正在加载图片...

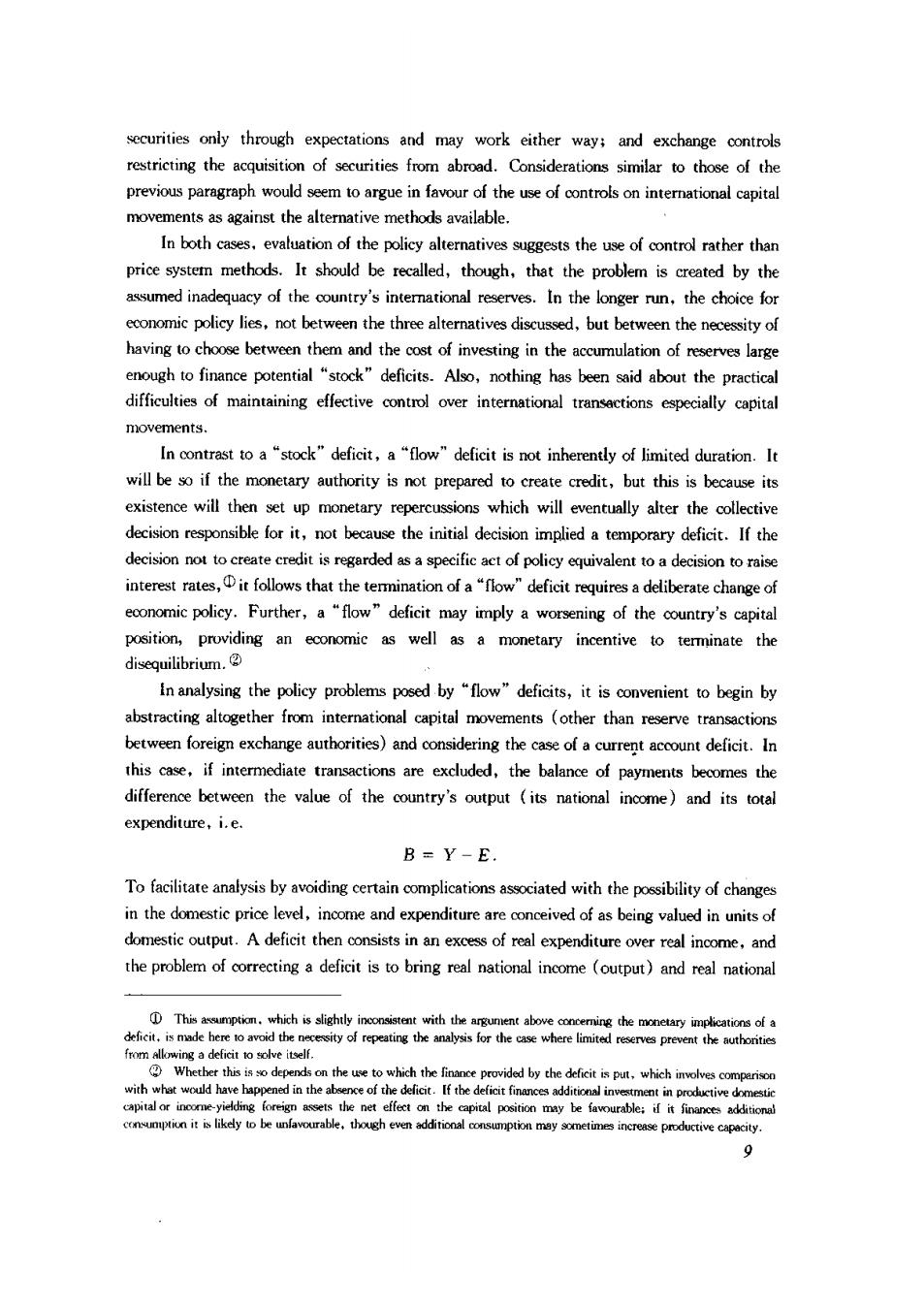

sccurities only through expectations and may work either way;and exchange controls restricting the acquisition of securities from abroad.Considerations similar to those of the previous paragraph would sem to argue in favour of the use capita In both cases,evaluation of the policy alternatives suggests the use of control rather than price system methods.It should be recalled,though,that the problem is created by the assumed inadequacy of the country's international reserves.In the longer run,the choice for eomic policy lies.not between the three alteratives discused,but between the necessityof having between them and the in the accumulation of large enough to finance potential "stock"deficits.Also,nothing has been said about the practical difficulties of maintaining effectiveonover interationa trasctopcially capital movements. 【n contrast to a“stock"deficit,a“flow”deficit is not inherently of limited duration.lt will be if the monetary authority is not prepared but this is because its existence will then set up monetary repercussions which will eventually alter the collective decision responsible for it,not because the initial decision implied a temporary deficit.If the interest rates,it follows that the terination of a"ow"deficit requires a deliberate change of econmic policy.Further,a"flow"deficit may imply a worsening of the ountry's capital position,providing an eonomic as well as a monetary incentive to terminate the diqim.② Inanalysing the policy problems posed by "flow"deficits,it is convenient to begin by abstracting altogetherfrom inteational capital movements (other than reserve transactions between foreign exchange authorities)and considering thecasofaceoun deficit.In this case.if intermediate transactions are excuded,the balance of payments becomes the difference between the value of the country's output (its national income)and its total expenditure.ie. B=Y-E. To facilitate analysis by avoiding certain complications associated with the possibility of changes in the omestic price and being vaed domestic output.A deficit then consists in an excess of real expenditure over real income.and the problem a deficit is to bring real nationl income (output)and real nationa This a which is slightly ino gadrfiamriotohe s the tion may be f urable:if it addition increase productive capacity 9