正在加载图片...

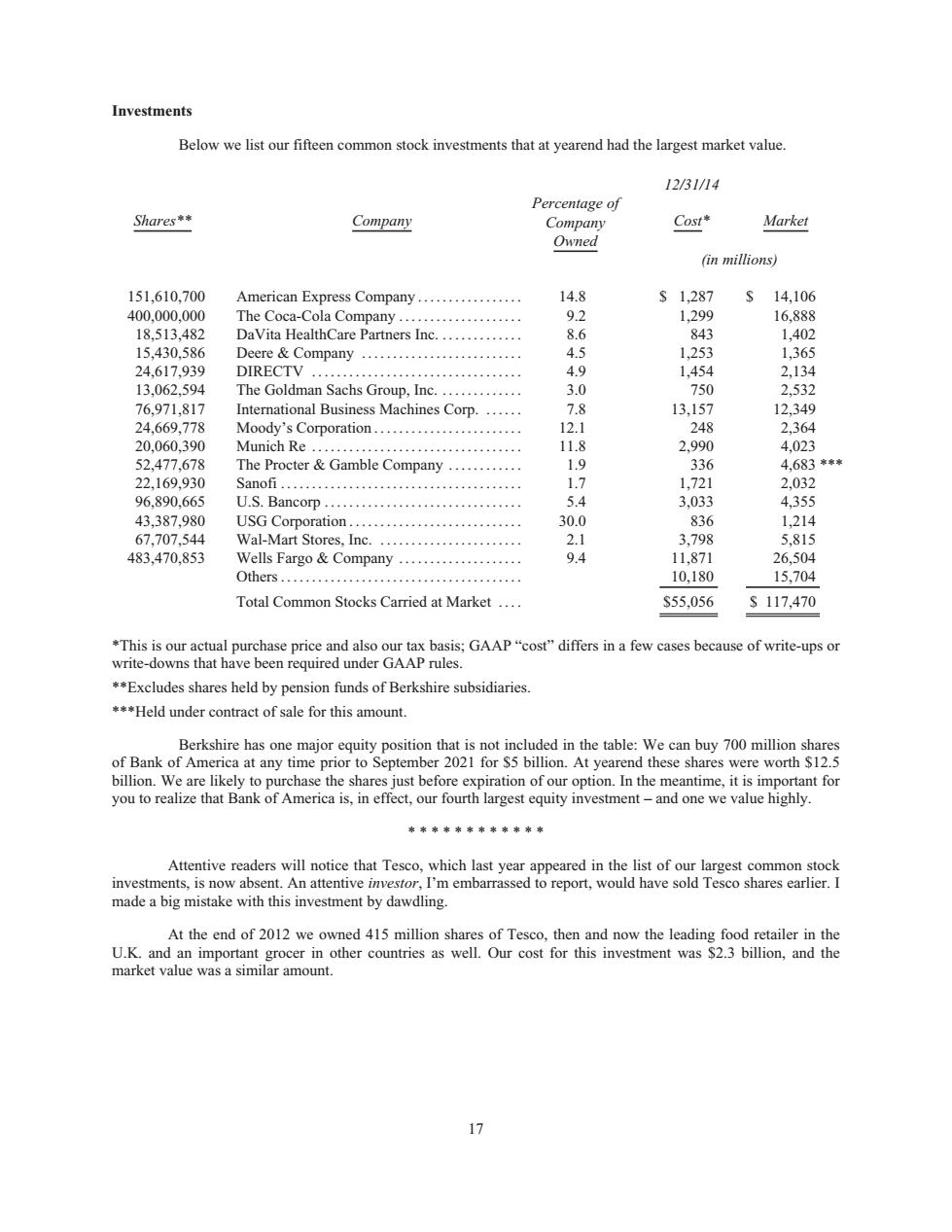

Investments Below we list our fifteen common stock investments that at yearend had the largest market value. 1231/14 Percentage of Shares* Company Cost* Market Owned (in millions) 151.610.700 American Express Company. 14.8 s1,287 s14.100 400.000.000 The Coca-Cola Company 9.2 1.299 16.88 18,513,482 DaVita HealthCare Partners Inc............ company ........................ 10网 24.617.939 2.13 13.062.594 The Goldman Sachs Group.Inc. 30 150 2,532 76.971,817 International Business Machines Corp.. 7.8 13,157 12,349 Moody's C0 poration......... The Po 4.683* 22,169,930 Sanofi 1,721 2,032 96,890,66 .S.Bancorp. 43.387 483.470.853 Wells Fargo Company 94 11,871 26.504 Others. 10.180 15.704 Total Common Stocks Carried at Market 55,056 S117,470 Excludes shares held by pension funds of Berkshire subsidiaries ***Held under contract of sale for this amount. shire has one major equity position that is not included in the table:we can buy 700 million shares o Bank of Am at any time prior er2021 for $5 billion.At yearen you to realize that Bank of America isin made a big mistake with this investment by dawdling. At the end of 2012 we owned 415 million shares of Tesco.then and now the leading food retailer in the U.K.and an important grocer in other countries as well.Our cost for this investment was $2.3 billion,and the market value was a similar amount Investments Below we list our fifteen common stock investments that at yearend had the largest market value. 12/31/14 Shares** Company Percentage of Company Owned Cost* Market (in millions) 151,610,700 American Express Company ................. 14.8 $ 1,287 $ 14,106 400,000,000 The Coca-Cola Company . . . . . . . . . . . . . . . . . . . . 9.2 1,299 16,888 18,513,482 DaVita HealthCare Partners Inc. . . . . . . . . . . . . . 8.6 843 1,402 15,430,586 Deere & Company . . . . . . . . . . . . . . . . . . . . . . . . . . 4.5 1,253 1,365 24,617,939 DIRECTV . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.9 1,454 2,134 13,062,594 The Goldman Sachs Group, Inc. . . . . . . . . . . . . . 3.0 750 2,532 76,971,817 International Business Machines Corp. . . . . . . 7.8 13,157 12,349 24,669,778 Moody’s Corporation ........................ 12.1 248 2,364 20,060,390 Munich Re .................................. 11.8 2,990 4,023 52,477,678 The Procter & Gamble Company . . . . . . . . . . . . 1.9 336 4,683 *** 22,169,930 Sanofi . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.7 1,721 2,032 96,890,665 U.S. Bancorp . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.4 3,033 4,355 43,387,980 USG Corporation ............................ 30.0 836 1,214 67,707,544 Wal-Mart Stores, Inc. . . . . . . . . . . . . . . . . . . . . . . . 2.1 3,798 5,815 483,470,853 Wells Fargo & Company . . . . . . . . . . . . . . . . . . . . 9.4 11,871 26,504 Others....................................... 10,180 15,704 Total Common Stocks Carried at Market .... $55,056 $ 117,470 *This is our actual purchase price and also our tax basis; GAAP “cost” differs in a few cases because of write-ups or write-downs that have been required under GAAP rules. **Excludes shares held by pension funds of Berkshire subsidiaries. ***Held under contract of sale for this amount. Berkshire has one major equity position that is not included in the table: We can buy 700 million shares of Bank of America at any time prior to September 2021 for $5 billion. At yearend these shares were worth $12.5 billion. We are likely to purchase the shares just before expiration of our option. In the meantime, it is important for you to realize that Bank of America is, in effect, our fourth largest equity investment – and one we value highly. ************ Attentive readers will notice that Tesco, which last year appeared in the list of our largest common stock investments, is now absent. An attentive investor, I’m embarrassed to report, would have sold Tesco shares earlier. I made a big mistake with this investment by dawdling. At the end of 2012 we owned 415 million shares of Tesco, then and now the leading food retailer in the U.K. and an important grocer in other countries as well. Our cost for this investment was $2.3 billion, and the market value was a similar amount. 17