - (0.02)(1,150) - 14 = 83 cents. Profit is total revenue minus total cost: = (83)(1,150)− ((60)(1,150) + 25,000)= 1450 cents, or $14.50 per week. Note: The price facing the consumer after the imposition of the tax is 97 cents. The monopolist receives 83 cents. Therefore, the consumer and the monopolist each pay 7 cents of the tax. If the monopolist had to pay the tax instead of the consumer, we would arrive at the same result. The monopolist’s cost function would then be TC = 60Q + 25,000 + TQ = (60 + T)Q + 25,000. The slope of the cost function is (60 + T), so MC = 60 + T. We set this MC to the marginal revenue function from part (a): 120 - 0.04Q = 60 + 14, or